Fill in a Valid IRS 8879 Form

Document Sample

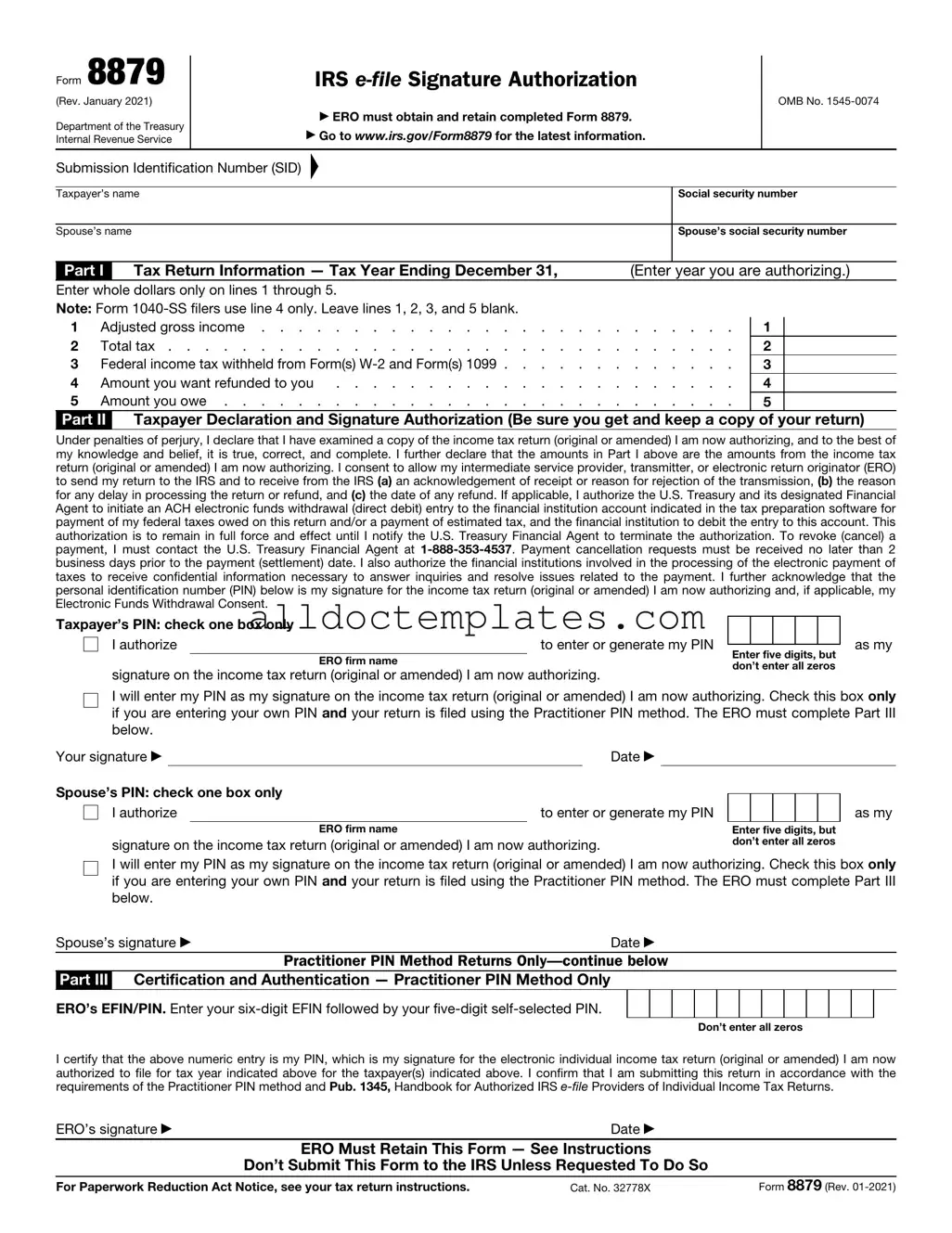

Form 8879

(Rev. January 2021)

Department of the Treasury Internal Revenue Service

IRS

▶ ERO must obtain and retain completed Form 8879.

▶Go to www.irs.gov/Form8879 for the latest information.

OMB No.

Submission Identification Number (SID)

▲

Taxpayer’s name |

|

|

|

Social security number |

||||

|

|

|

|

|

|

|

||

Spouse’s name |

|

|

|

|

Spouse’s social security number |

|||

|

|

|

|

|

|

|||

Part I |

|

Tax Return Information — Tax Year Ending December 31, |

|

(Enter |

year you are authorizing.) |

|||

Enter whole dollars only on lines 1 through 5. |

|

|

|

|

|

|||

Note: Form |

|

|

|

|

|

|||

1 |

Adjusted gross income |

. |

. . |

. |

. . . |

1 |

||

2 |

Total tax |

. |

. . |

. |

. . . |

2 |

||

3 |

Federal income tax withheld from Form(s) |

. |

. . |

. |

. . . |

3 |

||

4 |

Amount you want refunded to you |

. |

. . |

. |

. . . |

4 |

||

5 |

Amount you owe |

. |

. . |

. |

. . . |

5 |

||

Part II Taxpayer Declaration and Signature Authorization (Be sure you get and keep a copy of your return)

Under penalties of perjury, I declare that I have examined a copy of the income tax return (original or amended) I am now authorizing, and to the best of my knowledge and belief, it is true, correct, and complete. I further declare that the amounts in Part I above are the amounts from the income tax return (original or amended) I am now authorizing. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send my return to the IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund. If applicable, I authorize the U.S. Treasury and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of my federal taxes owed on this return and/or a payment of estimated tax, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke (cancel) a payment, I must contact the U.S. Treasury Financial Agent at

Taxpayer’s PIN: check one box only |

|

|

|

|

|

|

|

||

I authorize |

|

|

to enter or generate my PIN |

|

|

|

|

|

|

|

Enter five digits, but |

||||||||

|

|

ERO firm name |

|||||||

|

|

don’t enter all zeros |

|||||||

signature on the income tax return (original or amended) I am now authorizing. |

|||||||||

|

|

|

|

|

|||||

as my

I will enter my PIN as my signature on the income tax return (original or amended) I am now authorizing. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Your signature ▶ |

|

|

Date ▶ |

|

|

|

|

|

|

Spouse’s PIN: check one box only |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

I authorize |

to enter or generate my PIN |

|

|

|

|

|

|||

|

|

ERO firm name |

|

|

Enter five digits, but |

||||

signature on the income tax return (original or amended) I am now authorizing. |

don’t enter all zeros |

||||||||

as my

I will enter my PIN as my signature on the income tax return (original or amended) I am now authorizing. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Spouse’s signature ▶ |

Date ▶ |

|

Practitioner PIN Method Returns |

Part III Certification and Authentication — Practitioner PIN Method Only

ERO’s EFIN/PIN. Enter your

Don’t enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the electronic individual income tax return (original or amended) I am now authorized to file for tax year indicated above for the taxpayer(s) indicated above. I confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method and Pub. 1345, Handbook for Authorized IRS

ERO’s signature ▶ |

Date ▶ |

|

ERO Must Retain This Form — See Instructions |

|

|

Don’t Submit This Form to the IRS Unless Requested To Do So |

|

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 32778X |

Form 8879 (Rev. |

Form 8879 (Rev. |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future developments. For the latest information about developments related to Form 8879 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8879.

What's New. Form 8879 is used to authorize the electronic filing

Purpose of Form

Form 8879 is the declaration document and signature authorization for an

|

|

▲ |

|

! |

Don’t send this form to the IRS. |

The ERO must retain Form 8879. |

|

CAUTION |

|

When and How To Complete

Use this chart to determine when and how to complete Form 8879.

IF the ERO is . . . |

THEN . . . |

|

|

|

|

Not using the Practitioner |

Don’t complete |

|

PIN method and the |

Form 8879. |

|

taxpayer enters his or her |

|

|

own PIN |

|

|

|

|

|

Not using the Practitioner |

Complete Form |

|

PIN method and is |

8879, Parts I and II. |

|

authorized to enter or |

|

|

generate the taxpayer’s |

|

|

PIN |

|

|

|

|

|

Using the Practitioner PIN |

Complete Form 8879, |

|

method and is authorized |

Parts I, II, and III. |

|

to enter or generate the |

|

|

taxpayer’s PIN |

|

|

|

|

|

Using the Practitioner PIN |

Complete Form 8879, |

|

Parts I, II, and III. |

||

method and the taxpayer |

||

|

||

enters his or her own PIN |

|

|

|

|

ERO Responsibilities

The ERO must:

1.Enter the name(s) and social security number(s) of the taxpayer(s) at the top of the form.

2.Complete Part I using the amounts (zeros may be entered when appropriate) from the taxpayer’s tax return. Form

3.Enter or generate, if authorized by the taxpayer, the taxpayer’s PIN and enter it in the boxes provided in Part II.

4.Enter on the authorization line in Part II the ERO firm name (not the name of the individual preparing the return) if the ERO is authorized to enter the taxpayer’s PIN.

5.Provide the taxpayer(s) Form 8879 by hand delivery, U.S. mail, private delivery service, email, Internet website, or fax.

6.Enter the

You must receive the completed ▲! and signed Form 8879 from the

taxpayer before the electronic CAUTION return is transmitted (or released

for transmission).

For additional information, see Pub. 1345.

Taxpayer Responsibilities

Taxpayers must:

1.Verify the accuracy of the prepared income tax return, including direct deposit information.

2.Check the appropriate box in Part II to authorize the ERO to enter or generate your PIN or to do it yourself.

3.Indicate or verify your PIN when authorizing the ERO to enter or generate it (the PIN must be five digits other than all zeros).

4.Sign and date Form 8879. Taxpayers must sign Form 8879 by handwritten signature, or electronic signature if supported by computer software.

5.Return the completed Form 8879 to the ERO by hand delivery, U.S. mail, private delivery service, email, Internet website, or fax.

Your return won’t be transmitted to the IRS until the ERO receives your signed Form 8879.

Refund information. You can check on the status of your refund if it has been at least 72 hours since the IRS acknowledged receipt of your

•Go to www.irs.gov/Refunds.

•Call

•Call

Important Notes for EROs

•Don’t send Form 8879 to the IRS unless requested to do so. Retain the completed Form 8879 for 3 years from the return due date or IRS received date, whichever is later. Form 8879 may be retained electronically in accordance with the recordkeeping guidelines in Rev. Proc.

•Confirm the identity of the taxpayer(s).

•Complete Part III only if you are filing the return using the Practitioner PIN method. You aren’t required to enter the taxpayer’s date of birth, prior year adjusted gross income, or PIN in the Authentication Record of the electronically filed return.

•If you aren’t using the Practitioner PIN method, enter the taxpayer(s) date of birth and either the adjusted gross income or the PIN, or both, from the taxpayer’s prior year originally filed return in the Authentication Record of the taxpayer’s electronically filed return. Don’t use an amount from an amended return or a math error correction made by the IRS.

•Enter the taxpayer’s PIN(s) on the input screen only if the taxpayer has authorized you to do so. If married filing jointly, it is acceptable for one spouse to authorize you to enter his or her PIN, and for the other spouse to enter his or her own PIN. It isn’t acceptable for a taxpayer to select or enter the PIN of an absent spouse.

•Taxpayers must use a PIN to sign their

•Provide the taxpayer with a copy of the signed Form 8879 for his or her records upon request.

•Provide the taxpayer with a corrected copy of Form 8879 if changes are made to the return (for example, based on taxpayer review).

•EROs can sign the form using a rubber stamp, mechanical device (such as a signature pen), or computer software program. See Notice

•Go to www.irs.gov/Efile for the latest information.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The IRS 8879 form is used to authorize an e-filed tax return. It allows taxpayers to sign their tax return electronically. |

| Eligibility | Any taxpayer who files an electronic return can use the IRS 8879 form, including individuals and businesses. |

| Signature Requirement | Taxpayers must sign the form to validate the e-filing process. This signature can be electronic. |

| Filing Deadline | The IRS 8879 must be submitted with the e-filed return by the tax filing deadline, typically April 15. |

| Retention Period | Taxpayers should retain the IRS 8879 form for at least three years from the date the return was filed. |

| State-Specific Forms | Some states have their own e-file authorization forms. For example, California uses Form 8453 for similar purposes. |

| Governing Laws | The IRS 8879 is governed by federal tax laws, specifically under the Internal Revenue Code. |

IRS 8879 - Usage Guidelines

After completing the IRS 8879 form, the next step is to submit it to your tax preparer or e-file your tax return. This form serves as an electronic signature authorization for your tax return. Ensure all information is accurate to avoid any delays in processing.

- Obtain a copy of the IRS 8879 form.

- Fill in your name, address, and Social Security number in the designated fields.

- Enter the tax year for which you are filing.

- Provide your tax preparer’s name, address, and their Preparer Tax Identification Number (PTIN).

- Review the section that states your return is ready to be filed electronically.

- Sign and date the form in the appropriate sections.

- Provide your email address if required.

- Submit the completed form to your tax preparer or follow the instructions for e-filing.

Common PDF Forms

Australian Passport Renewal Application (pc7) - Requirements for photos include being recent and in color.

The Texas Mobile Home Bill of Sale is a legal document that facilitates the transfer of ownership of a mobile home from one party to another. This form outlines essential details, including the buyer's and seller's information, the mobile home's specifications, and the sale price. For those looking to create or access a template for this important transaction, resources such as mobilehomebillofsale.com/blank-texas-mobile-home-bill-of-sale/ can be invaluable in ensuring a smooth process and protecting both parties' interests.

Section 8 Voucher Expiration - Your extension request should reflect your genuine need for more time.

Signs of a Miscarriage Coming - It is designed to facilitate respectful handling of sensitive matters like miscarriage.

Dos and Don'ts

When filling out the IRS 8879 form, it’s important to approach the task with care. Here’s a helpful list of things to do and avoid, ensuring a smooth process.

- Do: Read the instructions carefully before starting.

- Do: Provide accurate information to avoid delays.

- Do: Double-check your Social Security Number (SSN) for accuracy.

- Do: Sign and date the form in the appropriate sections.

- Do: Keep a copy of the completed form for your records.

- Don’t: Leave any required fields blank.

- Don’t: Forget to check for any errors before submission.

- Don’t: Use the form if you are not eligible to e-file.

- Don’t: Submit the form without the necessary signatures.

By following these guidelines, you can ensure that your IRS 8879 form is filled out correctly and submitted without issues.

Common mistakes

-

Incorrect Social Security Number (SSN): One common mistake is entering the wrong SSN. This can lead to delays in processing and potential issues with the IRS. Always double-check the number against official documents.

-

Missing Signatures: The IRS 8879 form requires signatures from both the taxpayer and the preparer. Omitting one of these signatures can result in the form being rejected. It is essential to ensure that both parties have signed before submission.

-

Inaccurate Income Information: Providing incorrect income figures can cause discrepancies in tax calculations. It's important to verify all income sources and ensure they match the information reported on other tax forms.

-

Failure to Review the Form: Many individuals submit the form without thoroughly reviewing it. This can lead to overlooked errors. Taking a moment to carefully check the entire form can prevent many common mistakes.