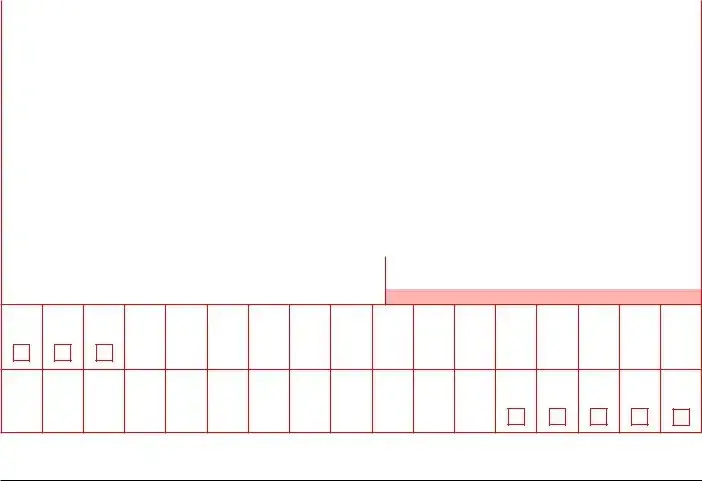

Fill in a Valid IRS 1096 Form

Document Sample

Attention filers of Form 1096:

This form is provided for informational purposes only. It appears in red, similar to the official IRS form. The official printed version of this IRS form is scannable, but a copy, printed from this website, is not. Do not print and file a Form 1096 downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

To order official IRS information returns, which include a scannable Form 1096 for filing with the IRS, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically. To file electronically, you must have software, or a service provider, that will create the file in the proper format. More information can be found at:

•IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE), or

•IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

Do Not Staple 6969

Form 1096 |

|

Annual Summary and Transmittal of |

|

|

|

|

|

|

|

|

|

OMB No. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

|||||||||||||||||||

Department of the Treasury |

|

|

U.S. Information Returns |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FILER’S name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (including room or suite number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

For Official Use Only |

|||||||||||||||||||||

Name of person to contact |

|

|

Telephone number |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email address |

|

|

Fax number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Employer identification number |

2 Social security number |

|

3 Total number of forms |

4 Federal income tax withheld |

5 Total amount reported with this Form 1096 |

||||||||||||||||||||||||||

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 Enter an “X” in only one box below to indicate the type of form being filed.

32 50

1098

81

78 |

|

84 |

|

03 |

|

74 |

|

83 |

|

80 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

79 |

|

85 |

|

73 |

91 |

|

86 |

|

92 |

|

10 |

|

16 |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3921 |

||||||||||||||||||||||||||||||

93 |

95 |

71 |

|

96 |

97 |

|

31 |

|

|

1A |

98 |

|

75 |

|

94 |

43 |

|

25 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3922

26

5498

28

72

2A 27

Return this entire page to the Internal Revenue Service. Photocopies are not acceptable.

Send this form, with the copies of the form checked in box 6, to the IRS in a flat mailer (not folded).

Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete.

Signature ▶ |

Title ▶ |

Date ▶ |

|

Instructions |

Enter the filer’s name, address (including room, suite, or other unit |

||

Future developments. For the latest information about developments |

number), and taxpayer identification number (TIN) in the spaces |

||

provided on the form. The name, address, and TIN of the filer on this |

|||

related to Form 1096, such as legislation enacted after it was |

|||

form must be the same as those you enter in the upper left area of |

|||

published, go to www.irs.gov/Form1096. |

|||

Forms 1097, 1098, 1099, 3921, 3922, 5498, or |

|||

|

|||

Reminder. The only acceptable method of electronically filing |

When to file. File Form 1096 as follows. |

|

|

information returns listed on this form in box 6 with the IRS is through |

• With Forms 1097, 1098, 1099, 3921, 3922, or |

||

the FIRE System. See Pub. 1220. |

|||

February 28, 2023. |

|

||

Purpose of form. Use this form to transmit paper Forms 1097, 1098, |

|

||

• With Forms |

|||

1099, 3921, 3922, 5498, and |

|||

• With Forms 5498, file by May 31, 2023. |

|

||

Caution: If you are required to file 250 or more information returns of |

|

||

|

|

||

any one type (excluding Form |

Where To File |

|

|

you are required to file electronically but fail to do so, and you do not |

Send all information returns filed on paper with Form 1096 to the |

||

have an approved waiver, you may be subject to a penalty. The |

|||

Taxpayer First Act of 2019, enacted July 1, 2019, authorized the |

following. |

|

|

Department of the Treasury and the IRS to issue regulations that |

If your principal business, office |

|

||

reduce the |

Use the following |

|||

or agency, or legal residence in |

||||

regulations are issued and effective for 2022 tax returns required to be |

the case of an individual, is |

address |

||

filed in 2023, we will post an article at www.irs.gov/Form1099 |

||||

|

located in |

|

||

explaining the change. Until regulations are issued, however, the |

|

|

||

|

▲ |

▲ |

||

number remains at 250, as reflected in these instructions. For more |

|

|||

|

|

|

||

information, see part F in the 2022 General Instructions for Certain |

Alabama, Arizona, Arkansas, Delaware, |

|

||

Information Returns. |

Florida, Georgia, Kentucky, Maine, |

Internal Revenue Service |

||

|

Massachusetts, Mississippi, New |

|||

Forms |

P.O. Box 149213 |

|||

Hampshire, New Jersey, New Mexico, |

||||

of the number of returns. |

New York, North Carolina, Ohio, Texas, |

Austin, TX |

||

Who must file. Any person or entity who files any of the forms shown |

Vermont, Virginia |

|

||

|

|

|

||

in line 6 above must file Form 1096 to transmit those forms to the IRS. |

|

|

|

|

Caution: Your name and TIN must match the name and TIN used on |

|

|

|

|

your 94X series tax return(s) or you may be subject to information |

|

|

|

|

return penalties. Do not use the name and/or TIN of your paying agent |

|

|

|

|

or service bureau. |

|

|

|

|

|

|

|

||

For more information and the Privacy Act and Paperwork Reduction Act Notice, |

Cat. No. 14400O |

Form 1096 (2022) |

||

see the 2022 General Instructions for Certain Information Returns. |

|

|

|

|

Form 1096 (2022) |

Page 2 |

Alaska, Colorado, Hawaii, Idaho, |

|

|

Illinois, Indiana, Iowa, Kansas, |

|

|

Michigan, Minnesota, Missouri, |

Internal Revenue Service Center |

|

Montana, Nebraska, Nevada, North |

P.O. Box 219256 |

|

Dakota, Oklahoma, Oregon, South |

Kansas City, MO |

|

Carolina, South Dakota, Tennessee, |

|

|

Utah, Washington, Wisconsin, Wyoming |

|

|

|

|

|

California, Connecticut, |

Internal Revenue Service Center |

|

District of Columbia, Louisiana, |

||

1973 North Rulon White Blvd. |

||

Maryland, Pennsylvania, |

||

Ogden, UT 84201 |

||

Rhode Island, West Virginia |

||

|

If your legal residence or principal place of business is outside the United States, file with the Internal Revenue Service, P.O. Box 149213, Austin, TX

Transmitting to the IRS. Group the forms by form number and transmit each group with a separate Form 1096. For example, if you must file both Forms 1098 and

Box 1 or 2. Enter your TIN in either box 1 or 2, not both. Individuals not in a trade or business must enter their social security number (SSN) in box 2. Sole proprietors and all others must enter their employer identification number (EIN) in box 1. However, sole proprietors who do not have an EIN must enter their SSN in box 2. Use the same EIN or SSN on Form 1096 that you use on Form 1097, 1098, 1099, 3921, 3922, 5498, or

Box 3. Enter the number of forms you are transmitting with this Form 1096. Do not include blank or voided forms or the Form 1096 in your total. Enter the number of correctly completed forms, not the number of pages, being transmitted. For example, if you send one page of

Box 4. Enter the total federal income tax withheld shown on the forms being transmitted with this Form 1096.

Box 5. No entry is required if you are filing Form

Form |

Box 1 |

Form |

Box 1 |

Form 1098 |

Boxes 1 and 6 |

Form |

Box 4c |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 4 |

Form |

Boxes 1d and 13 |

Form |

Box 2 |

Form |

Box 2 |

Form |

Boxes 1a, 2a, 3, 9, 10, and 11 |

Form |

Boxes 1, 3, 8, 10, 11, and 13 |

Form |

Box 1a |

Form |

Box 1 |

Form |

Boxes 1 and 2 |

Form |

Boxes 1, 2, 3, 5, 6, 8, 9, 10, 11, and 13 |

Form |

Box 1 |

Form |

Boxes 1, 2, 5, 6, and 8 |

Form |

Boxes 1, 2, 3, and 5 |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 2 |

Form |

Box 1 |

Form |

Boxes 1 and 2 |

Form 3921 |

Boxes 3 and 4 |

Form 3922 |

Boxes 3, 4, and 5 |

Form 5498 |

Boxes 1, 2, 3, 4, 5, 8, 9, 10, 12b, 13a, |

|

and 14a |

Form |

Boxes 1 and 2 |

Form |

Boxes 1 and 2 |

Form |

Box 1 |

Corrected returns. For information about filing corrections, see the 2022 General Instructions for Certain Information Returns. Originals and corrections of the same type of return can be submitted using one Form 1096.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1096 serves as a summary of information returns submitted to the IRS, such as Forms 1099, 1098, and W-2G. |

| Filing Requirement | Businesses must file Form 1096 if they are submitting paper copies of certain information returns, and it must accompany those returns. |

| Deadline | The form is typically due by the end of February for paper submissions, aligning with the deadlines for the information returns it summarizes. |

| State-Specific Forms | Some states have their own summary forms, such as California's Form 1096, governed by the California Revenue and Taxation Code. |

IRS 1096 - Usage Guidelines

After completing the IRS 1096 form, you will need to submit it along with your other tax documents to the IRS. Ensure that you keep a copy for your records. Follow the steps below to accurately fill out the form.

- Obtain a blank IRS 1096 form. You can download it from the IRS website or request a paper form.

- Fill in the filer's name in the designated box. This should be the name of the entity or individual submitting the form.

- Enter the filer's address. Include the street address, city, state, and ZIP code.

- Provide the filer's TIN (Taxpayer Identification Number). This could be a Social Security Number (SSN) or Employer Identification Number (EIN).

- In the section labeled total number of forms, indicate how many forms you are submitting.

- Enter the total amount of money reported on the accompanying forms in the appropriate box.

- Sign and date the form at the bottom. Ensure that the signature belongs to the person authorized to file the form.

- Make a copy of the completed form for your records before submitting.

Common PDF Forms

Florida Realtors Lease Agreement - Provisions included will assist in the management of common property rules and behavior.

In addition to the critical details needed for a successful transaction, it's important to utilize reliable resources when completing the Washington Trailer Bill of Sale, and you can find helpful templates at Washington Templates to guide you through the process and ensure compliance with state regulations.

What Is an Identity Verification Form - Each section of the form serves a specific purpose in ensuring identity verification is thorough.

Dos and Don'ts

When filling out the IRS 1096 form, it’s essential to be careful and thorough. This form serves as a summary of information returns that you are submitting to the IRS. Here are some important do's and don'ts to consider:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and identification numbers.

- Do use the correct version of the form for the tax year you are reporting. Each year may have updates or changes.

- Do sign and date the form before submitting it. An unsigned form may be considered invalid.

- Do keep a copy of the completed form for your records. This can be helpful for future reference or if questions arise.

- Don't leave any fields blank. If a section does not apply, write “N/A” instead of leaving it empty.

- Don't forget to check the submission deadline. Late filings can result in penalties.

- Don't submit the form without the necessary accompanying information returns. Ensure everything is included.

- Don't ignore any instructions provided by the IRS. These guidelines are there to help you complete the form correctly.

Common mistakes

-

Incorrect Tax Year: One common mistake is entering the wrong tax year on the form. The tax year must match the year for which the information returns are being submitted. If a different year is indicated, the IRS may reject the submission.

-

Missing or Incorrect Employer Identification Number (EIN): Failing to include the correct EIN can lead to processing delays. The EIN must be accurate and match the information returns being reported. A missing or incorrect number can result in penalties or the return being deemed invalid.

-

Omitting Signature: The IRS requires that the form be signed by an authorized person. Neglecting to sign the form can cause it to be considered incomplete. This oversight can lead to further complications and delays in processing.

-

Inaccurate Totals: Errors in calculating the total number of forms submitted can create discrepancies. It is essential to ensure that the totals match the actual number of information returns attached. Any discrepancies may trigger an audit or additional inquiries from the IRS.