Valid Investment Letter of Intent Template

Document Sample

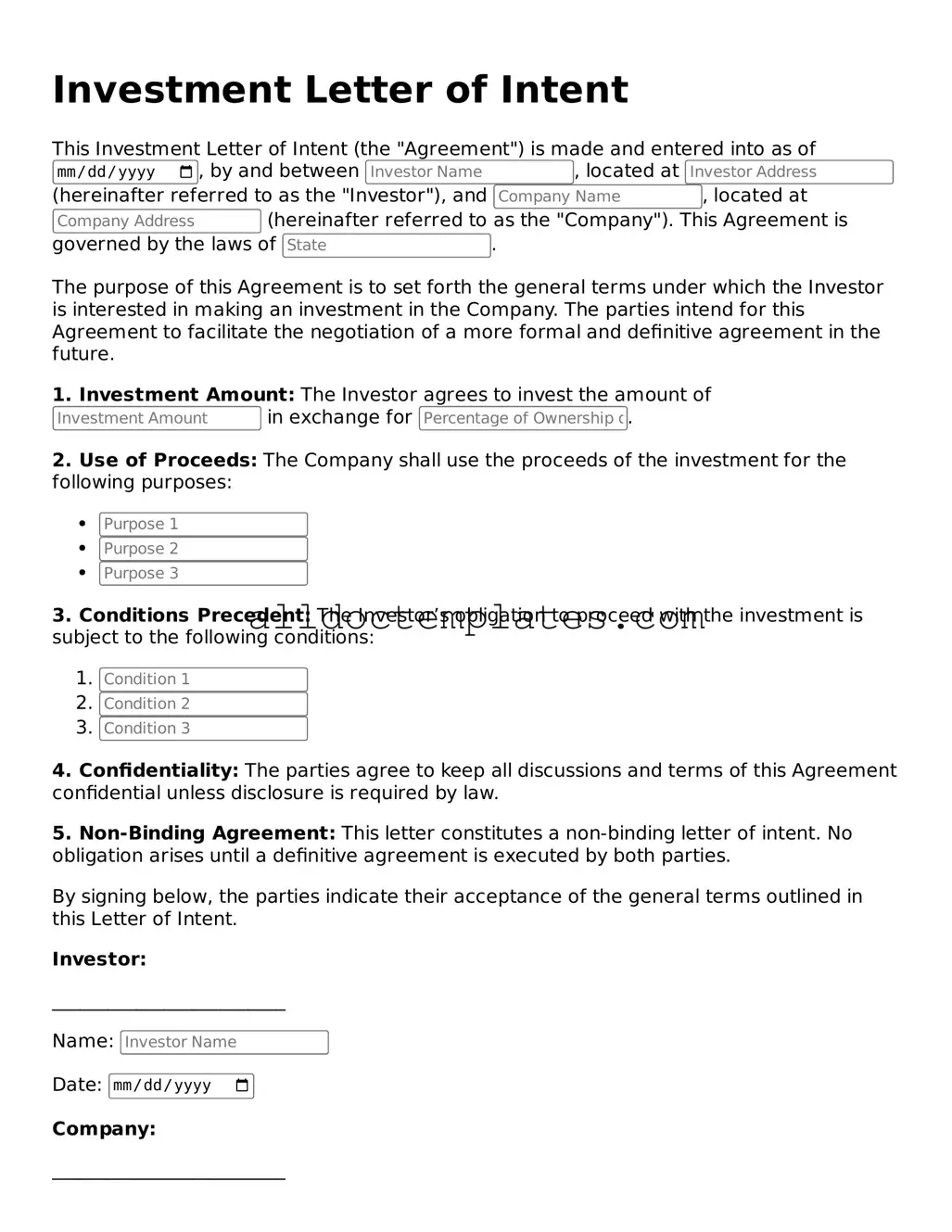

Investment Letter of Intent

This Investment Letter of Intent (the "Agreement") is made and entered into as of , by and between , located at (hereinafter referred to as the "Investor"), and , located at (hereinafter referred to as the "Company"). This Agreement is governed by the laws of .

The purpose of this Agreement is to set forth the general terms under which the Investor is interested in making an investment in the Company. The parties intend for this Agreement to facilitate the negotiation of a more formal and definitive agreement in the future.

1. Investment Amount: The Investor agrees to invest the amount of in exchange for .

2. Use of Proceeds: The Company shall use the proceeds of the investment for the following purposes:

3. Conditions Precedent: The Investor’s obligation to proceed with the investment is subject to the following conditions:

4. Confidentiality: The parties agree to keep all discussions and terms of this Agreement confidential unless disclosure is required by law.

5. Non-Binding Agreement: This letter constitutes a non-binding letter of intent. No obligation arises until a definitive agreement is executed by both parties.

By signing below, the parties indicate their acceptance of the general terms outlined in this Letter of Intent.

Investor:

_________________________

Name:

Date:

Company:

_________________________

Name:

Date:

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent form outlines the preliminary agreement between parties interested in making an investment. It sets the stage for further negotiations and due diligence. |

| Non-Binding Nature | This form typically serves as a non-binding document, meaning that while it expresses the intent to invest, it does not create a legally enforceable obligation to proceed with the investment. |

| Confidentiality Clause | Many Investment Letters of Intent include a confidentiality clause, which protects sensitive information shared during the negotiation process from being disclosed to third parties. |

| Governing Law | The governing law for state-specific forms may vary. For example, an Investment Letter of Intent executed in California would be governed by California state law, while one in New York would adhere to New York law. |

Investment Letter of Intent - Usage Guidelines

Once you have the Investment Letter of Intent form in front of you, it’s time to get started on filling it out. This form is an important step in the investment process, and completing it accurately will help ensure that your intentions are clearly communicated. Follow the steps below to fill out the form correctly.

- Begin by entering your full name in the designated field. Make sure to use your legal name as it appears on official documents.

- Provide your contact information, including your phone number and email address. Double-check for accuracy to avoid any communication issues.

- In the next section, indicate the type of investment you are interested in. This could be a specific project or a general investment opportunity.

- Clearly state the amount you intend to invest. Be specific and ensure that the number is accurate.

- Include any relevant details about your investment preferences. This might include the timeline for your investment or any particular conditions you wish to set.

- Sign and date the form at the bottom. Your signature indicates your commitment and understanding of the information provided.

After completing the form, review it carefully to ensure all information is accurate and complete. Once satisfied, submit the form according to the instructions provided, whether that’s electronically or via mail. This will set the wheels in motion for your investment journey.

More Types of Investment Letter of Intent Templates:

Letter of Intent to Purchase Property - The Purchase Letter of Intent can highlight critical deadlines for both parties to follow.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it's important to approach the task with care. Here are seven things to keep in mind:

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do double-check all entries for errors.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or jargon that may confuse the reader.

- Don't submit the form without a final review.

By following these guidelines, you can ensure that your submission is clear and professional.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields. Leaving sections blank can delay the process or lead to rejection.

-

Incorrect Contact Details: Providing wrong phone numbers or email addresses can result in missed communications. Always double-check your contact information.

-

Failure to Sign: Some individuals neglect to sign the form. A signature is often necessary to validate the intent and ensure it is legally binding.

-

Not Reviewing Terms: Skimming through the terms and conditions can lead to misunderstandings. Take the time to read and understand what you are agreeing to.

-

Using Outdated Forms: Using an old version of the Investment Letter of Intent can cause issues. Always check for the most current version before filling it out.

-

Ignoring Submission Guidelines: Each investment opportunity may have specific submission requirements. Failing to follow these can result in your form being rejected.

-

Not Disclosing Conflicts of Interest: Transparency is key. Failing to disclose any potential conflicts can harm your credibility and the investment process.

-

Assuming Everyone Understands Your Intent: Clearly articulate your investment goals. Ambiguity can lead to misinterpretations.

-

Rushing the Process: Filling out the form in haste often leads to mistakes. Take your time to ensure accuracy and completeness.