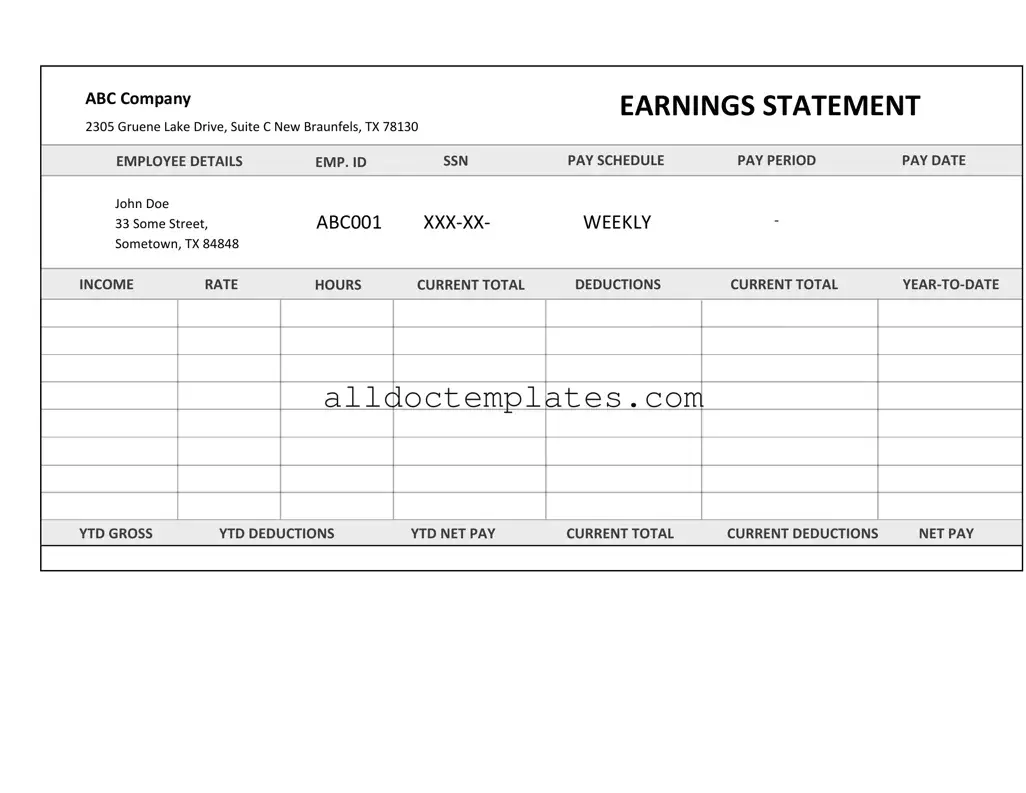

Fill in a Valid Independent Contractor Pay Stub Form

Document Sample

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Document Information

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings and deductions of an independent contractor for a specific pay period. |

| Purpose | This form helps contractors keep track of their income and provides proof of earnings for tax purposes. |

| Required Information | The pay stub typically includes the contractor's name, payment date, total earnings, and any deductions. |

| State Variations | Different states may have specific requirements for pay stubs, including what information must be included. |

| Governing Laws | In California, for example, the Labor Code Section 226 governs the requirements for pay stubs. |

| Tax Implications | Independent contractors are responsible for paying their own taxes, and accurate pay stubs help in calculating these amounts. |

| Record Keeping | Contractors should keep their pay stubs for at least three years for tax and legal purposes. |

Independent Contractor Pay Stub - Usage Guidelines

Filling out the Independent Contractor Pay Stub form is a straightforward process. This form is essential for documenting the payment details for services rendered by independent contractors. Properly completing the form ensures that both the contractor and the hiring entity maintain accurate records for tax and accounting purposes.

- Begin by entering the contractor's name at the top of the form. This should be the full legal name as it appears on tax documents.

- Next, fill in the contractor's address. Include the street address, city, state, and zip code.

- Provide the date of payment. This is the date on which the payment is being made to the contractor.

- Indicate the payment period. Specify the start and end dates for the services provided.

- List the total amount paid to the contractor for the services rendered during the specified period.

- If applicable, include any deductions such as taxes or other withholdings. Clearly specify the amounts for transparency.

- Finally, sign and date the form at the bottom to confirm the payment details are accurate and complete.

Common PDF Forms

Navy Leave Chit - A section on the form is dedicated to reporting emergencies or changes in leave plans.

Da 5960 Army - The DA 5960 is an important tool for proactive financial management within military ranks.

Understanding the importance of a General Power of Attorney can greatly aid individuals in delegating their financial responsibilities. This document provides flexibility and clarity in managing one's affairs. For those seeking assistance, exploring a professional guide on how a General Power of Attorney operates can be invaluable. Visit this resource on General Power of Attorney for more insights.

Joint Tenancy in California - Trust administration must adhere to legal guidelines that this affidavit upholds.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it's essential to approach the task with care and attention to detail. Here are five key do's and don'ts to keep in mind:

- Do ensure all personal information is accurate and up to date. Mistakes can lead to payment delays.

- Do clearly outline the services provided and the corresponding payment amounts. Transparency is crucial.

- Do double-check the dates of service. Accurate dates prevent confusion and disputes.

- Do keep a copy of the completed pay stub for your records. This can be invaluable for tax purposes.

- Do consult with a tax professional if you have questions about deductions or tax implications.

- Don't leave any sections blank. Incomplete forms can lead to processing issues.

- Don't use vague descriptions for services rendered. Be specific to avoid misunderstandings.

- Don't forget to sign and date the form. An unsigned document may not be considered valid.

- Don't submit the form without reviewing it thoroughly. Errors can lead to financial repercussions.

- Don't ignore deadlines for submission. Timely filing is essential for smooth operations.

Common mistakes

-

Failing to include the correct contractor name. Ensure the name matches the one on the tax documents.

-

Omitting the contractor address. This information is essential for tax purposes and should be accurate.

-

Incorrectly entering the payment date. Always verify that the date corresponds to when the payment was made.

-

Not specifying the payment amount clearly. Double-check calculations to avoid any discrepancies.

-

Leaving out the payment method. Indicate whether the payment was made via check, direct deposit, or another method.

-

Neglecting to include tax deductions. If applicable, list any deductions that have been taken out of the payment.

-

Failing to sign the form. A signature is often required to validate the document.

-

Using outdated forms. Always ensure you are using the most current version of the Independent Contractor Pay Stub form.

-

Not keeping a copy for records. Retain a copy for personal records and future reference.

-

Rushing through the form. Take your time to review each section for accuracy before submission.