Fill in a Valid Goodwill donation receipt Form

Document Sample

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

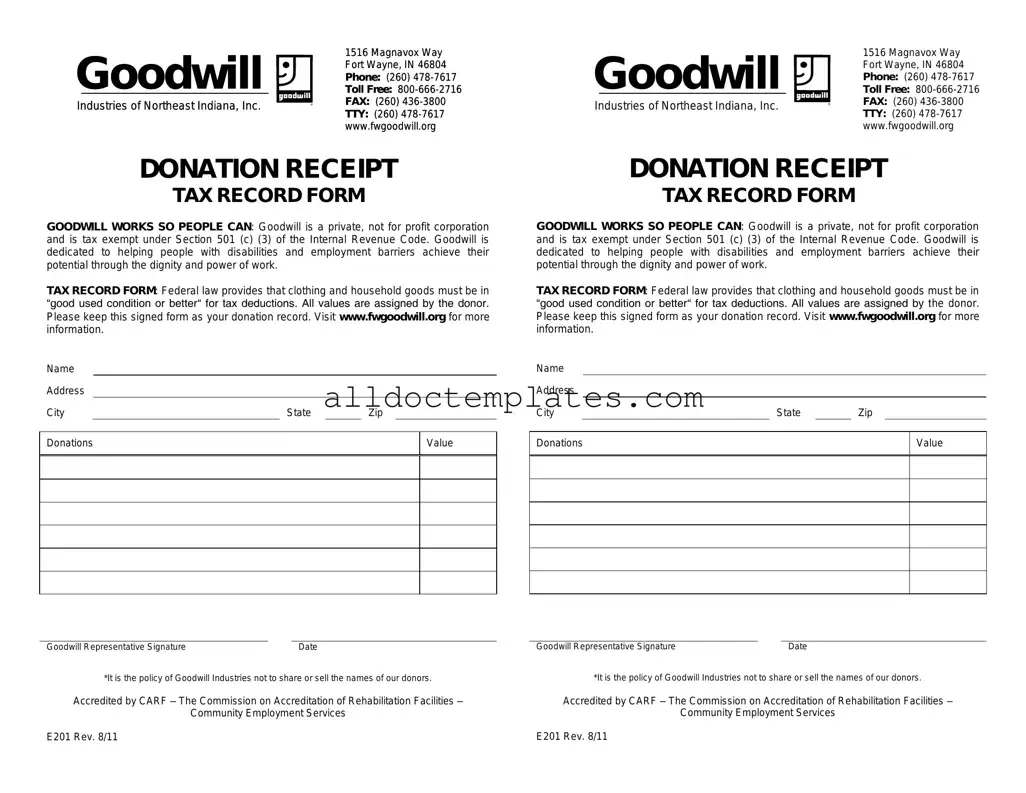

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Goodwill donation receipt form serves as proof of donation for tax purposes. |

| Tax Deductibility | Donors may claim a tax deduction for their donations, subject to IRS regulations. |

| Itemization | Donors should list the items donated on the receipt for accurate tax reporting. |

| Value Estimation | Donors are responsible for estimating the fair market value of their donated items. |

| State-Specific Forms | Some states may have specific requirements for donation receipts, including California and New York. |

| IRS Form 8283 | For donations over $500, donors must complete IRS Form 8283 in addition to the receipt. |

| Record Keeping | Donors should keep the receipt for their records, especially during tax season. |

| Non-Profit Status | Goodwill is a registered non-profit organization, which allows for tax-deductible donations. |

| Donation Limits | There are limits to how much can be deducted based on income and type of donation. |

| Governing Laws | IRS regulations govern the use of donation receipts for tax deductions. |

Goodwill donation receipt - Usage Guidelines

After gathering your items for donation to Goodwill, you will need to complete a donation receipt form. This form serves as proof of your charitable contribution and may be used for tax purposes. Follow these steps to fill out the form accurately.

- Start by writing the date of your donation at the top of the form.

- Next, fill in your name and address. This information identifies you as the donor.

- In the section for the donation description, list the items you are donating. Be specific about each item, including quantity and condition.

- Indicate the estimated value of each item. This value should reflect what you believe the items are worth.

- Sign the form to confirm that the information you provided is accurate.

- Finally, keep a copy of the completed receipt for your records. This will be useful when filing your taxes.

Once you have completed the form, you can submit it to Goodwill along with your donated items. Be sure to keep your copy safe for future reference.

Common PDF Forms

Medication Administration Record Pdf Fillable - Can assist in reducing medication waste through accurate tracking.

Accident Report Form Template - Address and mitigate risks associated with workplace injuries.

A Colorado Do Not Resuscitate (DNR) Order form is a legal document that allows individuals to refuse resuscitation efforts in the event of a medical emergency. This form ensures that a person's wishes regarding life-sustaining treatment are respected by healthcare providers. For more information on how to complete this important document, you may refer to Colorado PDF Templates, which provides useful resources for those considering their end-of-life care options.

Progress Notes Should Be Written - Patient missed last appointment; reschedule suggested.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it is important to follow certain guidelines to ensure that your donation is properly documented. Here are four things you should do and four things you should avoid.

Things You Should Do:

- Provide accurate information about the items you are donating.

- Include your name and contact information for future reference.

- Make sure to date the receipt to establish when the donation took place.

- Keep a copy of the receipt for your records and tax purposes.

Things You Shouldn't Do:

- Do not estimate the value of your donated items without proper assessment.

- Avoid leaving any sections of the form blank; complete all required fields.

- Do not forget to sign the receipt, as this confirms your donation.

- Refrain from submitting the form without double-checking for errors.

Common mistakes

-

Failing to provide accurate contact information. Donors should include their name, address, and phone number to ensure proper documentation.

-

Not listing all donated items. It is important to itemize each item being donated, as this can affect tax deductions.

-

Omitting the condition of items. Donors should describe the condition of each item (e.g., new, gently used, or damaged) to give a clear understanding of the donation's value.

-

Forgetting to date the receipt. A receipt should always include the date of the donation for record-keeping and tax purposes.

-

Not signing the receipt. A signature from the donor can validate the receipt and affirm the donation.

-

Leaving out the estimated value of items. Donors should provide a fair market value for each item listed, which is necessary for tax deductions.

-

Not keeping a copy of the receipt. It is advisable to maintain a copy of the donation receipt for personal records and tax filings.

-

Misunderstanding the tax implications. Donors should be aware of the IRS guidelines regarding charitable donations to ensure compliance.

-

Relying solely on the receipt for tax deductions. Donors should also keep records of the donation process, such as photos of items or notes on their condition.