Fill in a Valid Gift Letter Form

Document Sample

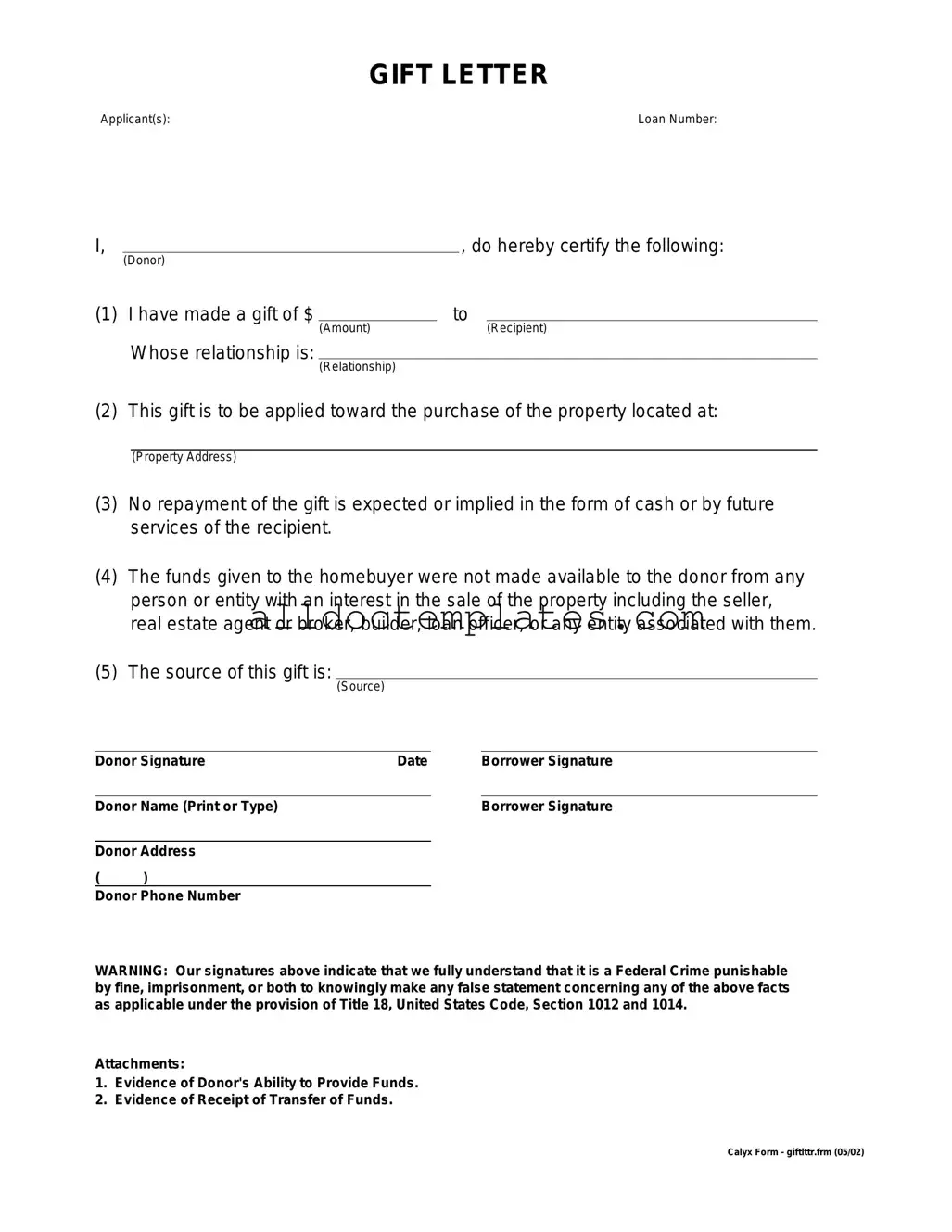

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Document Information

| Fact Name | Description |

|---|---|

| Definition | A gift letter is a document that outlines a financial gift given to a recipient, often used in real estate transactions. |

| Purpose | It serves to clarify that the funds are a gift and not a loan, which can impact mortgage approval. |

| Common Use | Gift letters are frequently used by homebuyers who receive financial assistance from family members for down payments. |

| Required Information | The letter typically includes the donor's name, recipient's name, amount of the gift, and a statement confirming that repayment is not expected. |

| State-Specific Forms | Some states may have specific requirements or forms related to gift letters, such as California and New York. |

| Governing Laws | In California, the gift letter must comply with the California Civil Code, while New York follows its own regulations regarding gifts and financial disclosures. |

| Donor's Affidavit | Some lenders may require the donor to provide an affidavit confirming the gift, which adds an extra layer of verification. |

| Impact on Taxes | Gift letters can have tax implications for both the donor and recipient, particularly concerning the annual gift tax exclusion. |

Gift Letter - Usage Guidelines

Once you have gathered the necessary information, you can begin filling out the Gift Letter form. This form is essential for documenting the details of a gift, ensuring that all parties involved are clear about the terms and intentions. Follow these steps to complete the form accurately.

- Start with the date at the top of the form. Write the current date in the designated space.

- Enter the name of the donor (the person giving the gift) in the appropriate field.

- Provide the donor's address, including street, city, state, and zip code.

- In the next section, write the name of the recipient (the person receiving the gift).

- Fill in the recipient's address, ensuring it matches their official residence.

- Specify the amount of the gift in the designated area. Be clear and precise.

- Indicate the purpose of the gift, such as "down payment for a home" or "personal use."

- Both the donor and recipient should sign the form. Make sure the signatures are dated.

- Review the completed form for accuracy and completeness before submission.

After filling out the Gift Letter form, ensure that all parties have copies for their records. This will help in maintaining transparency and clarity regarding the gift transaction.

Common PDF Forms

Broward Animal Care and Adoption - This form emphasizes public health responsibility among pet owners.

To streamline your service agreements, understanding the importance of the necessary Independent Contractor Agreement details is vital. This ensures both parties are on the same page regarding their responsibilities and expectations.

Aca Dog Registration - Encourage other breeders to register with ACA to maintain breed standards.

Dos and Don'ts

When filling out a Gift Letter form, attention to detail is crucial. Here are ten important tips to guide you through the process.

- Do clearly state the relationship between the giver and the recipient. This helps establish the legitimacy of the gift.

- Do include the exact amount of the gift. Precision is key to avoid any misunderstandings later.

- Do sign and date the form. A signature adds authenticity and confirms the giver's intent.

- Do use clear and concise language. This ensures that everyone understands the terms of the gift.

- Do provide your contact information. This allows for any follow-up questions or clarifications.

- Don't leave any fields blank. Incomplete forms can lead to delays or complications.

- Don't use vague terms. Be specific about the gift to avoid confusion.

- Don't forget to check for errors. Typos or inaccuracies can undermine the credibility of the document.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

- Don't assume the recipient knows the details. Clearly outline the terms to prevent any future disputes.

By following these guidelines, you can ensure that your Gift Letter form is completed accurately and effectively. This not only protects the interests of both parties but also helps in maintaining a smooth transaction.

Common mistakes

-

Missing Information: One of the most common mistakes is failing to provide all required details. This can include the donor's name, address, and relationship to the recipient. Each piece of information plays a crucial role in verifying the legitimacy of the gift.

-

Incorrect Amounts: Entering the wrong gift amount can lead to confusion and delays. It's essential to double-check the figures to ensure they match the amount that will be transferred. A small error can have significant implications.

-

Not Signing the Letter: Forgetting to sign the gift letter is another frequent oversight. A signature is often required to validate the document, and without it, the letter may not be accepted by the lender or financial institution.

-

Failure to Include a Date: Omitting the date can cause issues, especially if the timing of the gift is questioned later on. Including the date helps establish when the gift was made and adds clarity to the transaction.