Valid Gift Deed Template

Document Sample

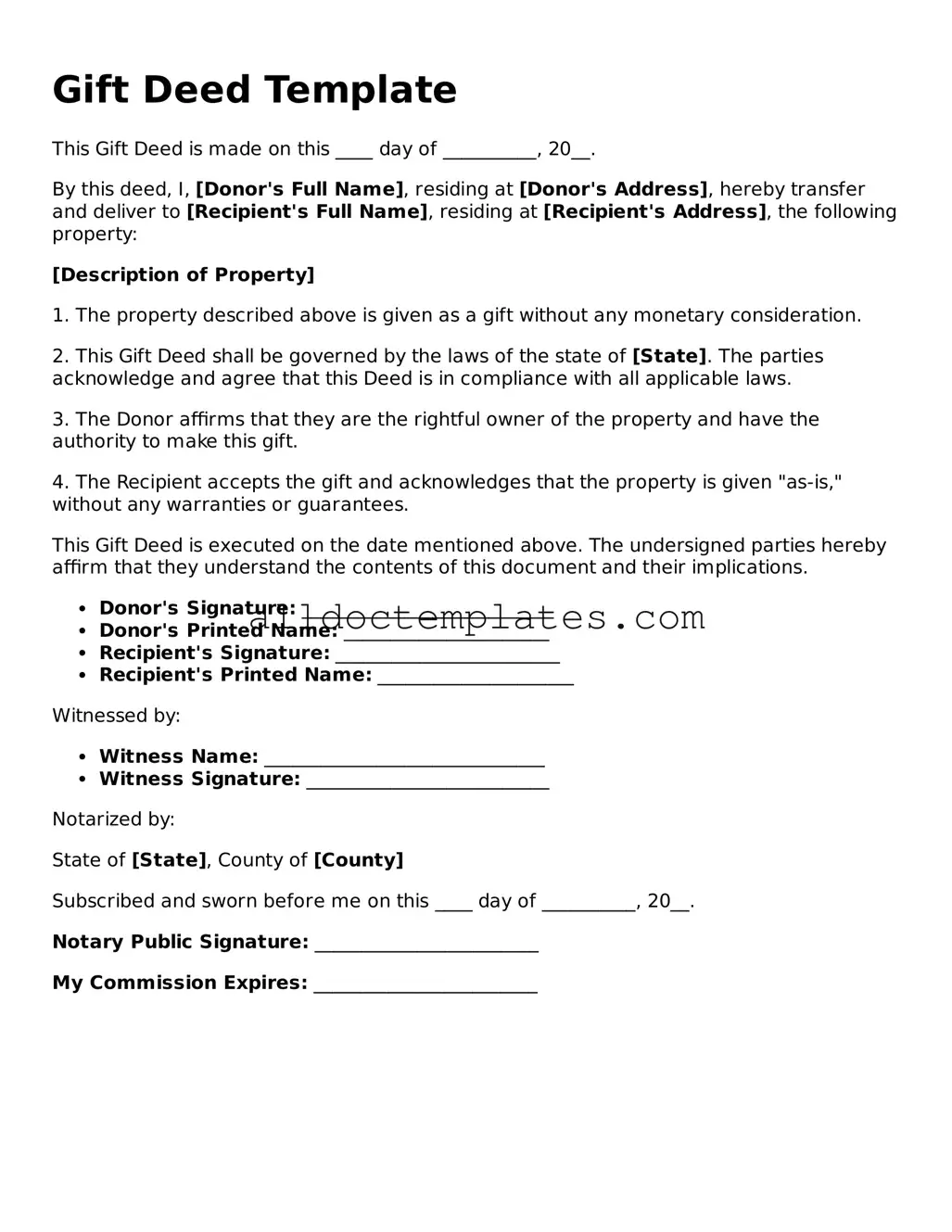

Gift Deed Template

This Gift Deed is made on this ____ day of __________, 20__.

By this deed, I, [Donor's Full Name], residing at [Donor's Address], hereby transfer and deliver to [Recipient's Full Name], residing at [Recipient's Address], the following property:

[Description of Property]

1. The property described above is given as a gift without any monetary consideration.

2. This Gift Deed shall be governed by the laws of the state of [State]. The parties acknowledge and agree that this Deed is in compliance with all applicable laws.

3. The Donor affirms that they are the rightful owner of the property and have the authority to make this gift.

4. The Recipient accepts the gift and acknowledges that the property is given "as-is," without any warranties or guarantees.

This Gift Deed is executed on the date mentioned above. The undersigned parties hereby affirm that they understand the contents of this document and their implications.

- Donor's Signature: ___________________________

- Donor's Printed Name: ______________________

- Recipient's Signature: ________________________

- Recipient's Printed Name: _____________________

Witnessed by:

- Witness Name: ______________________________

- Witness Signature: __________________________

Notarized by:

State of [State], County of [County]

Subscribed and sworn before me on this ____ day of __________, 20__.

Notary Public Signature: ________________________

My Commission Expires: ________________________

State-specific Information for Gift Deed Forms

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. |

| Governing Law | In the United States, the laws governing Gift Deeds can vary by state. Generally, they are regulated by state property laws. |

| Requirements | Most states require the Gift Deed to be in writing, signed by the donor, and notarized to be legally valid. |

| Tax Implications | Gifts may have tax implications. The donor might need to file a gift tax return if the value exceeds the annual exclusion limit set by the IRS. |

Gift Deed - Usage Guidelines

Filling out a Gift Deed form is an important step in transferring ownership of a property or asset from one person to another without any exchange of money. After completing the form, it should be signed and possibly notarized, depending on your state’s requirements. This ensures that the gift is legally recognized and can be recorded with the appropriate authorities.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the donor (the person giving the gift).

- Next, enter the full name and address of the recipient (the person receiving the gift).

- Clearly describe the property or asset being gifted. Include details like the address for real estate or a description for personal property.

- Specify any conditions or restrictions related to the gift, if applicable.

- Both the donor and recipient should sign the form in the designated areas.

- If required by your state, have the form notarized to ensure its validity.

- Make copies of the completed form for both parties’ records.

- Submit the form to the appropriate local or state office if necessary.

More Types of Gift Deed Templates:

What Is a Deed in Lieu of Foreclosure - Each party's legal rights and obligations should be clearly defined in the deed in lieu agreement.

A Colorado Do Not Resuscitate (DNR) Order form is a crucial legal document that allows individuals to refuse resuscitation efforts in the event of a medical emergency. This form ensures that a person's wishes regarding life-sustaining treatment are respected by healthcare providers. For those looking to navigate this process effectively, resources like Colorado PDF Templates can provide valuable guidance in understanding how to properly complete and utilize this form, which is essential for anyone considering their end-of-life care options.

Dos and Don'ts

When filling out a Gift Deed form, it’s important to be careful and thorough. Here are some guidelines to help you through the process.

- Do ensure that all parties involved are clearly identified. Include full names and addresses.

- Don't leave any sections blank. Incomplete forms can lead to delays or legal issues.

- Do specify the gift clearly. Describe the property or item being gifted in detail.

- Don't use vague language. Ambiguity can create confusion and disputes later.

- Do have the document signed in front of a notary public. This adds an important layer of authenticity.

- Don't forget to keep a copy of the signed Gift Deed for your records.

- Do consult with a legal professional if you have any questions about the process.

Common mistakes

-

Incomplete Information: One of the most common mistakes is not filling out all required fields. Each section of the Gift Deed form is important for clarity and legality. Omitting details can lead to confusion or disputes later on.

-

Incorrect Names: Ensure that the names of both the giver and the recipient are spelled correctly. Any discrepancies can create complications in the future, especially if the deed needs to be referenced in legal matters.

-

Failure to Include a Description of the Gift: It’s essential to clearly describe the item or property being gifted. Without a detailed description, the intent of the gift may not be clear, which can lead to misunderstandings.

-

Not Notarizing the Document: Many states require that a Gift Deed be notarized to be legally binding. Skipping this step can render the document invalid, making it crucial to find a notary public before finalizing the deed.

-

Ignoring State Laws: Each state has specific laws regarding gift deeds. Failing to adhere to these regulations can invalidate the gift. It’s advisable to check local requirements before submitting the form.

-

Not Keeping Copies: After completing the Gift Deed, it’s important to keep copies for both the giver and the recipient. This ensures that both parties have proof of the transaction, which can be necessary for future reference.