Fill in a Valid Generic Direct Deposit Form

Document Sample

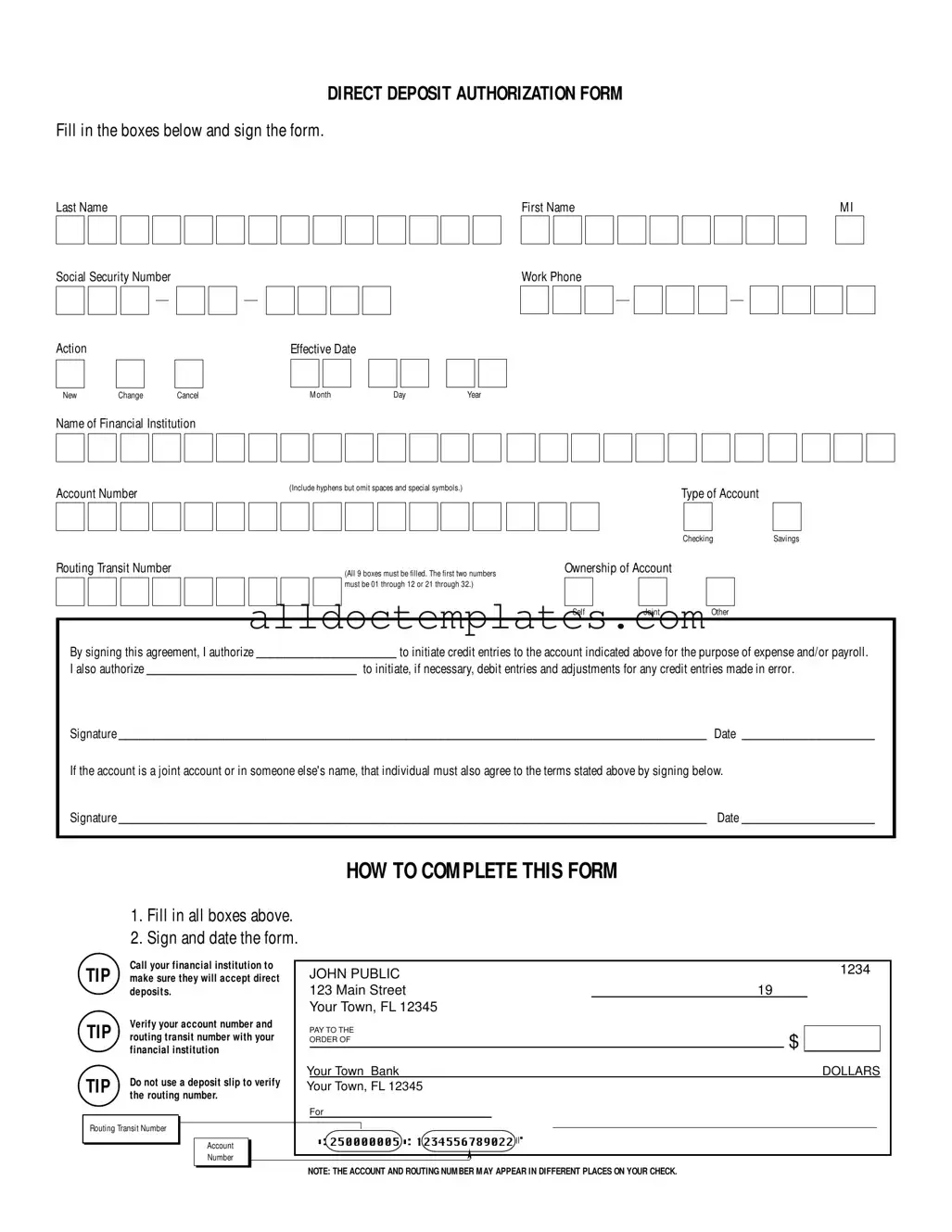

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

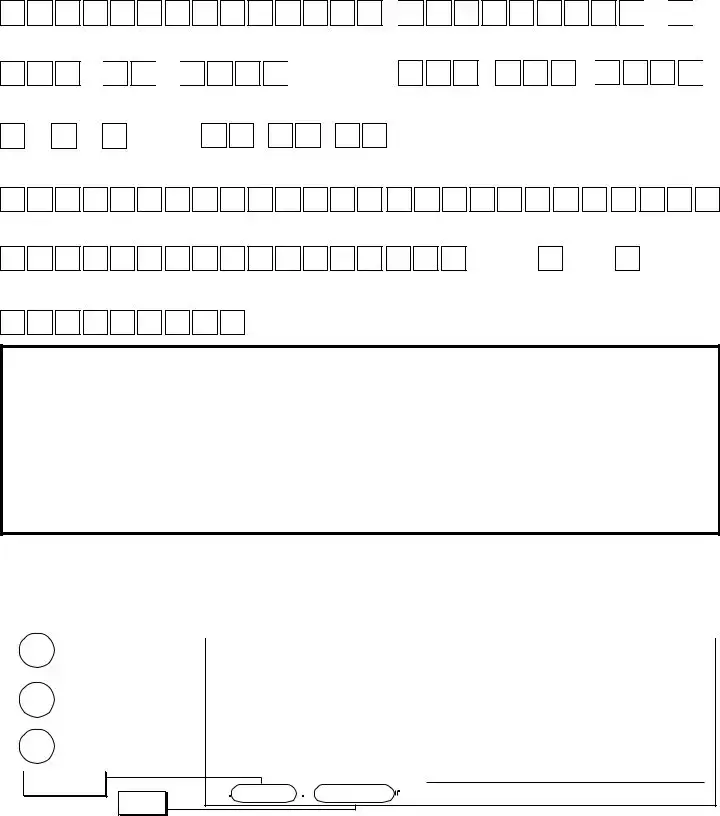

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Generic Direct Deposit form allows individuals to authorize direct deposits into their bank accounts, facilitating timely payments. |

| Information Required | Users must provide personal information, including their name, Social Security number, and account details. |

| Account Types | Depositors can choose between a checking account or a savings account for their direct deposit. |

| Routing Number | The routing transit number is a crucial part of the form; it must consist of 9 digits and follow specific formatting rules. |

| Ownership Declaration | Individuals must indicate whether the account is self-owned, joint, or owned by another party. |

| Signature Requirement | Signing the form is essential, as it authorizes the financial institution to process the direct deposit. |

| Effective Date | The form allows users to specify an effective date for when the direct deposit should begin. |

| Joint Accounts | If the account is a joint account, all account holders must sign the form to authorize deposits. |

| Verification Tips | It is advisable to verify account and routing numbers with the financial institution to avoid errors. |

| State-Specific Forms | Some states may have specific requirements or forms governed by state laws regarding direct deposits. |

Generic Direct Deposit - Usage Guidelines

Once you have the Generic Direct Deposit form in hand, it's important to fill it out accurately to ensure that your funds are deposited correctly. After completing the form, you will need to submit it to your employer or the designated department. Here are the steps to guide you through the process of filling out the form.

- Write your Last Name, First Name, and Middle Initial in the designated boxes.

- Enter your Social Security Number in the format of XXX-XX-XXXX.

- Select the Action you are taking: New, Change, or Cancel.

- Fill in the Effective Date using the month, day, and year format.

- Provide your Work Phone number.

- Write the Name of Financial Institution where you have your account.

- Input your Account Number and ensure to include any hyphens, but leave out spaces and special symbols.

- Choose the type of account by marking either Savings or Checking.

- Fill in the Routing Transit Number, ensuring all 9 boxes are filled. Remember, the first two numbers must be between 01-12 or 21-32.

- Indicate the Ownership of Account by selecting Self, Joint, or Other.

- Sign and date the form in the designated areas.

- If applicable, have the other account holder sign and date the form as well.

After you have completed all the steps, double-check your entries for accuracy. This will help prevent any delays in processing your direct deposit. It’s also a good idea to contact your financial institution to confirm that they accept direct deposits and to verify your account and routing numbers. Once everything looks good, submit the form to the appropriate party.

Common PDF Forms

Miscellaneous Information - Businesses use the 1099-MISC to report payments exceeding $600 to service providers.

A Colorado Medical Power of Attorney form is a vital legal document that allows an individual to designate someone else to make medical decisions on their behalf if they become unable to do so. This important tool ensures that a person's healthcare preferences are honored, even when they cannot communicate them. For those interested in creating this essential document, resources like Colorado PDF Templates can provide the necessary guidance and templates to help safeguard their medical choices.

Streamlined Foreign Offshore Procedures - This form requires thorough attention to detail and factual accuracy.

Dos and Don'ts

When filling out the Generic Direct Deposit form, it is important to approach the task with care. Here are some essential do's and don'ts to keep in mind:

- Do fill in all boxes completely. Ensure that every required field is addressed.

- Do sign and date the form at the designated areas to validate your authorization.

- Do verify your account number and routing transit number with your financial institution to avoid errors.

- Do call your financial institution to confirm they accept direct deposits.

- Don't use a deposit slip to verify the routing number; this can lead to mistakes.

- Don't leave any boxes blank, as incomplete information may delay processing.

- Don't forget to include hyphens in your account number, but omit any spaces or special symbols.

- Don't assume that a joint account does not require both parties to sign; both must agree to the terms.

Common mistakes

-

Omitting Required Information: Failing to fill in all required fields, such as the last name, first name, or Social Security number, can lead to delays or rejections.

-

Incorrect Account Numbers: Entering the wrong account number can result in funds being deposited into the wrong account. Always double-check the number.

-

Missing Signatures: Not signing the form can invalidate the authorization. Both account holders must sign if it is a joint account.

-

Incorrect Routing Numbers: Using an incorrect routing transit number can prevent successful transactions. Ensure all nine digits are accurate.

-

Not Specifying Account Type: Failing to indicate whether the account is a checking or savings account can cause processing issues.

-

Using a Deposit Slip for Verification: Relying on a deposit slip to verify account and routing numbers can lead to errors. Always confirm with the financial institution directly.

-

Ignoring Effective Date: Not specifying an effective date can lead to confusion about when the direct deposit should start.

-

Not Following Up: Failing to confirm with the employer or financial institution that the direct deposit has been set up correctly can result in missed payments.

-

Providing Incomplete Information: Leaving out details such as the name of the financial institution can cause processing delays.

-

Not Keeping a Copy: Not retaining a copy of the completed form for personal records can lead to difficulties if issues arise later.