Free Transfer-on-Death Deed Document for Florida State

Document Sample

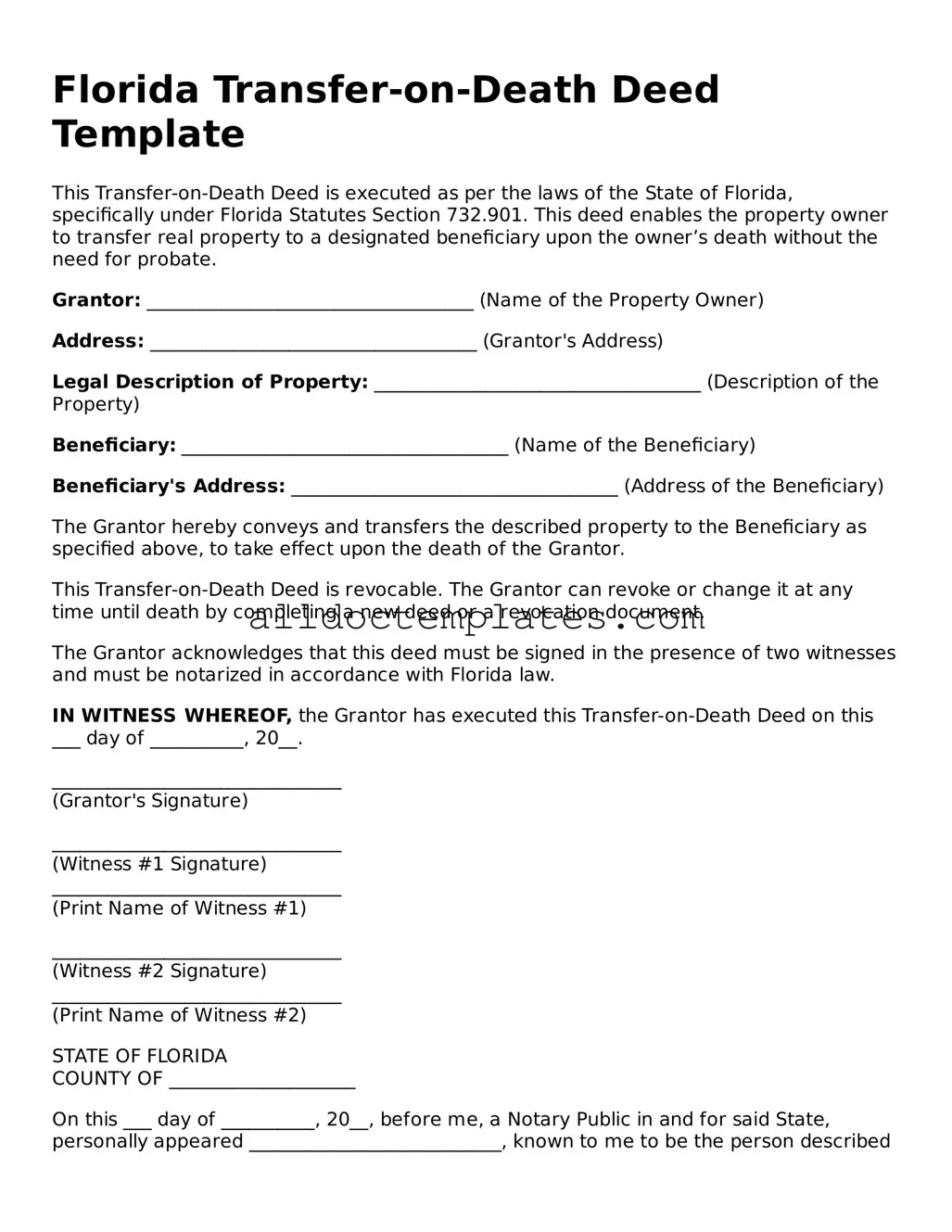

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed as per the laws of the State of Florida, specifically under Florida Statutes Section 732.901. This deed enables the property owner to transfer real property to a designated beneficiary upon the owner’s death without the need for probate.

Grantor: ___________________________________ (Name of the Property Owner)

Address: ___________________________________ (Grantor's Address)

Legal Description of Property: ___________________________________ (Description of the Property)

Beneficiary: ___________________________________ (Name of the Beneficiary)

Beneficiary's Address: ___________________________________ (Address of the Beneficiary)

The Grantor hereby conveys and transfers the described property to the Beneficiary as specified above, to take effect upon the death of the Grantor.

This Transfer-on-Death Deed is revocable. The Grantor can revoke or change it at any time until death by completing a new deed or a revocation document.

The Grantor acknowledges that this deed must be signed in the presence of two witnesses and must be notarized in accordance with Florida law.

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on this ___ day of __________, 20__.

_______________________________

(Grantor's Signature)

_______________________________

(Witness #1 Signature)

_______________________________

(Print Name of Witness #1)

_______________________________

(Witness #2 Signature)

_______________________________

(Print Name of Witness #2)

STATE OF FLORIDA

COUNTY OF ____________________

On this ___ day of __________, 20__, before me, a Notary Public in and for said State, personally appeared ___________________________, known to me to be the person described in the foregoing Transfer-on-Death Deed, and acknowledged that he/she executed the same.

_______________________________

(Notary Public Signature)

My Commission Expires: ____________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, specifically Section 732.4015. |

| Eligibility | Only individuals, not entities, can create a TOD Deed in Florida. |

| Property Types | The deed can be used for various types of real estate, including residential and commercial properties. |

| Revocability | Property owners can revoke or change the TOD Deed at any time during their lifetime. |

| Beneficiary Designation | Multiple beneficiaries can be named, and percentages of ownership can be specified. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals, and it must be recorded in the county where the property is located. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes, as the transfer occurs at death. |

| Effectiveness | The deed takes effect automatically upon the death of the property owner, transferring ownership to the designated beneficiaries. |

| Limitations | The TOD Deed does not affect the property owner’s rights to sell or mortgage the property during their lifetime. |

Florida Transfer-on-Death Deed - Usage Guidelines

After obtaining the Florida Transfer-on-Death Deed form, you will need to complete it accurately to ensure proper transfer of property upon death. Follow the steps below to fill out the form correctly.

- Begin by entering the full name of the property owner(s) in the designated section at the top of the form.

- Provide the current address of the property owner(s). This should include the street address, city, state, and zip code.

- Identify the property being transferred. Include the legal description of the property, which can typically be found on the current deed or tax records.

- Fill in the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner's death. Ensure the names are spelled correctly.

- Include the address of each beneficiary. This should also include the street address, city, state, and zip code.

- Sign and date the form in the designated area. If there are multiple property owners, each owner must sign the form.

- Have the form notarized. A notary public must witness the signatures to validate the document.

- File the completed form with the appropriate county clerk’s office where the property is located. This step is crucial for the deed to take effect.

Some Other Transfer-on-Death Deed State Templates

Transfer on Death Deed Form Pennsylvania - A Transfer-on-Death Deed must be executed in accordance with state laws and procedures.

When engaging in the purchase or sale of a mobile home in Utah, it is crucial to utilize the Utah Mobile Home Bill of Sale, as it serves to formalize the transaction and safeguard both parties involved. For those seeking a reliable template, you can find one at https://mobilehomebillofsale.com/blank-utah-mobile-home-bill-of-sale, which outlines the necessary details and requirements for an effective sale.

Transfer Upon Death Deed Texas - Setting up a Transfer-on-Death Deed could help your loved ones avoid legal complications later.

Where Can I Get a Tod Form - By using a Transfer-on-Death Deed, you can maintain your current lifestyle while securing your property for your beneficiaries.

What Is a Transfer on Death - Adding or removing beneficiaries on the deed can help adapt to life changes.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure everything is done correctly. Here are some things you should and shouldn't do:

- Do provide accurate property information. Make sure to include the correct legal description of the property.

- Do include the names of the beneficiaries clearly. Double-check spellings to avoid confusion.

- Do sign the form in front of a notary. This step is essential for the deed to be valid.

- Do file the deed with the county clerk's office. This ensures that the deed is officially recorded.

- Don't use vague language. Be specific about who will receive the property.

- Don't forget to date the form. An undated form may lead to complications.

- Don't leave any required fields blank. Incomplete forms can be rejected.

- Don't attempt to fill out the form without understanding its implications. Seek guidance if needed.

Common mistakes

-

Failing to include all required information about the property. It’s essential to provide the complete legal description of the property, not just the address.

-

Not identifying the beneficiaries clearly. Each beneficiary must be named specifically, and any ambiguity can lead to complications later.

-

Neglecting to sign the deed in the presence of a notary. A signature without notarization may render the deed invalid.

-

Overlooking the need for witnesses. In Florida, at least two witnesses must sign the deed for it to be legally binding.

-

Using outdated forms. Always ensure that the form being used is the most current version, as laws and requirements can change.

-

Failing to record the deed with the appropriate county office. If the deed is not recorded, it may not be recognized after the owner’s death.

-

Not considering the implications of joint ownership. If the property is jointly owned, the transfer-on-death designation may not apply as expected.

-

Forgetting to review the deed periodically. Life changes, such as marriage or divorce, may necessitate updates to the beneficiaries listed.

-

Assuming that a transfer-on-death deed can override a will. While it provides a way to transfer property outside of probate, it does not supersede a will.

-

Neglecting to seek legal advice. Consulting with a legal professional can help avoid potential pitfalls and ensure that the deed meets all legal requirements.