Free Real Estate Purchase Agreement Document for Florida State

Document Sample

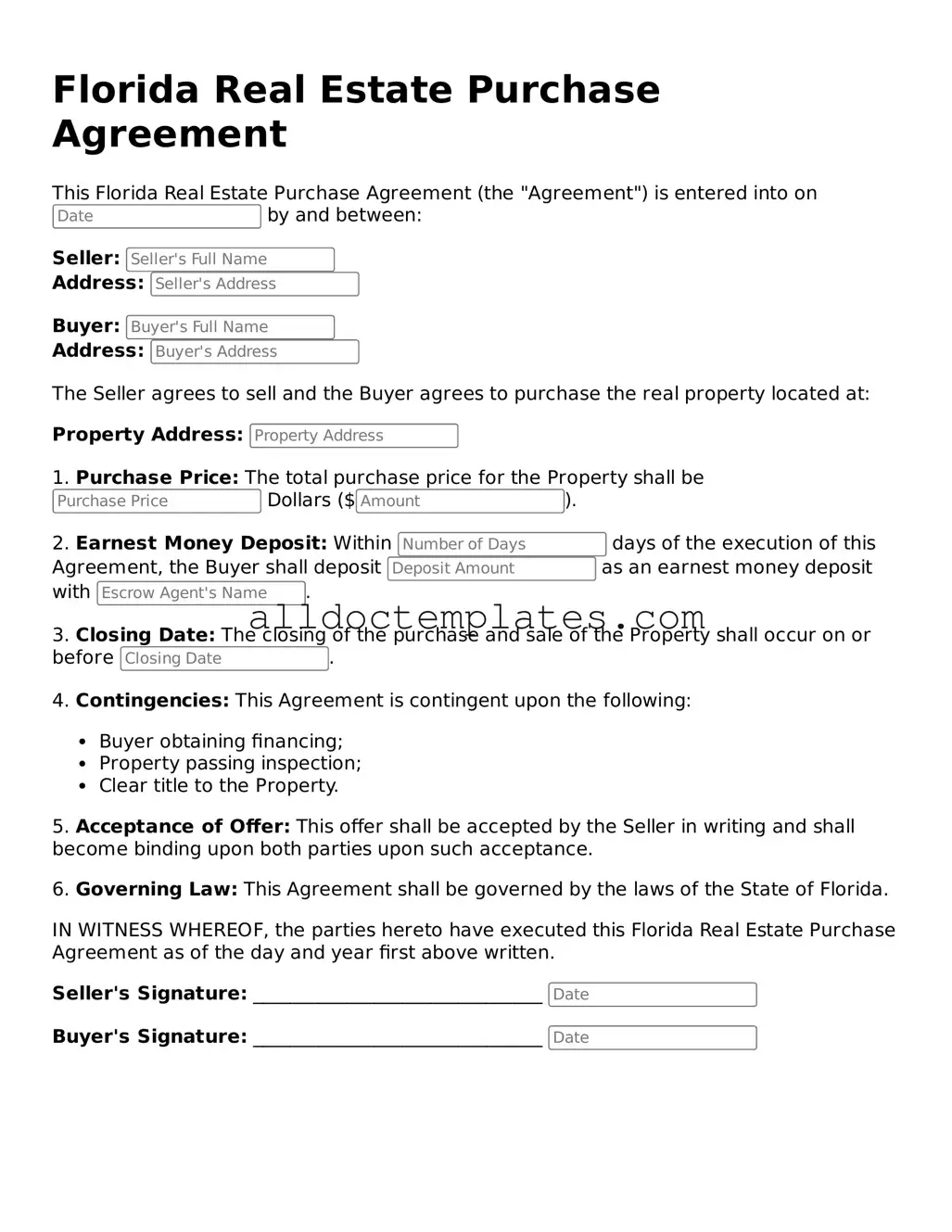

Florida Real Estate Purchase Agreement

This Florida Real Estate Purchase Agreement (the "Agreement") is entered into on by and between:

Seller:

Address:

Buyer:

Address:

The Seller agrees to sell and the Buyer agrees to purchase the real property located at:

Property Address:

1. Purchase Price: The total purchase price for the Property shall be Dollars ($).

2. Earnest Money Deposit: Within days of the execution of this Agreement, the Buyer shall deposit as an earnest money deposit with .

3. Closing Date: The closing of the purchase and sale of the Property shall occur on or before .

4. Contingencies: This Agreement is contingent upon the following:

- Buyer obtaining financing;

- Property passing inspection;

- Clear title to the Property.

5. Acceptance of Offer: This offer shall be accepted by the Seller in writing and shall become binding upon both parties upon such acceptance.

6. Governing Law: This Agreement shall be governed by the laws of the State of Florida.

IN WITNESS WHEREOF, the parties hereto have executed this Florida Real Estate Purchase Agreement as of the day and year first above written.

Seller's Signature: _______________________________

Buyer's Signature: _______________________________

Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Real Estate Purchase Agreement is governed by the laws of the State of Florida. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Offer and Acceptance | The agreement serves as an offer from the buyer that can be accepted or countered by the seller. |

| Contingencies | Common contingencies include financing, inspections, and appraisal, which must be satisfied for the sale to proceed. |

| Earnest Money | Typically, the buyer submits earnest money as a deposit to demonstrate serious intent to purchase. |

| Closing Process | The agreement outlines the closing date and procedures, marking the official transfer of property ownership. |

| Disclosures | Sellers are required to disclose any known defects or issues with the property, ensuring transparency in the transaction. |

Florida Real Estate Purchase Agreement - Usage Guidelines

After obtaining the Florida Real Estate Purchase Agreement form, the next steps involve carefully filling out the required information. Accuracy is essential to ensure that all parties understand the terms of the agreement. Below are the steps to complete the form.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of the buyer(s) in the designated section.

- List the names and addresses of the seller(s) in the appropriate area.

- Specify the property address, including any relevant details such as unit number or subdivision.

- Fill in the purchase price of the property.

- Indicate the amount of the earnest money deposit, if applicable.

- Choose the closing date and write it in the designated space.

- Detail any contingencies, such as financing or inspection requirements.

- Sign and date the agreement in the spaces provided for the buyer(s) and seller(s).

- Ensure all parties receive a copy of the completed agreement for their records.

Some Other Real Estate Purchase Agreement State Templates

Real Estate Contract Template - Details any warranties or disclosures related to the property.

Pa Real Estate Contract - Defines the legal description of the property being sold.

When engaging in the transaction of an all-terrain vehicle in Colorado, it's essential to use the appropriate documentation, such as the Colorado ATV Bill of Sale form. This form not only provides a clear record of the transaction but also helps to protect both the buyer and seller by detailing the vehicle's information and the parties involved. For those looking to obtain this form, you can visit Colorado PDF Templates to ensure a smooth transfer of ownership.

Home Purchase Agreement - The Real Estate Purchase Agreement can protect buyer interests with contingencies for loan approval.

Dos and Don'ts

When filling out the Florida Real Estate Purchase Agreement form, it's essential to approach the process with care. Here are five important dos and don'ts to keep in mind.

- Do read the entire agreement thoroughly before signing. Understanding every clause can save you from future headaches.

- Do provide accurate information. Ensure that names, addresses, and financial details are correct to avoid complications.

- Do consult with a real estate agent or attorney if you have questions. They can clarify terms and help you make informed decisions.

- Don't rush through the process. Take your time to review each section carefully.

- Don't overlook contingencies. These are crucial for protecting your interests, so make sure they are included and clearly defined.

By following these guidelines, you can navigate the purchase agreement with confidence and clarity.

Common mistakes

-

Not including all parties involved: It's crucial to list all buyers and sellers accurately. Omitting someone can lead to disputes later.

-

Incorrect property description: Ensure the property is described accurately. Include the address and any specific details that identify it clearly.

-

Missing signatures: Every party must sign the agreement. A missing signature can render the document invalid.

-

Failing to specify the purchase price: Clearly state the total amount being offered for the property. Ambiguity can cause misunderstandings.

-

Ignoring contingencies: Include any contingencies, such as financing or inspection requirements. These protect buyers from unexpected issues.

-

Not including earnest money details: Specify the amount of earnest money and how it will be handled. This shows the seller that the buyer is serious.

-

Overlooking deadlines: Clearly outline important dates, such as the closing date and inspection periods. Missing deadlines can lead to complications.

-

Using vague language: Be clear and precise in your wording. Ambiguous terms can lead to different interpretations and potential disputes.

-

Not seeking legal advice: Many people skip this step, but consulting a real estate attorney can help avoid costly mistakes.