Free Promissory Note Document for Florida State

Document Sample

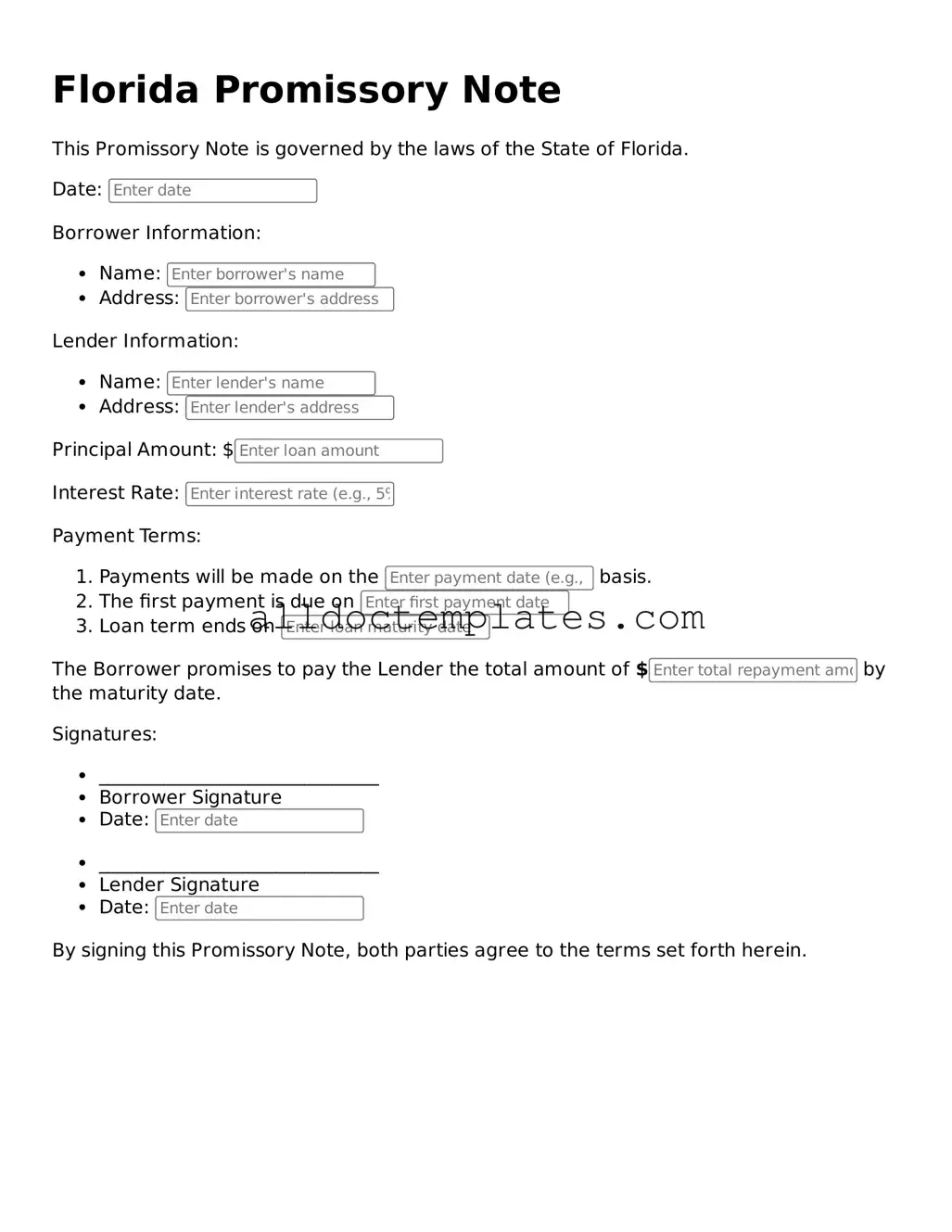

Florida Promissory Note

This Promissory Note is governed by the laws of the State of Florida.

Date:

Borrower Information:

- Name:

- Address:

Lender Information:

- Name:

- Address:

Principal Amount: $

Interest Rate:

Payment Terms:

- Payments will be made on the basis.

- The first payment is due on

- Loan term ends on

The Borrower promises to pay the Lender the total amount of $ by the maturity date.

Signatures:

- ______________________________

- Borrower Signature

- Date:

- ______________________________

- Lender Signature

- Date:

By signing this Promissory Note, both parties agree to the terms set forth herein.

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a legal document in which one party promises to pay a specific amount of money to another party under agreed-upon terms. |

| Governing Law | The Florida Promissory Note is governed by Florida Statutes, particularly Chapter 673, which deals with commercial paper. |

| Parties Involved | Typically, there are two main parties involved: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Interest Rate | The note may specify an interest rate. If not stated, Florida law allows for a reasonable rate, which can be determined based on the context of the loan. |

| Payment Terms | Payment terms, including the due date and payment schedule, must be clearly outlined in the note to avoid confusion. |

| Enforceability | A properly executed Florida Promissory Note is legally enforceable in court, provided it meets all necessary legal requirements. |

Florida Promissory Note - Usage Guidelines

Once you have the Florida Promissory Note form in hand, it’s time to fill it out carefully. This document will require specific details about the loan arrangement between the borrower and the lender. Ensure that all information is accurate to avoid any potential disputes later on.

- Title the Document: At the top of the form, write “Promissory Note” to clearly indicate the purpose of the document.

- Identify the Parties: Fill in the names and addresses of both the borrower and the lender. Make sure to include the full legal names to avoid any confusion.

- Loan Amount: Clearly state the total amount of money being borrowed. This figure should be written both in numbers and in words for clarity.

- Interest Rate: Specify the interest rate that will apply to the loan. Indicate whether it is fixed or variable, and include the percentage rate.

- Payment Terms: Outline the repayment schedule. Include the frequency of payments (monthly, quarterly, etc.) and the due date for the first payment.

- Maturity Date: Indicate the date by which the loan must be fully repaid. This is the final date for the borrower to settle the debt.

- Late Fees: If applicable, state any late fees that will be incurred if payments are not made on time. Clearly outline how these fees will be calculated.

- Signatures: Both the borrower and lender must sign the document. Include the date of signing next to each signature to confirm when the agreement was made.

After completing the form, make sure to keep a copy for your records. It’s also advisable to have the document notarized to add an extra layer of authenticity and protection for both parties involved.

Some Other Promissory Note State Templates

Promissory Note for Loan - The signature of the borrower is crucial for the document to be valid.

The New York Power of Attorney form is a legal document that allows one person to grant another person the authority to make decisions on their behalf. This could range from financial decisions to health care directives. It's crucial for individuals who want to ensure their affairs are handled according to their wishes, even if they're unable to make those decisions themselves. For more information, you can refer to the Power of Attorney form.

Promissory Note Template Texas - Paying off a promissory note early may benefit borrowers by reducing total interest costs.

How to Write a Promissory Note Example - A promissory note is an essential financial tool for personal and business transactions alike.

Dos and Don'ts

When filling out the Florida Promissory Note form, it's essential to follow certain guidelines to ensure accuracy and legality. Here are five important dos and don'ts:

- Do provide accurate information for all parties involved, including names and addresses.

- Do clearly state the loan amount and the interest rate, if applicable.

- Do specify the repayment terms, including the due date and payment schedule.

- Don't leave any sections blank; every part of the form should be completed.

- Don't use vague language; ensure that all terms are clear and unambiguous.

Common mistakes

-

Incorrect Borrower Information: Failing to provide the full legal name of the borrower can lead to confusion and potential legal issues. Ensure that the name matches the identification documents.

-

Missing Lender Details: Omitting the lender's name and contact information is a common error. Always include complete details to ensure clarity in the agreement.

-

Inaccurate Loan Amount: Entering the wrong loan amount can create disputes later. Double-check the figures to confirm accuracy before submission.

-

Vague Repayment Terms: Failing to specify clear repayment terms, including interest rates and payment schedules, can lead to misunderstandings. Be precise in outlining these terms.

-

Neglecting Signatures: Not signing the document, or having only one party sign, invalidates the agreement. Both borrower and lender must sign to make it legally binding.

-

Ignoring Witness Requirements: Some situations may require a witness or notarization. Not adhering to these requirements can jeopardize the enforceability of the note.

-

Failure to Keep Copies: Not retaining a copy of the signed Promissory Note can lead to issues if disputes arise. Always keep a copy for your records.