Free Loan Agreement Document for Florida State

Document Sample

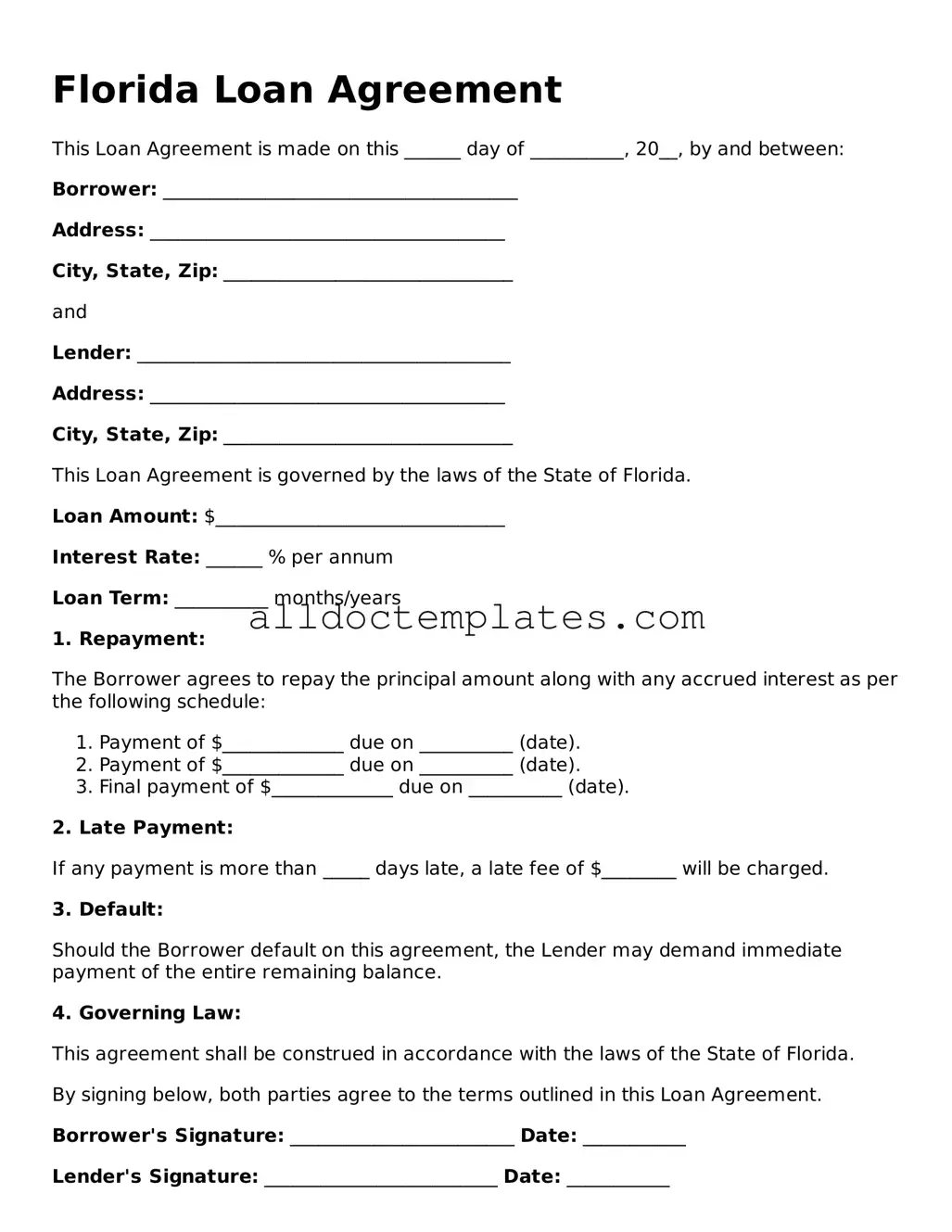

Florida Loan Agreement

This Loan Agreement is made on this ______ day of __________, 20__, by and between:

Borrower: ______________________________________

Address: ______________________________________

City, State, Zip: _______________________________

and

Lender: ________________________________________

Address: ______________________________________

City, State, Zip: _______________________________

This Loan Agreement is governed by the laws of the State of Florida.

Loan Amount: $_______________________________

Interest Rate: ______ % per annum

Loan Term: __________ months/years

1. Repayment:

The Borrower agrees to repay the principal amount along with any accrued interest as per the following schedule:

- Payment of $_____________ due on __________ (date).

- Payment of $_____________ due on __________ (date).

- Final payment of $_____________ due on __________ (date).

2. Late Payment:

If any payment is more than _____ days late, a late fee of $________ will be charged.

3. Default:

Should the Borrower default on this agreement, the Lender may demand immediate payment of the entire remaining balance.

4. Governing Law:

This agreement shall be construed in accordance with the laws of the State of Florida.

By signing below, both parties agree to the terms outlined in this Loan Agreement.

Borrower's Signature: ________________________ Date: ___________

Lender's Signature: _________________________ Date: ___________

Form Data

| Fact Name | Details |

|---|---|

| Definition | The Florida Loan Agreement form is a legal document outlining the terms of a loan between a lender and a borrower in Florida. |

| Governing Laws | This agreement is governed by the laws of the State of Florida, specifically Florida Statutes Chapter 687. |

| Essential Components | Key elements include the loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding. |

Florida Loan Agreement - Usage Guidelines

Once you have the Florida Loan Agreement form in hand, it's time to fill it out carefully. Ensure you have all necessary information ready, as accuracy is key to avoid issues later on. Follow these steps to complete the form properly.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the borrower and the lender. Make sure to include any relevant contact information.

- Specify the loan amount in clear terms. Write the amount in both numbers and words to avoid confusion.

- Indicate the interest rate. Be precise about whether it's fixed or variable.

- Detail the repayment terms. Include the payment schedule, such as monthly or quarterly payments.

- State the purpose of the loan. This helps clarify the intention behind the borrowing.

- Include any collateral information if applicable. Describe what is being used as security for the loan.

- Sign and date the form at the bottom. Ensure both parties do this to validate the agreement.

After completing the form, review it for any errors or missing information. Once everything is accurate, both parties can keep a signed copy for their records.

Some Other Loan Agreement State Templates

Sample Promissory Note California - Informs parties of possible tax implications related to the agreement.

For those navigating the rental landscape in Arizona, the process can be simplified by utilizing a structured Room Rental Agreement form that clearly delineates rights and responsibilities. This important document not only protects both parties but also outlines specific terms tailored to individual living arrangements. To explore a helpful resource regarding the Room Rental Agreement form, visit an overview of the Room Rental Agreement details.

Dos and Don'ts

When filling out the Florida Loan Agreement form, it's important to be thorough and accurate. Here are some key dos and don'ts to keep in mind:

- Do read the entire form carefully before filling it out.

- Do provide accurate personal information, including your name, address, and contact details.

- Do specify the loan amount clearly.

- Do review the terms and conditions of the loan.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed to do so.

- Don't use abbreviations or shorthand that could cause confusion.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to keep a copy of the completed form for your records.

- Don't hesitate to ask for clarification if you don't understand something.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or rejection of the application.

-

Incorrect Personal Details: Providing inaccurate names, addresses, or contact information can create confusion and may result in legal issues.

-

Missing Signatures: Not signing the document in the required places can render the agreement invalid.

-

Wrong Loan Amount: Entering an incorrect loan amount can affect the terms of the agreement and lead to financial complications.

-

Ignoring Terms and Conditions: Not reading or understanding the terms can lead to misunderstandings about repayment obligations.

-

Failure to Provide Supporting Documents: Not attaching necessary documents, such as proof of income, can delay the approval process.

-

Neglecting to Review the Agreement: Skipping a final review before submission can result in overlooked errors.

-

Assuming All Information is Correct: Believing that the information is correct without double-checking can lead to significant issues later on.