Free Lady Bird Deed Document for Florida State

Document Sample

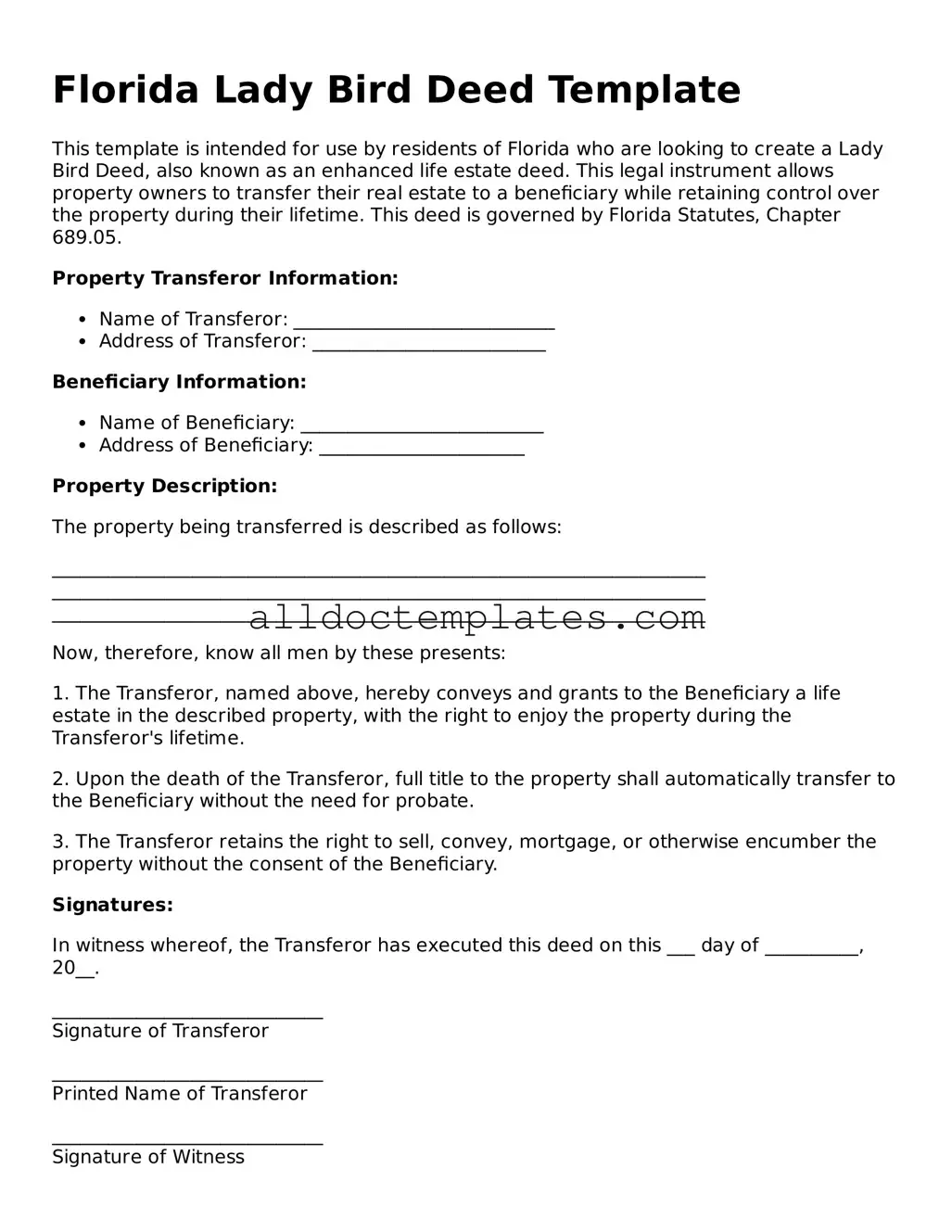

Florida Lady Bird Deed Template

This template is intended for use by residents of Florida who are looking to create a Lady Bird Deed, also known as an enhanced life estate deed. This legal instrument allows property owners to transfer their real estate to a beneficiary while retaining control over the property during their lifetime. This deed is governed by Florida Statutes, Chapter 689.05.

Property Transferor Information:

- Name of Transferor: ____________________________

- Address of Transferor: _________________________

Beneficiary Information:

- Name of Beneficiary: __________________________

- Address of Beneficiary: ______________________

Property Description:

The property being transferred is described as follows:

______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

Now, therefore, know all men by these presents:

1. The Transferor, named above, hereby conveys and grants to the Beneficiary a life estate in the described property, with the right to enjoy the property during the Transferor's lifetime.

2. Upon the death of the Transferor, full title to the property shall automatically transfer to the Beneficiary without the need for probate.

3. The Transferor retains the right to sell, convey, mortgage, or otherwise encumber the property without the consent of the Beneficiary.

Signatures:

In witness whereof, the Transferor has executed this deed on this ___ day of __________, 20__.

_____________________________

Signature of Transferor

_____________________________

Printed Name of Transferor

_____________________________

Signature of Witness

_____________________________

Printed Name of Witness

_____________________________

Signature of Witness

_____________________________

Printed Name of Witness

Notary Acknowledgment:

State of Florida

County of ________________

On this ___ day of __________, 20__, before me, a Notary Public, personally appeared __________________________, known to me to be the person who executed the above instrument, and acknowledged that he/she executed it for the purposes therein contained.

_____________________________

Notary Public

My Commission Expires: ________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Florida Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Florida Statutes, specifically under Section 732.4015. |

| Benefits | This deed helps avoid probate, allowing for a smoother transition of property to heirs. |

| Retained Rights | Property owners maintain the right to sell, mortgage, or change the deed at any time before their death. |

| Tax Implications | There are generally no immediate tax implications for transferring property via a Lady Bird Deed. |

| Execution Requirements | The deed must be signed, notarized, and recorded in the county where the property is located to be valid. |

Florida Lady Bird Deed - Usage Guidelines

Completing the Florida Lady Bird Deed form requires attention to detail and accuracy. After filling out the form, you will need to ensure that it is properly executed and recorded to make it legally binding. Follow the steps below to guide you through the process.

- Obtain the Form: Start by downloading the Florida Lady Bird Deed form from a reliable source or obtain a physical copy from a legal document provider.

- Identify the Grantor: In the designated section, clearly write the full name of the property owner(s) who will be transferring the property. Include any middle names or initials for clarity.

- Identify the Grantee: Next, list the name(s) of the individual(s) who will receive the property. This can include family members or others you wish to designate.

- Provide Property Description: Accurately describe the property being transferred. Include the address and any relevant legal descriptions, such as parcel numbers or lot numbers, to avoid confusion.

- Include Powers Reserved: Indicate any powers that the grantor wishes to retain. This often includes the ability to sell, change, or mortgage the property during their lifetime.

- Sign the Form: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name listed as the grantor.

- Notarization: Have the notary public complete the notarization section. This step is crucial for the validity of the deed.

- Record the Deed: Finally, take the completed and notarized form to the local county clerk's office to record it. This step makes the transfer official and public.

Some Other Lady Bird Deed State Templates

Lady Bird Deed Form Texas - The recognition of Lady Bird Deeds varies by state, so local laws should be considered.

A Colorado Last Will and Testament form is a legal document that outlines how a person's assets and responsibilities should be handled after their death. This essential tool ensures that your wishes are honored and that your loved ones are taken care of according to your preferences. For those looking to prepare this important document, resources like Colorado PDF Templates can provide valuable assistance in understanding its components and requirements, helping you create a will that reflects your intentions clearly and effectively.

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it's essential to approach the task with care. This deed allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. Here are some important dos and don'ts to keep in mind:

- Do ensure you have the correct legal description of the property.

- Do clearly identify the beneficiaries by their full names.

- Do review the form for accuracy before submitting it.

- Do consult with a legal professional if you have any questions.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't forget to sign the deed in the presence of a notary public.

By following these guidelines, you can help ensure that your Lady Bird Deed is completed correctly, allowing for a smoother transfer of property in the future.

Common mistakes

-

Not Understanding the Purpose: Many people fill out the Lady Bird Deed form without fully grasping its purpose. This type of deed allows property owners to transfer their home to beneficiaries while retaining certain rights. Without understanding this, individuals may make decisions that do not align with their intentions.

-

Incorrect Property Description: A common mistake is failing to provide a precise legal description of the property. Instead of using a street address, the legal description should include details from the property deed. Omitting this can lead to confusion or disputes later on.

-

Missing Signatures: All necessary parties must sign the deed. Often, people forget to include their own signature or that of a spouse. Without these signatures, the deed may be deemed invalid.

-

Not Notarizing the Document: A Lady Bird Deed must be notarized to be legally binding. Some individuals overlook this crucial step, thinking that a simple signature will suffice. Without notarization, the deed may not hold up in court.

-

Failing to Record the Deed: After completing the deed, it is essential to record it with the county clerk's office. Neglecting this step can lead to complications, especially if the property owner passes away. Recording ensures that the deed is part of the public record.

-

Not Considering Tax Implications: People often overlook the potential tax consequences of transferring property through a Lady Bird Deed. It’s important to consult with a tax professional to understand how this transfer may affect property taxes or inheritance taxes.