Free Deed in Lieu of Foreclosure Document for Florida State

Document Sample

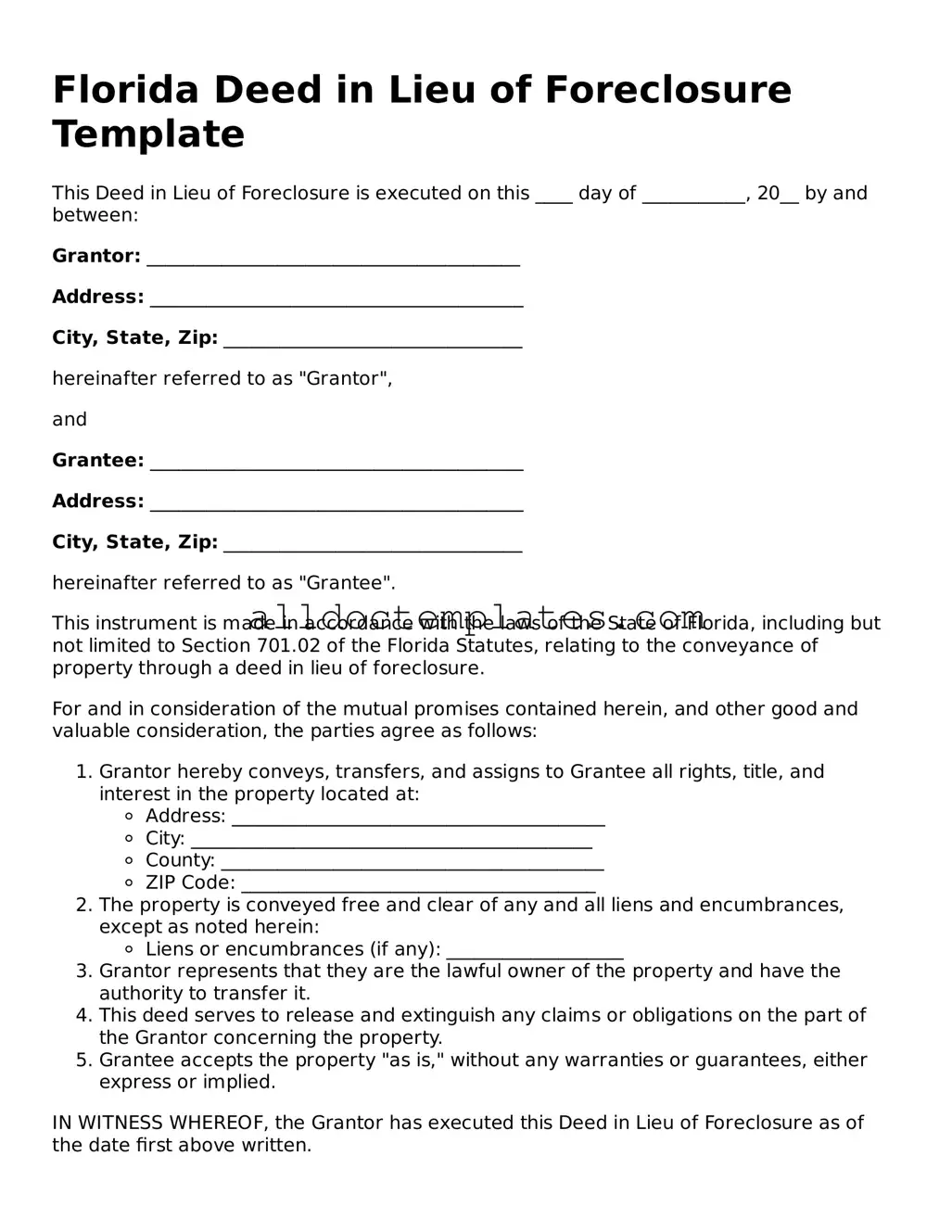

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed on this ____ day of ___________, 20__ by and between:

Grantor: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

hereinafter referred to as "Grantor",

and

Grantee: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

hereinafter referred to as "Grantee".

This instrument is made in accordance with the laws of the State of Florida, including but not limited to Section 701.02 of the Florida Statutes, relating to the conveyance of property through a deed in lieu of foreclosure.

For and in consideration of the mutual promises contained herein, and other good and valuable consideration, the parties agree as follows:

- Grantor hereby conveys, transfers, and assigns to Grantee all rights, title, and interest in the property located at:

- Address: ________________________________________

- City: ___________________________________________

- County: _________________________________________

- ZIP Code: ______________________________________

- The property is conveyed free and clear of any and all liens and encumbrances, except as noted herein:

- Liens or encumbrances (if any): ___________________

- Grantor represents that they are the lawful owner of the property and have the authority to transfer it.

- This deed serves to release and extinguish any claims or obligations on the part of the Grantor concerning the property.

- Grantee accepts the property "as is," without any warranties or guarantees, either express or implied.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor Signature: _________________________________

Print Name: _____________________________________

State of Florida

County of ________________________

On this ____ day of ___________, 20__, before me appeared ____________________, who is personally known to me or who has produced ________________________ as identification, and who acknowledged that (he/she) executed the same for the purposes therein contained.

Notary Public: _________________________________

My Commission Expires: ________________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Florida, the Deed in Lieu of Foreclosure is governed by Florida Statutes, particularly Chapter 697. |

| Eligibility | Typically, borrowers facing financial hardship and unable to meet mortgage obligations may qualify for this option. |

| Benefits | This process can help borrowers avoid the lengthy and costly foreclosure process, protecting their credit score more effectively. |

| Risks | Borrowers may still face tax implications on any forgiven debt, and lenders may require a deficiency waiver to protect the borrower. |

| Process | The borrower must negotiate with the lender, complete the necessary paperwork, and ensure all liens are addressed before transferring the deed. |

| Alternatives | Options such as loan modification, short sales, or bankruptcy may also be considered by borrowers as alternatives to a deed in lieu. |

| Impact on Credit | While a deed in lieu is less damaging than foreclosure, it may still affect the borrower's credit score negatively. |

| Legal Assistance | It is advisable for borrowers to seek legal advice to understand their rights and obligations before proceeding with a deed in lieu. |

Florida Deed in Lieu of Foreclosure - Usage Guidelines

After completing the Florida Deed in Lieu of Foreclosure form, you will need to submit it to your lender for review. They will evaluate the document and, if everything is in order, proceed with the necessary steps to finalize the process. This may include the cancellation of your mortgage and transferring the property back to the lender.

- Obtain the Florida Deed in Lieu of Foreclosure form. You can find it online or request it from your lender.

- Fill in the name of the borrower(s) in the designated section. Ensure that all names are spelled correctly.

- Provide the address of the property being transferred. This should include the street address, city, and zip code.

- Enter the legal description of the property. This can typically be found on your mortgage documents or property tax statements.

- Include the name of the lender or the institution receiving the deed. Verify that the lender's name is accurate.

- Indicate the date on which the deed is being executed. This should be the current date.

- Sign the document in the presence of a notary public. Both borrowers must sign if there is more than one.

- Have the notary public complete their section, ensuring they affix their seal and signature.

- Make copies of the completed deed for your records.

- Submit the original deed to your lender. Follow any specific instructions they provide for submission.

Some Other Deed in Lieu of Foreclosure State Templates

Foreclosure Deed - This arrangement commonly involves discussing the homeowner's long-term financial plans.

For those looking to understand the intricacies of mobile home sales, the Arizona Mobile Home Bill of Sale form is a vital document that ensures a smooth transaction process. It allows both parties to legally verify the sale and includes necessary information such as the buyer and seller's identities and the mobile home's specifications. To learn more about this important form, refer to the helpful resources on the essential Mobile Home Bill of Sale guidelines.

Will I Owe Money After a Deed in Lieu of Foreclosure - The lender must agree to accept the property through this deed to finalize the process.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - In many cases, lenders will initiate the Deed in Lieu process to avoid the costs of managing foreclosures.

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it’s important to approach the process with care. Here are ten essential dos and don’ts to consider.

- Do ensure that you fully understand the implications of signing a deed in lieu of foreclosure.

- Do consult with a real estate attorney or a trusted advisor before proceeding.

- Do provide accurate and complete information on the form.

- Do include all necessary documentation, such as proof of ownership and mortgage details.

- Do check for any outstanding liens or claims against the property.

- Don't rush through the form; take your time to review each section carefully.

- Don't omit any required signatures or dates.

- Don't ignore any specific instructions provided with the form.

- Don't assume that the lender will accept the deed without prior communication.

- Don't forget to keep copies of all documents for your records.

Following these guidelines can help ensure that the process goes smoothly and that you are protected throughout the transaction.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to significant legal issues. The description must include the property's address and legal description as recorded in public records.

-

Not Identifying All Parties: It is essential to list all individuals or entities involved in the deed. Omitting any party can create complications in the transfer of ownership.

-

Failure to Obtain Lender Approval: Before submitting the deed, it is crucial to ensure that the lender has agreed to the deed in lieu of foreclosure. Without this approval, the process may not be valid.

-

Not Including Necessary Signatures: All required signatures must be present on the form. This includes signatures from all owners and, in some cases, witnesses or notaries.

-

Neglecting to Record the Deed: After completing the form, it is vital to record the deed with the local county clerk's office. Failing to do so can result in the deed not being legally recognized.

-

Ignoring Tax Implications: People often overlook potential tax consequences associated with a deed in lieu of foreclosure. Consulting with a tax professional can help clarify any liabilities that may arise.