Free Affidavit of Gift Document for Florida State

Document Sample

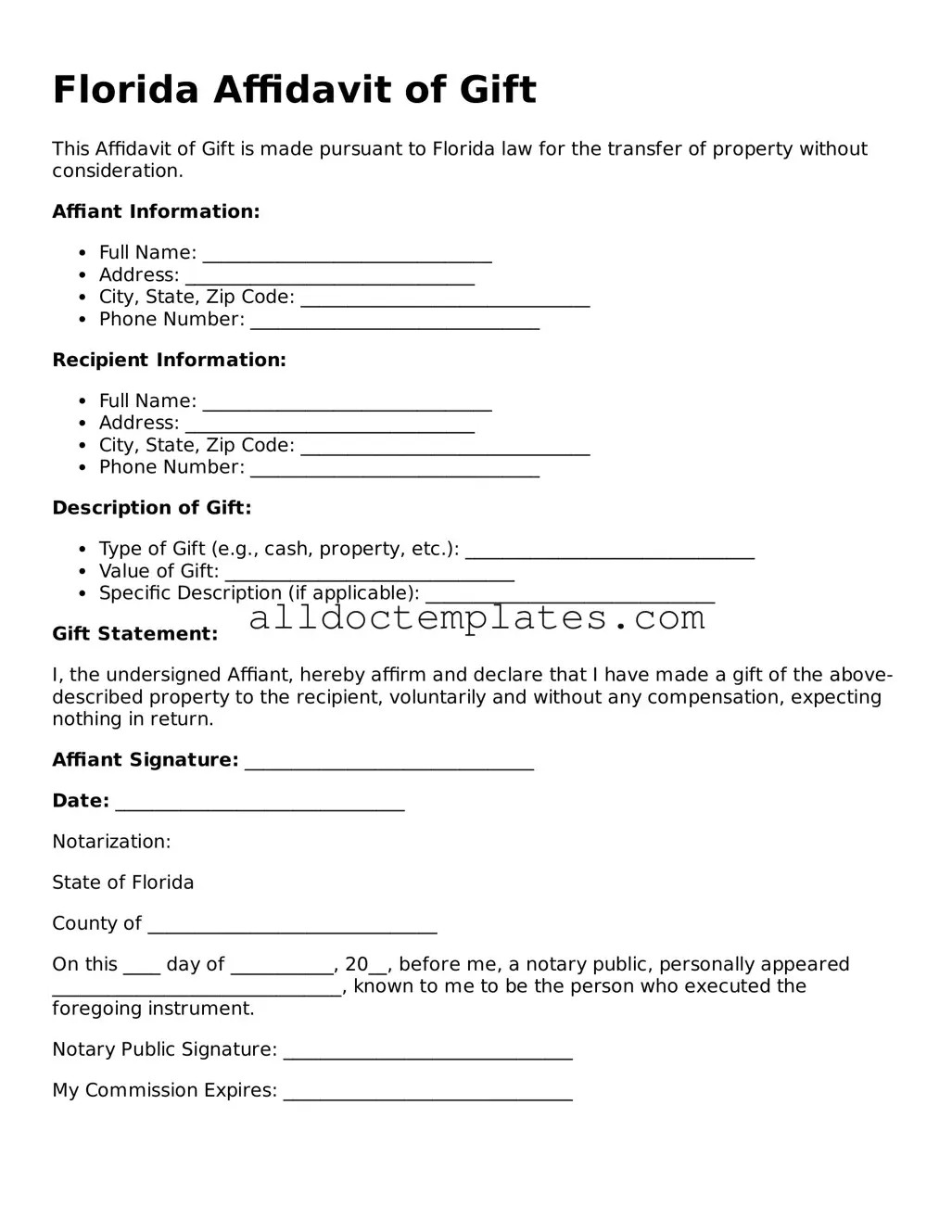

Florida Affidavit of Gift

This Affidavit of Gift is made pursuant to Florida law for the transfer of property without consideration.

Affiant Information:

- Full Name: _______________________________

- Address: _______________________________

- City, State, Zip Code: _______________________________

- Phone Number: _______________________________

Recipient Information:

- Full Name: _______________________________

- Address: _______________________________

- City, State, Zip Code: _______________________________

- Phone Number: _______________________________

Description of Gift:

- Type of Gift (e.g., cash, property, etc.): _______________________________

- Value of Gift: _______________________________

- Specific Description (if applicable): _______________________________

Gift Statement:

I, the undersigned Affiant, hereby affirm and declare that I have made a gift of the above-described property to the recipient, voluntarily and without any compensation, expecting nothing in return.

Affiant Signature: _______________________________

Date: _______________________________

Notarization:

State of Florida

County of _______________________________

On this ____ day of ___________, 20__, before me, a notary public, personally appeared _______________________________, known to me to be the person who executed the foregoing instrument.

Notary Public Signature: _______________________________

My Commission Expires: _______________________________

Form Data

| Fact Name | Details |

|---|---|

| Purpose | The Florida Affidavit of Gift form is used to document the transfer of property or assets as a gift without consideration. |

| Governing Law | This form is governed by Florida Statutes, particularly Chapter 731, which deals with wills, trusts, and estates. |

| Notarization Requirement | The form must be notarized to be legally binding, ensuring the authenticity of the signatures. |

| Eligibility | Any individual who wishes to gift property can use this form, provided they have the legal capacity to do so. |

| Property Types | The affidavit can be used for various types of property, including real estate, vehicles, and personal belongings. |

| Tax Implications | Gifts over a certain value may have tax implications. It is advisable to consult with a tax professional. |

| Record Keeping | It is important to keep a copy of the completed affidavit for personal records and potential future legal reference. |

| Transfer of Title | When applicable, the affidavit should be filed with the appropriate county office to transfer title of the gifted property. |

| Revocation | A gift can be revoked before the transfer is completed, but once the affidavit is executed, it is generally considered final. |

| Legal Advice | Consulting with a legal expert is recommended to ensure compliance with all applicable laws and to understand rights and obligations. |

Florida Affidavit of Gift - Usage Guidelines

After obtaining the Florida Affidavit of Gift form, it is essential to complete it accurately to ensure proper processing. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the name of the donor, including their address and contact information.

- Provide the recipient's name, address, and contact information.

- Clearly describe the gift being given, including any relevant details such as quantity, value, and condition.

- Include any additional terms or conditions related to the gift, if applicable.

- Sign the form in the designated area to validate the affidavit.

- Have the signature notarized by a licensed notary public.

Once the form is completed and notarized, it can be submitted as required for the intended purpose.

Some Other Affidavit of Gift State Templates

Texas Dept of Motor Vehicles - After execution, the donor should provide the recipient with a copy for their records.

The process of transferring ownership of an all-terrain vehicle can be simplified by using the Colorado ATV Bill of Sale form, which serves as a crucial document for both buyers and sellers in Colorado. This form not only helps in providing a clear record of the transaction but also includes necessary vehicle information and the details of the parties involved. For those looking to create this important document, resources such as Colorado PDF Templates can be invaluable in ensuring a smooth transfer of ownership and protecting the interests of both parties.

Dos and Don'ts

When filling out the Florida Affidavit of Gift form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are seven things you should and shouldn't do:

- Do read the instructions carefully before starting the form.

- Don't leave any required fields blank.

- Do provide accurate information about the donor and recipient.

- Don't use abbreviations that may cause confusion.

- Do sign and date the affidavit in the designated areas.

- Don't forget to have the form notarized if required.

- Do keep a copy of the completed form for your records.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as names, addresses, and dates, can lead to processing delays.

-

Incorrect Signatures: Not having the necessary signatures from both the donor and the recipient can invalidate the form.

-

Missing Notarization: Neglecting to have the affidavit notarized may result in the form being rejected.

-

Wrong Form Version: Using an outdated version of the Affidavit of Gift form can cause complications. Always check for the latest version.

-

Failure to Date the Form: Omitting the date can create confusion regarding when the gift was made.

-

Ignoring State Requirements: Not being aware of specific Florida state requirements for gifts can lead to non-compliance issues.

-

Not Keeping Copies: Failing to retain a copy of the completed form for personal records can be problematic in the future.