Fill in a Valid Fl Dr 312 Form

Document Sample

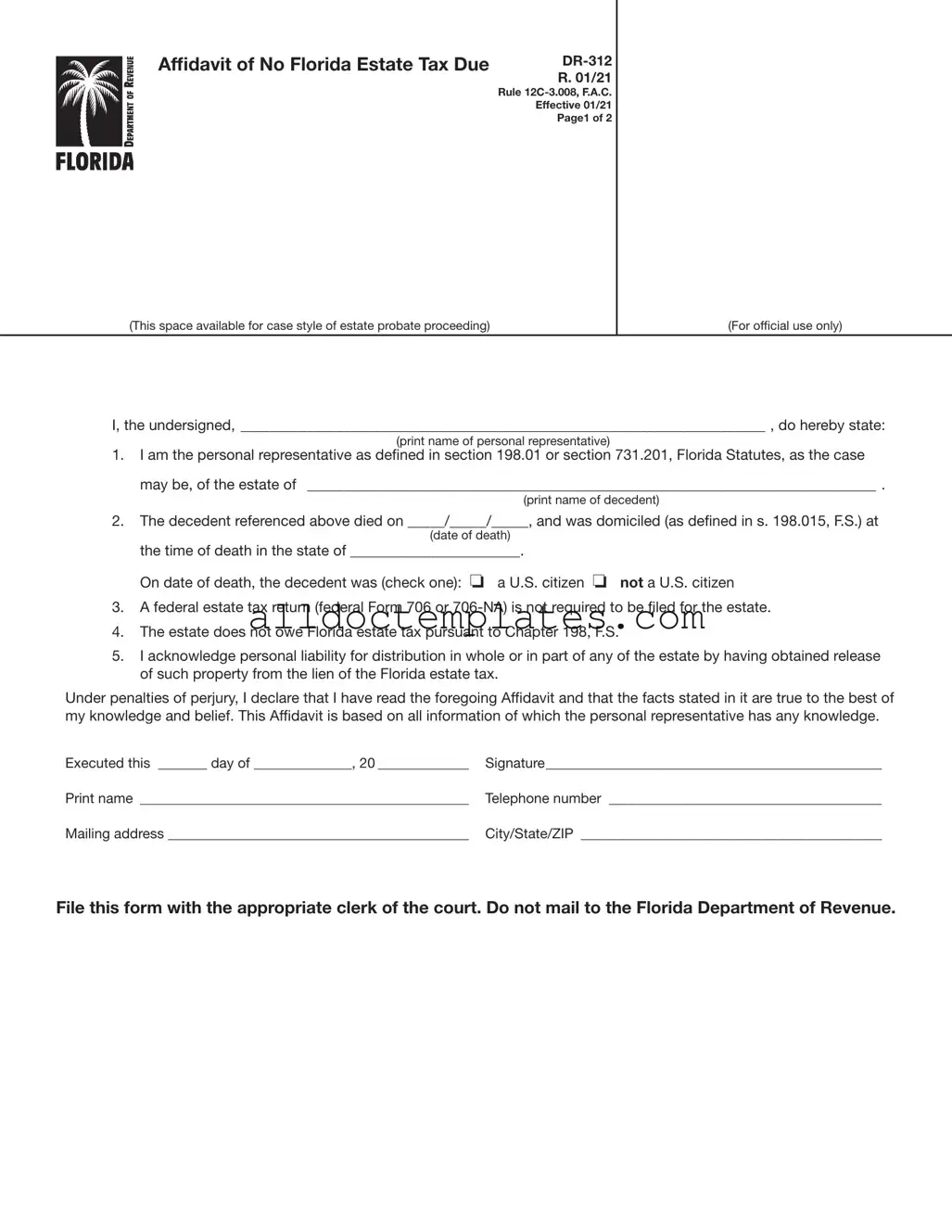

Affidavit of No Florida Estate Tax Due

Rule

Effective 01/21

Page1 of 2

(This space available for case style of estate probate proceeding) |

(For official use only) |

I, the undersigned, _______________________________________________________________________ , do hereby state:

(print name of personal representative)

1.I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes, as the case may be, of the estate of _____________________________________________________________________________ .

(print name of decedent)

2.The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in s. 198.015, F.S.) at

(date of death)

the time of death in the state of _______________________.

On date of death, the decedent was (check one): o a U.S. citizen o not a U.S. citizen

3.A federal estate tax return (federal Form 706 or

4.The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5.I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Executed this _______ day of ______________, 20 _____________ |

Signature________________________________________________ |

Print name _______________________________________________ |

Telephone number _______________________________________ |

Mailing address ___________________________________________ |

City/State/ZIP ___________________________________________ |

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

R. 01/21

Page 2 of 2

Instructions for Completing Form

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

If Florida estate tax is not due and a federal estate tax return (federal Form 706 or

Form

The

Where to File Form

Form

When to Use Form

Form

and a federal estate tax return (federal Form 706 or

Federal thresholds for filing federal Form 706 only: (For informational purposes only. Please confirm with Form 706 instructions.)

Date of Death |

Dollar Threshold |

(year) |

for Filing Form 706 |

|

(value of gross estate) |

|

|

2000 and 2001 |

$675,000 |

|

|

2002 and 2003 |

$1,000,000 |

|

|

2004 and 2005 |

$1,500,000 |

|

|

For 2006 and forward |

|

go to the IRS website at |

|

www.irs.gov to obtain |

|

thresholds. |

|

|

|

For thresholds for filing federal Form

If an administration proceeding is pending for an estate, Form

To Contact Us

Information, forms, and tutorials are available on the Department’s website floridarevenue.com

If you have any questions, or need assistance, call Taxpayer Services at

To find a taxpayer service center near you, go to: floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to: Taxpayer Services - Mail Stop

5050 W Tennessee St Tallahassee FL

Subscribe to Receive Email Alerts from the Department.

Subscribe to receive an email when Tax Information Publications and proposed rules are posted to the Department’s website. Subscribe today at floridarevenue.com/dor/subscribe.

Reference Material

Rule Chapter

Document Information

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The DR-312 form serves as an Affidavit of No Florida Estate Tax Due, allowing personal representatives to declare that no estate tax is owed under Florida law. |

| Governing Laws | This form is governed by Chapter 198 of the Florida Statutes and Rule 12C-3.008 of the Florida Administrative Code. |

| Filing Requirements | It must be filed with the clerk of the circuit court in the county where the decedent owned property; mailing it to the Florida Department of Revenue is not permitted. |

| Eligibility Criteria | The form is applicable when the estate is not subject to Florida estate tax and a federal estate tax return (Form 706 or 706-NA) is not required. |

| Personal Liability | The personal representative acknowledges liability for any distributions made from the estate, based on the affidavit's statements. |

| Evidence of Nonliability | Once filed, the DR-312 serves as evidence of nonliability for Florida estate tax and removes any associated tax lien from the estate. |

Fl Dr 312 - Usage Guidelines

Filling out the FL DR-312 form is a straightforward process. This form is necessary when an estate does not owe Florida estate tax and a federal estate tax return is not required. Below are the steps to complete the form accurately.

- Begin by printing your name in the designated space for the personal representative.

- Next, enter the name of the decedent in the provided line.

- Fill in the date of death in the format MM/DD/YYYY.

- Indicate the state where the decedent was domiciled at the time of death.

- Check the appropriate box to indicate whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return is not required by checking the corresponding statement.

- State that the estate does not owe Florida estate tax as per Chapter 198, F.S.

- Acknowledge your personal liability for any distribution of estate property by signing your name.

- Print your name again below your signature.

- Provide your telephone number for contact purposes.

- Enter your mailing address, including city, state, and ZIP code.

- Finally, date the form in the designated space.

Once completed, submit the form to the appropriate clerk of the court in the county where the decedent owned property. Remember, do not send this form to the Florida Department of Revenue.

Common PDF Forms

Printable Truck Driver Daily Time Sheet - Use it to verify your compliance with safety regulations on the road.

To ensure a smooth renting experience, it is important to understand the key elements of the Arizona Room Rental Agreement and how it can help establish clear rental terms between landlords and tenants.

California Corrective Deed - The affidavit may accompany other legal documents to provide context.

Dos and Don'ts

When filling out the Fl Dr 312 form, there are several important dos and don'ts to keep in mind. Here’s a concise list to guide you:

- Do ensure that all personal information is accurate and complete.

- Do check the decedent's date of death and domicile state carefully.

- Do indicate whether the decedent was a U.S. citizen or not.

- Do confirm that a federal estate tax return is not required before filing.

- Do file the form with the appropriate clerk of the court in the county where the decedent owned property.

- Don't write or mark in the 3-inch by 3-inch space reserved for the clerk.

- Don't mail the form to the Florida Department of Revenue.

- Don't use this form if a federal Form 706 or 706-NA is required.

- Don't forget to sign and date the affidavit to validate it.

Common mistakes

-

Failing to accurately identify the personal representative. It is essential to print the full name of the personal representative clearly in the designated space. Missing or incorrect names can lead to delays in processing.

-

Not providing the correct date of death. The form requires the exact date when the decedent passed away. Omitting this information or entering an incorrect date can result in complications.

-

Neglecting to check the citizenship status of the decedent. The form includes a checkbox for identifying whether the decedent was a U.S. citizen or not. Failing to check one of these boxes may lead to confusion regarding tax obligations.

-

Incorrectly filing the form. This form must be filed with the appropriate clerk of the court, not mailed to the Florida Department of Revenue. Misfiling can cause unnecessary delays.

-

Leaving out the signature or contact information. The personal representative must sign the form and provide a telephone number and mailing address. Omitting these details can render the form incomplete.