Valid Employee Loan Agreement Template

Document Sample

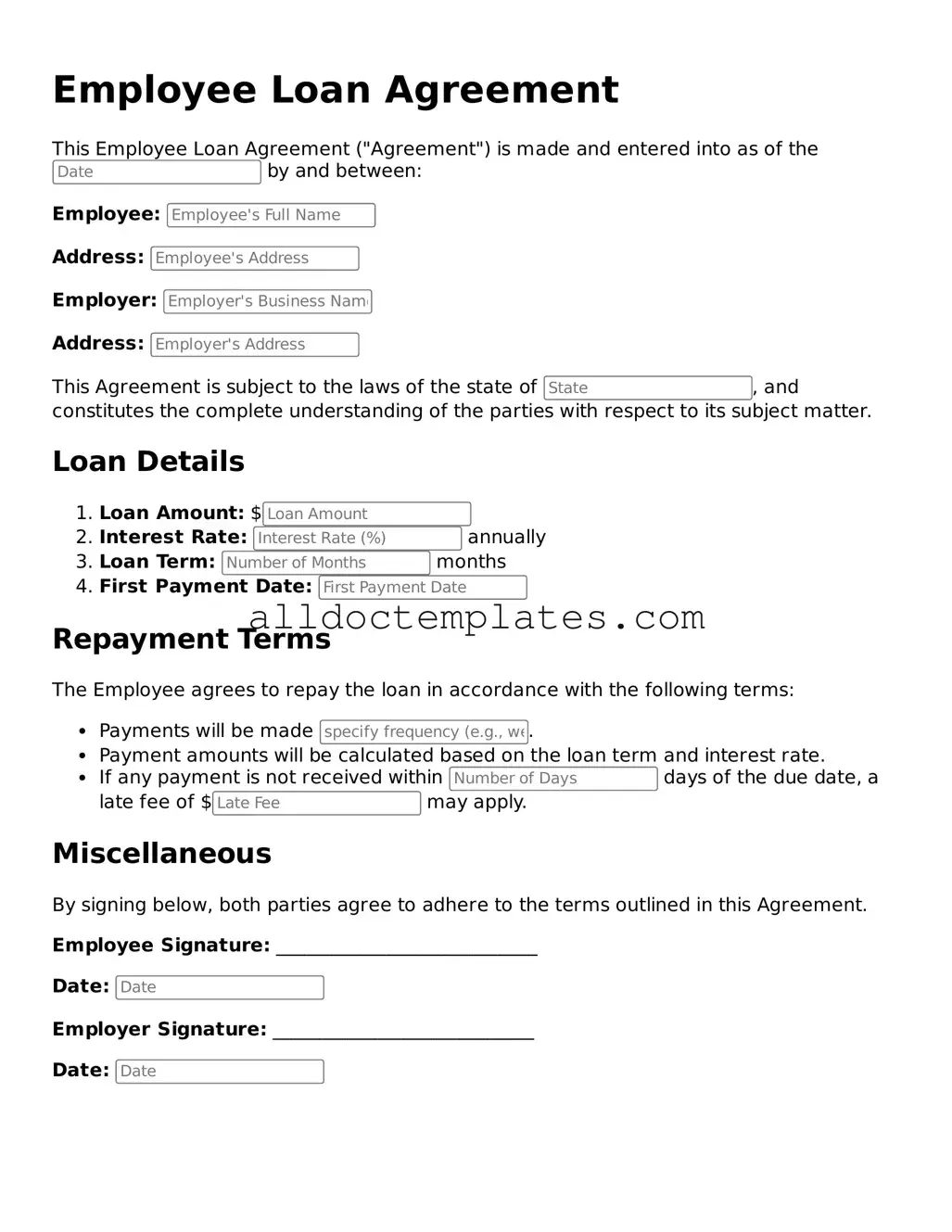

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made and entered into as of the by and between:

Employee:

Address:

Employer:

Address:

This Agreement is subject to the laws of the state of , and constitutes the complete understanding of the parties with respect to its subject matter.

Loan Details

- Loan Amount: $

- Interest Rate: annually

- Loan Term: months

- First Payment Date:

Repayment Terms

The Employee agrees to repay the loan in accordance with the following terms:

- Payments will be made .

- Payment amounts will be calculated based on the loan term and interest rate.

- If any payment is not received within days of the due date, a late fee of $ may apply.

Miscellaneous

By signing below, both parties agree to adhere to the terms outlined in this Agreement.

Employee Signature: ____________________________

Date:

Employer Signature: ____________________________

Date:

Form Data

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a document outlining the terms under which an employer lends money to an employee. |

| Purpose | This agreement serves to clarify the repayment terms, interest rates, and any other conditions related to the loan. |

| Governing Law | The agreement is typically governed by state law, which can vary significantly. For example, in California, the applicable laws include the California Civil Code. |

| Loan Amount | The document specifies the total amount of money being loaned to the employee. |

| Repayment Schedule | It outlines the repayment schedule, including the frequency of payments and the duration of the loan. |

| Interest Rate | The agreement may include an interest rate, which can be fixed or variable, depending on the terms agreed upon. |

| Default Terms | Provisions for default are included, detailing what happens if the employee fails to repay the loan as agreed. |

| Confidentiality | The agreement often contains a confidentiality clause to protect sensitive financial information of both parties. |

Employee Loan Agreement - Usage Guidelines

Filling out the Employee Loan Agreement form is an important step for both the employee and the employer. This form ensures that both parties understand the terms of the loan and agree to the repayment conditions. Follow the steps below to complete the form accurately.

- Start with the employee's full name. Write it in the designated space at the top of the form.

- Next, provide the employee's job title. This helps identify the position held within the company.

- Fill in the employee's department. This is important for record-keeping purposes.

- Enter the date the loan is being requested. This should be the current date.

- Specify the loan amount. Clearly write the total amount the employee wishes to borrow.

- Outline the purpose of the loan. Briefly explain why the employee needs the loan.

- Detail the repayment terms. Include how long the employee has to repay the loan and the payment schedule.

- Provide the employee's signature. This indicates that the employee agrees to the terms outlined in the form.

- Have a witness sign the form, if required. This adds an extra layer of verification.

- Finally, submit the completed form to the appropriate department for processing.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do: Read the entire agreement carefully before filling it out.

- Do: Provide accurate personal information, including your full name and contact details.

- Do: Clearly state the loan amount you are requesting.

- Do: Sign and date the form where indicated.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or informal language in your responses.

- Don't: Submit the form without reviewing it for errors.

Following these guidelines will help ensure that your Employee Loan Agreement is processed smoothly and efficiently.

Common mistakes

-

Incomplete Personal Information: Many individuals forget to fill in all required personal details, such as their full name, address, or employee ID. This oversight can lead to delays in processing the loan.

-

Incorrect Loan Amount: Applicants sometimes miscalculate the loan amount they are requesting. This can result in either requesting too much or too little, which complicates approval and repayment terms.

-

Failure to Specify Purpose: Not indicating the purpose of the loan is a common mistake. Lenders often want to know how the funds will be used, and omitting this information can raise red flags.

-

Ignoring Repayment Terms: Some employees overlook the importance of clearly understanding and agreeing to the repayment terms. Misunderstandings about repayment schedules can lead to financial strain.

-

Not Providing Supporting Documentation: In many cases, additional documentation is required to support the loan request. Failing to include these documents can result in a denial of the application.

-

Missing Signatures: A simple yet critical mistake is forgetting to sign the agreement. Without a signature, the document is not valid, and the loan cannot be processed.

-

Overlooking Review of Terms: Some applicants rush through the agreement without thoroughly reviewing the terms and conditions. This can lead to unexpected obligations and misunderstandings later on.