Fill in a Valid Employee Advance Form

Document Sample

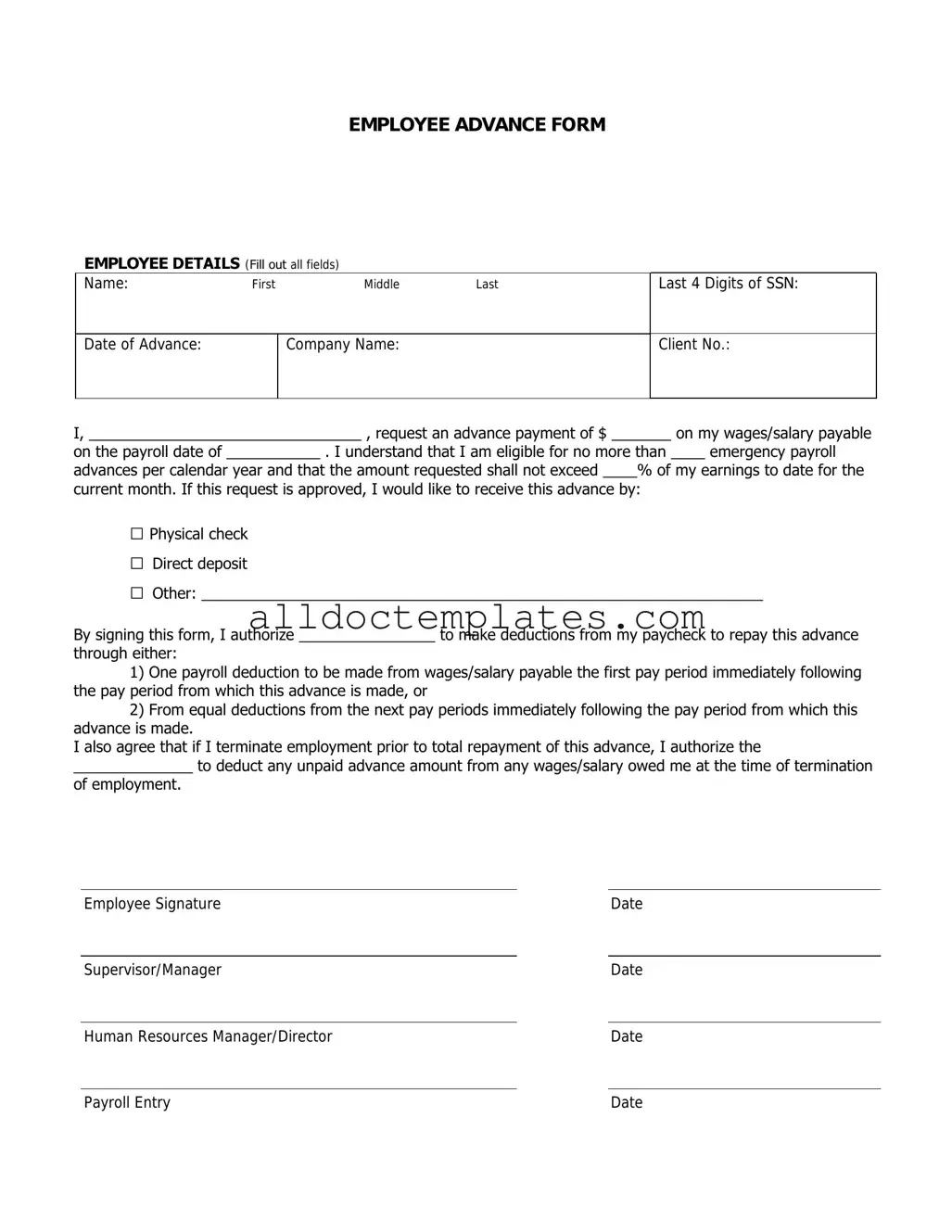

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request funds from an employer before the scheduled payday. |

| Eligibility | Typically, only employees who have completed a certain period of employment can apply for an advance. |

| Repayment Terms | Repayment is usually deducted from future paychecks, often within a specified timeframe. |

| State Regulations | In states like California, the governing law requires clear terms regarding advances and their repayment. |

| Documentation | Employees may need to provide supporting documentation, such as a reason for the advance and their financial situation. |

Employee Advance - Usage Guidelines

Filling out the Employee Advance form accurately is crucial for processing your request efficiently. Follow these steps carefully to ensure all necessary information is provided.

- Begin with your personal details. Enter your full name, employee ID, and department at the top of the form.

- Specify the date of the request. Use the format MM/DD/YYYY for clarity.

- In the section labeled "Amount Requested," clearly write the total amount you are seeking as an advance.

- Provide a brief description of the purpose of the advance. Be concise but informative.

- List any supporting documents you are including with the form. This could be receipts, invoices, or other relevant paperwork.

- Sign and date the form at the bottom. Ensure your signature matches the one on file with your employer.

- Submit the completed form to your supervisor or the designated HR representative as instructed by your company’s policy.

Common PDF Forms

Tax Form for Mortgage Interest - The regular monthly payment is the standard amount you owe each month.

When engaging in a transaction, having the right documentation is crucial. The necessary Arizona Tractor Bill of Sale is pivotal in legitimizing the sale and ensuring a smooth transfer of ownership between parties involved.

Concert Band Seating Arrangement - Plan for effective communication among staff regarding the setup.

Faa Form 8050-2 - Be aware of the different sections of the form to fill it out correctly.

Dos and Don'ts

When filling out the Employee Advance form, it's important to follow certain guidelines to ensure accuracy and efficiency. Here are four things you should and shouldn't do:

- Do: Read the form carefully before starting to fill it out.

- Do: Provide all necessary information, including your name, department, and the amount requested.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Submit the form without double-checking for errors or missing information.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays. Ensure every section is completed, including your name, department, and the purpose of the advance.

-

Incorrect Amount Requested: Double-check the amount you are requesting. Asking for too much or too little can raise questions and complicate the approval process.

-

Missing Justification: Not providing a clear reason for the advance can result in rejection. Be specific about why the funds are necessary.

-

Neglecting Signatures: Forgetting to sign the form or obtain necessary approvals can halt processing. Always check for required signatures before submission.

-

Submitting Late: Turning in the form after deadlines can cause issues. Be mindful of submission timelines to avoid complications.

-

Not Keeping Copies: Failing to make a copy of the submitted form can lead to confusion later. Always retain a copy for your records.

-

Ignoring Company Policies: Overlooking specific guidelines set by your employer can lead to mistakes. Familiarize yourself with the company’s advance policies before filling out the form.

-

Assuming Approval: Don’t assume that submitting the form guarantees approval. Understand that the request will be reviewed and may require further discussion.