Valid Deed of Trust Template

Document Sample

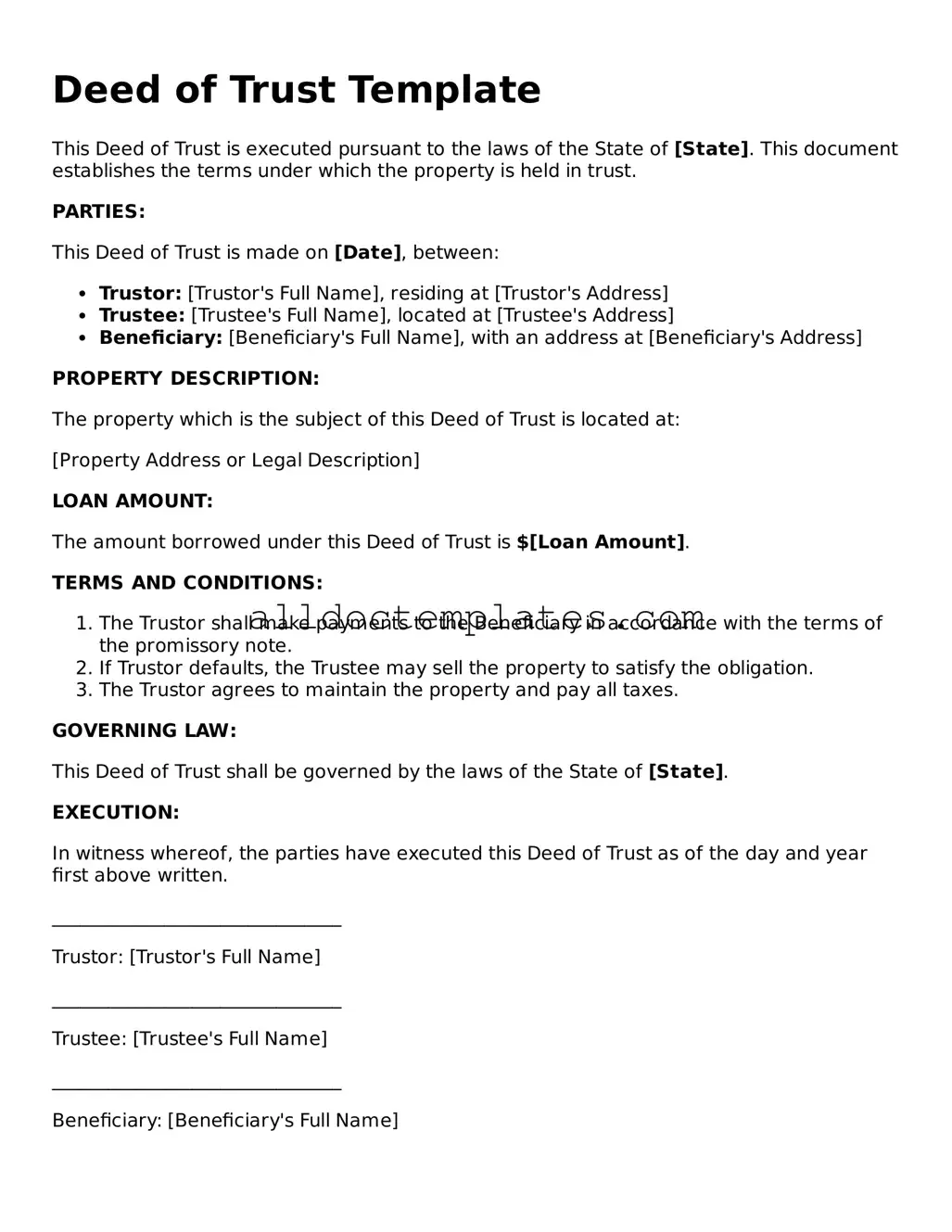

Deed of Trust Template

This Deed of Trust is executed pursuant to the laws of the State of [State]. This document establishes the terms under which the property is held in trust.

PARTIES:

This Deed of Trust is made on [Date], between:

- Trustor: [Trustor's Full Name], residing at [Trustor's Address]

- Trustee: [Trustee's Full Name], located at [Trustee's Address]

- Beneficiary: [Beneficiary's Full Name], with an address at [Beneficiary's Address]

PROPERTY DESCRIPTION:

The property which is the subject of this Deed of Trust is located at:

[Property Address or Legal Description]

LOAN AMOUNT:

The amount borrowed under this Deed of Trust is $[Loan Amount].

TERMS AND CONDITIONS:

- The Trustor shall make payments to the Beneficiary in accordance with the terms of the promissory note.

- If Trustor defaults, the Trustee may sell the property to satisfy the obligation.

- The Trustor agrees to maintain the property and pay all taxes.

GOVERNING LAW:

This Deed of Trust shall be governed by the laws of the State of [State].

EXECUTION:

In witness whereof, the parties have executed this Deed of Trust as of the day and year first above written.

_______________________________

Trustor: [Trustor's Full Name]

_______________________________

Trustee: [Trustee's Full Name]

_______________________________

Beneficiary: [Beneficiary's Full Name]

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a trustee until the loan is repaid. |

| Parties Involved | The Deed of Trust involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. |

| Purpose | This document serves to protect the lender's interest in the property while providing the borrower with the necessary funds. |

| State Variations | Each state may have specific requirements and forms for a Deed of Trust, governed by local laws. |

| Foreclosure Process | In the event of default, the trustee can initiate a non-judicial foreclosure process, which is often quicker than judicial foreclosure. |

| Recording Requirement | A Deed of Trust must be recorded with the county recorder's office to provide public notice of the lender's interest in the property. |

| Governing Laws | In California, for example, the Deed of Trust is governed by the California Civil Code, while in Texas, it falls under the Texas Property Code. |

Deed of Trust - Usage Guidelines

Once you have the Deed of Trust form ready, it's essential to complete it accurately to ensure that all necessary information is included. Following these steps will help you fill out the form correctly.

- Obtain the Deed of Trust form: Ensure you have the correct version of the form for your state.

- Identify the parties involved: Clearly write the names and addresses of the borrower(s) and lender.

- Provide property details: Enter the legal description of the property being secured, including the address and any relevant identifiers.

- State the loan amount: Indicate the total amount of the loan that the borrower is taking out.

- Include terms of the loan: Specify the interest rate, payment schedule, and any other pertinent loan terms.

- Designate a trustee: Name the individual or entity that will hold the title until the loan is paid off.

- Sign and date the form: All parties must sign the document in the appropriate places and include the date of signing.

- Notarization: Have the signatures notarized to ensure the document is legally binding.

- File the form: Submit the completed and notarized Deed of Trust with the appropriate county office or recorder’s office.

Completing these steps carefully will help ensure that your Deed of Trust is properly filled out and legally valid. After filing, keep a copy for your records, as it serves as an important document in the event of any future disputes or transactions related to the property.

More Types of Deed of Trust Templates:

New Jersey Quitclaim Deed Form - It’s advisable to consult an attorney when using this form.

For those looking to understand the nuances of property transfers, a Texas Quitclaim Deed is essential, as it enables a property owner to relinquish their ownership rights to another individual. It is important to remember that this deed, which can be particularly useful in familial transactions or situations requiring less formal title verification, does not provide a warranty against existing liens or claims on the property. For more detailed information, you can visit https://topformsonline.com/texas-quitclaim-deed/.

Dos and Don'ts

When filling out a Deed of Trust form, careful attention is essential to ensure that all information is accurate and complete. Here are some important dos and don'ts to keep in mind:

- Do provide accurate information about the borrower, lender, and property.

- Do ensure that all parties involved sign the document where required.

- Do double-check the legal descriptions of the property for accuracy.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use abbreviations that may cause confusion.

- Don't forget to review the form for any spelling or grammatical errors.

By adhering to these guidelines, you can help ensure that the Deed of Trust form is completed correctly, which can prevent potential issues down the line.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to confusion and potential legal issues. Ensure that the address and legal description are precise.

-

Missing Signatures: All required parties must sign the document. Omitting a signature can invalidate the deed. Verify that everyone involved has signed before submission.

-

Wrong Names: Using incorrect names or misspellings can create complications. Double-check the names of all parties to ensure they match official identification.

-

Failure to Notarize: Many jurisdictions require notarization for the deed to be legally binding. Ensure that a notary public witnesses the signing process.

-

Incorrect Date: Entering the wrong date can lead to disputes regarding the timing of the agreement. Always verify that the date is accurate before finalizing the document.

-

Not Understanding the Terms: Failing to fully comprehend the terms of the deed can result in unintended consequences. Review all clauses carefully and seek clarification if needed.