Valid Deed in Lieu of Foreclosure Template

Document Sample

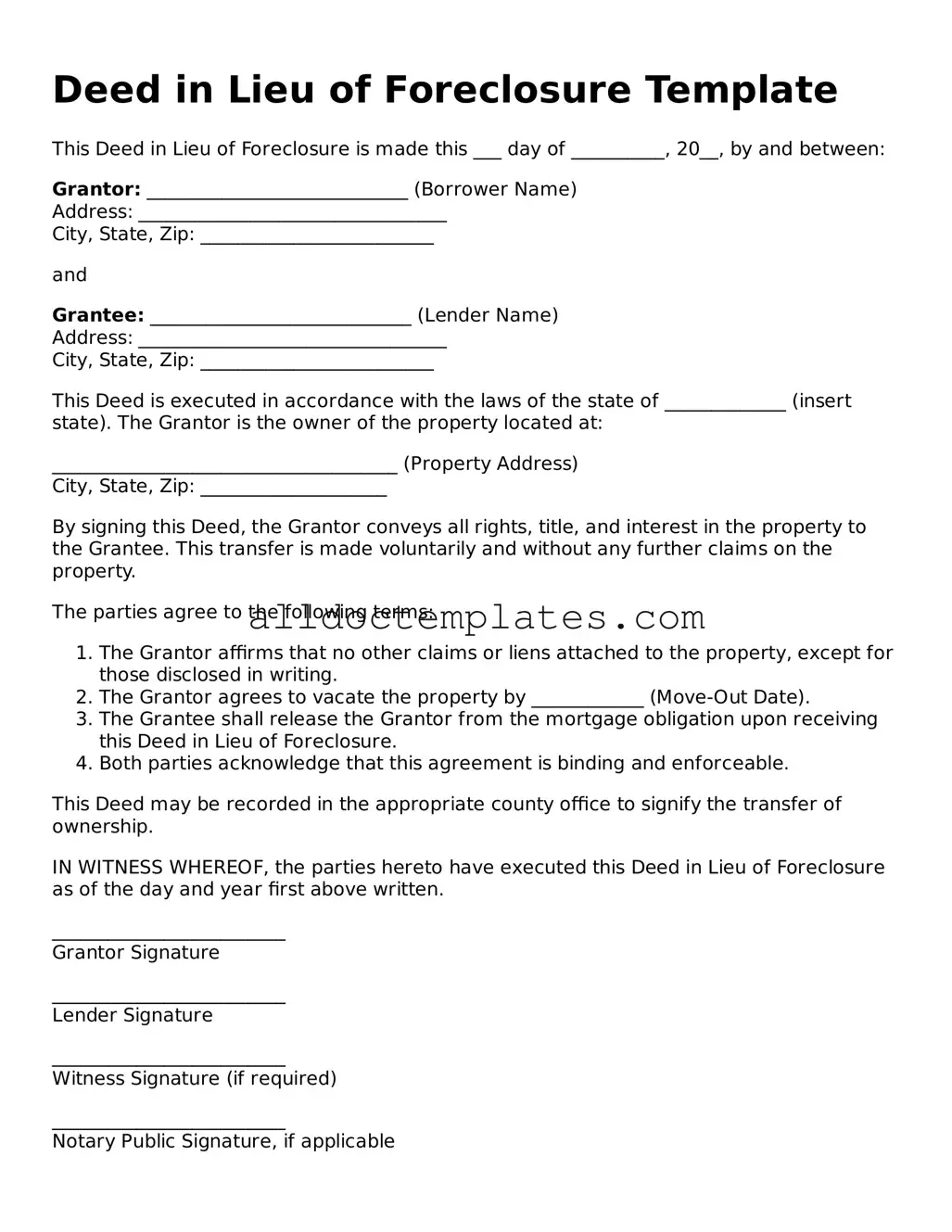

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20__, by and between:

Grantor: ____________________________ (Borrower Name)

Address: _________________________________

City, State, Zip: _________________________

and

Grantee: ____________________________ (Lender Name)

Address: _________________________________

City, State, Zip: _________________________

This Deed is executed in accordance with the laws of the state of _____________ (insert state). The Grantor is the owner of the property located at:

_____________________________________ (Property Address)

City, State, Zip: ____________________

By signing this Deed, the Grantor conveys all rights, title, and interest in the property to the Grantee. This transfer is made voluntarily and without any further claims on the property.

The parties agree to the following terms:

- The Grantor affirms that no other claims or liens attached to the property, except for those disclosed in writing.

- The Grantor agrees to vacate the property by ____________ (Move-Out Date).

- The Grantee shall release the Grantor from the mortgage obligation upon receiving this Deed in Lieu of Foreclosure.

- Both parties acknowledge that this agreement is binding and enforceable.

This Deed may be recorded in the appropriate county office to signify the transfer of ownership.

IN WITNESS WHEREOF, the parties hereto have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

_________________________

Grantor Signature

_________________________

Lender Signature

_________________________

Witness Signature (if required)

_________________________

Notary Public Signature, if applicable

My Commission Expires: _______________

State-specific Information for Deed in Lieu of Foreclosure Forms

Form Data

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure. |

| Purpose | This form serves as a way for homeowners to mitigate the impact of foreclosure on their credit history and financial future. |

| Eligibility | Typically, the borrower must be facing financial difficulties and unable to keep up with mortgage payments. |

| State-Specific Forms | Each state may have specific requirements for the deed in lieu of foreclosure. For example, in California, the governing law is found under California Civil Code Section 2929.5. |

| Process | The borrower must provide the lender with a written request, and both parties must agree to the terms outlined in the deed. |

| Impact on Credit | While a deed in lieu of foreclosure is less damaging than a foreclosure, it may still negatively affect the borrower’s credit score. |

| Tax Implications | In some cases, the borrower may face tax consequences due to the cancellation of debt, which can be considered taxable income. |

Deed in Lieu of Foreclosure - Usage Guidelines

After completing the Deed in Lieu of Foreclosure form, you will need to submit it to your lender for review. They will assess the document and determine the next steps in the process. Be prepared to provide any additional information they may request.

- Begin by entering the date at the top of the form.

- Fill in the name of the property owner(s) as they appear on the mortgage.

- Provide the complete address of the property, including city, state, and ZIP code.

- Identify the lender by writing their full name and address.

- Clearly state the legal description of the property. This can often be found on your mortgage documents.

- Indicate any outstanding loans or liens against the property, if applicable.

- Sign the form in the designated area. Ensure that all property owners sign, if there are multiple owners.

- Have your signature notarized to validate the document.

- Make copies of the completed form for your records before submitting it to the lender.

More Types of Deed in Lieu of Foreclosure Templates:

Title Companies and Transfer on Death Deeds - The Transfer-on-Death Deed is a modern solution for efficient property succession planning.

When considering the usage of a Colorado Hold Harmless Agreement, it is crucial to understand its importance in protecting both parties from potential liabilities. By utilizing this document, individuals and organizations can confidently participate in various activities while mitigating legal risks. For those seeking a comprehensive resource on such agreements, Colorado PDF Templates offers helpful templates and guidance to ensure that all parties are well-informed and safeguarded.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it's important to follow certain guidelines. Here are some things to consider doing and avoiding:

- Do: Provide accurate information about the property.

- Do: Sign the form in front of a notary public.

- Do: Include all necessary documentation with your submission.

- Do: Keep copies of everything you send.

- Do: Consult with a legal professional if you have questions.

- Don't: Leave any sections of the form blank.

- Don't: Submit the form without reviewing it thoroughly.

- Don't: Rush the process; take your time to ensure accuracy.

- Don't: Ignore any specific instructions provided with the form.

- Don't: Forget to check for any deadlines related to submission.

Common mistakes

-

Not Understanding the Terms: Many individuals fail to fully grasp the implications of a deed in lieu of foreclosure. This document transfers ownership of the property to the lender, which can affect credit scores and future borrowing potential.

-

Incorrect Property Information: Providing inaccurate details about the property can lead to delays or rejection of the deed. Ensure that the address, legal description, and other pertinent information are correct.

-

Missing Signatures: All necessary parties must sign the document. Often, people forget to include the spouse or co-owner's signature, which can invalidate the deed.

-

Not Consulting with Professionals: Some individuals attempt to complete the form without seeking advice from legal or financial professionals. This can lead to errors that may have been easily avoided with proper guidance.

-

Overlooking Additional Documents: A deed in lieu of foreclosure often requires accompanying paperwork. Neglecting to include these documents can result in processing delays or complications.