Fill in a Valid DD 2656 Form

Document Sample

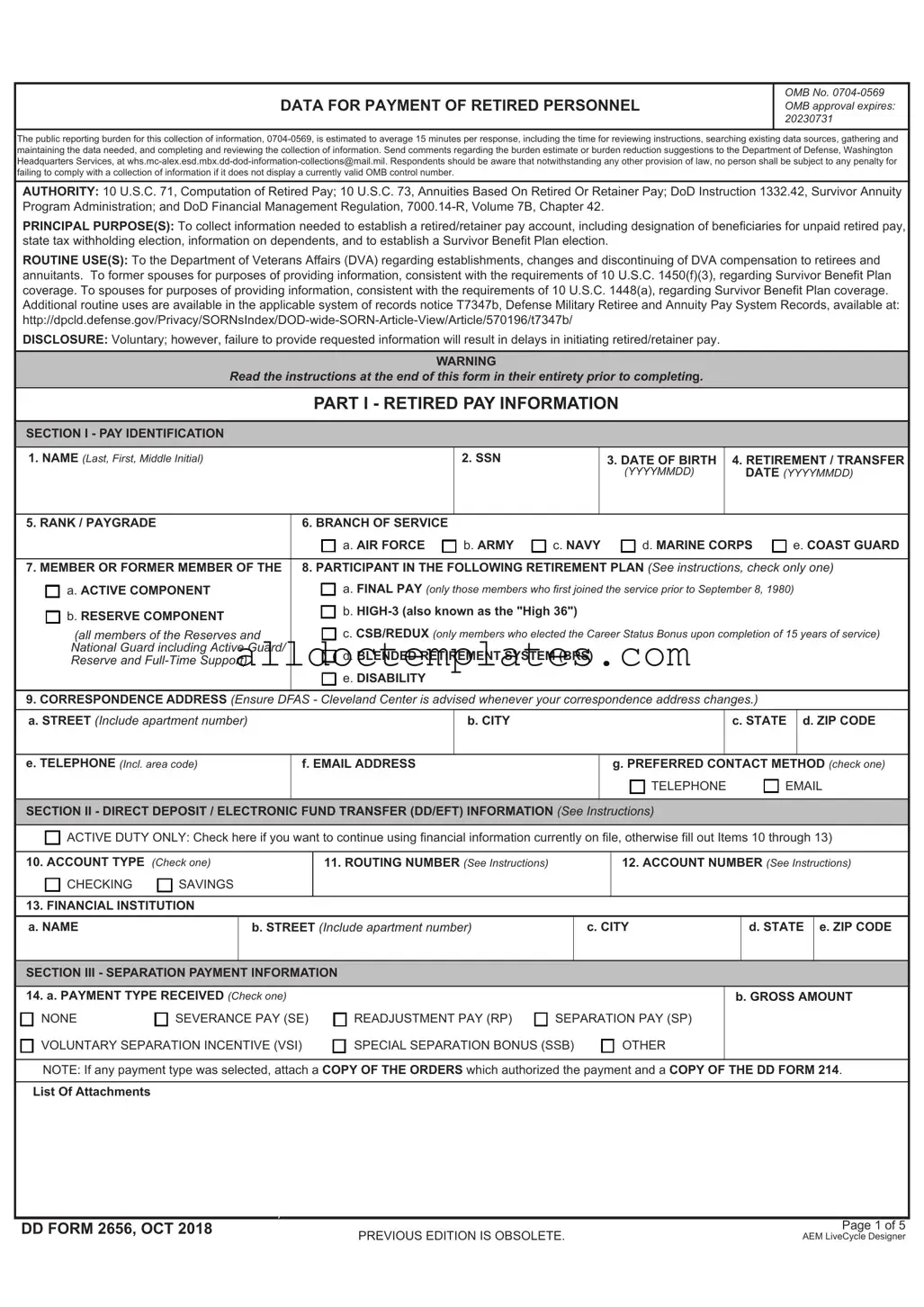

DATA FOR PAYMENT OF RETIRED PERSONNEL

OMB No.

The public reporting burden for this collection of information,

AUTHORITY: 10 U.S.C. 71, Computation of Retired Pay; 10 U.S.C. 73, Annuities Based On Retired Or Retainer Pay; DoD Instruction 1332.42, Survivor Annuity Program Administration; and DoD Financial Management Regulation,

PRINCIPAL PURPOSE(S): To collect information needed to establish a retired/retainer pay account, including designation of beneficiaries for unpaid retired pay, state tax withholding election, information on dependents, and to establish a Survivor Benefit Plan election.

ROUTINE USE(S): To the Department of Veterans Affairs (DVA) regarding establishments, changes and discontinuing of DVA compensation to retirees and annuitants. To former spouses for purposes of providing information, consistent with the requirements of 10 U.S.C. 1450(f)(3), regarding Survivor Benefit Plan coverage. To spouses for purposes of providing information, consistent with the requirements of 10 U.S.C. 1448(a), regarding Survivor Benefit Plan coverage. Additional routine uses are available in the applicable system of records notice T7347b, Defense Military Retiree and Annuity Pay System Records, available at:

DISCLOSURE: Voluntary; however, failure to provide requested information will result in delays in initiating retired/retainer pay.

WARNING

Read the instructions at the end of this form in their entirety prior to completing.

PART I - RETIRED PAY INFORMATION

SECTION I - PAY IDENTIFICATION

1. NAME (Last, First, Middle Initial) |

|

2. SSN |

|

|

3. DATE OF BIRTH |

4. RETIREMENT / TRANSFER |

||

|

|

|

|

|

(YYYYMMDD) |

DATE (YYYYMMDD) |

||

|

|

|

|

|

|

|

|

|

5. RANK / PAYGRADE |

6. BRANCH OF SERVICE |

|

|

|

|

|

|

|

|

a. AIR FORCE |

b. ARMY |

c. NAVY |

d. MARINE CORPS |

e. COAST GUARD |

|||

|

|

|||||||

7. MEMBER OR FORMER MEMBER OF THE |

8. PARTICIPANT IN THE FOLLOWING RETIREMENT PLAN (See instructions, check only one) |

|||||||

a. ACTIVE COMPONENT |

a. FINAL PAY (only those members who first joined the service prior to September 8, 1980) |

|||||||

b. RESERVE COMPONENT |

b. |

|

|

|

||||

c. CSB/REDUX (only members who elected the Career Status Bonus upon completion of 15 years of service) |

||||||||

(all members of the Reserves and |

||||||||

National Guard including Active Guard/ |

d. BLENDED RETIREMENT SYSTEM (BRS) |

|

|

|

||||

Reserve and |

|

|

|

|||||

|

e. DISABILITY |

|

|

|

|

|

|

|

9.CORRESPONDENCE ADDRESS (Ensure DFAS - Cleveland Center is advised whenever your correspondence address changes.)

a. STREET (Include apartment number) |

b. CITY |

c. STATE |

d. ZIP CODE |

|

|

|

|

e. TELEPHONE (Incl. area code)

f. EMAIL ADDRESS

g. PREFERRED CONTACT METHOD (check one)

TELEPHONE

TELEPHONE  EMAIL

EMAIL

SECTION II - DIRECT DEPOSIT / ELECTRONIC FUND TRANSFER (DD/EFT) INFORMATION (See Instructions)

ACTIVE DUTY ONLY: Check here if you want to continue using financial information currently on file, otherwise fill out Items 10 through 13)

ACTIVE DUTY ONLY: Check here if you want to continue using financial information currently on file, otherwise fill out Items 10 through 13)

10. ACCOUNT TYPE (Check one) |

11. ROUTING NUMBER (See Instructions) |

|

|

|

12. ACCOUNT NUMBER (See Instructions) |

|||||

CHECKING |

SAVINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. FINANCIAL INSTITUTION |

|

|

|

|

|

|

|

|

||

a. NAME |

|

b. STREET (Include apartment number) |

|

|

c. CITY |

|

d. STATE |

e. ZIP CODE |

||

|

|

|

|

|

|

|

|

|

||

SECTION III - SEPARATION PAYMENT INFORMATION |

|

|

|

|

|

|

|

|||

14. a. PAYMENT TYPE RECEIVED (Check one) |

|

|

|

|

|

b. GROSS AMOUNT |

||||

NONE |

SEVERANCE PAY (SE) |

READJUSTMENT PAY (RP) |

SEPARATION PAY (SP) |

|

|

|

||||

VOLUNTARY SEPARATION INCENTIVE (VSI) |

SPECIAL SEPARATION BONUS (SSB) |

|

OTHER |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

NOTE: If any payment type was selected, attach a COPY OF THE ORDERS which authorized the payment and a COPY OF THE DD FORM 214.

List Of Attachments

If Yes, Attach Page

DD FORM 2656, OCT 2018

PREVIOUS EDITION IS OBSOLETE. |

Page 1 of 5 |

AEM LiveCycle Designer |

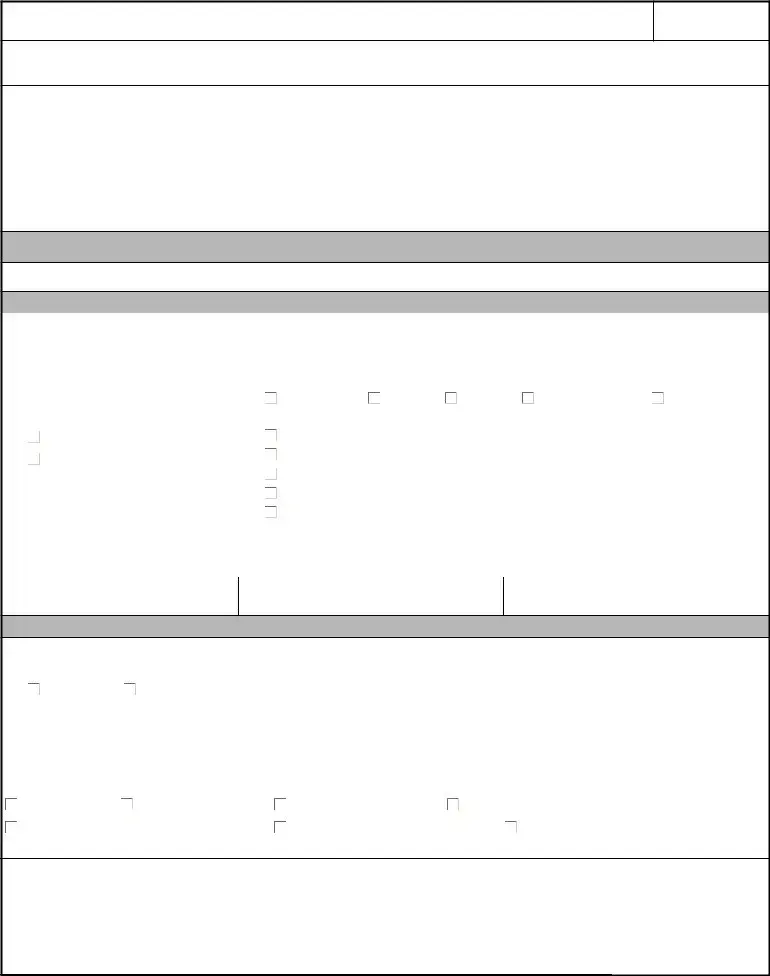

MEMBER NAME (Last, First, Middle Initial)

SSN

SECTION IV - VETERANS AFFAIRS (VA) DISABILITY COMPENSATION INFORMATION

15. VA DISABILITY COMPENSATION

a. IN THE EVENT I AM AWARDED DISABILITY |

b. HAVE YOU APPLIED FOR OR ARE |

c. EFFECTIVE DATE OF |

d. MONTHLY AMOUNT |

|

COMPENSATION BY THE VA, I WILL NOTIFY |

YOU RECEIVING VA COMPENSATION |

PAYMENT (YYYYMMDD) |

OF PAYMENT |

|

DFAS OF THE AMOUNT OF ANY AWARD, AS IT |

FOR A DISABILITY? |

|

|

|

MAY IMPACT MY RETIRED PAY BENEFIT. |

|

|

|

|

Agree |

Yes |

No |

|

|

|

|

|

|

|

SECTION V - DESIGNATION OF BENEFICIARIES FOR UNPAID RETIRED PAY (See Instructions)

Check this box if you want to designate your spouse as 100% beneficiary of any unpaid retired pay upon death OR complete Item 16

Check this box if you want to designate your spouse as 100% beneficiary of any unpaid retired pay upon death OR complete Item 16

16. BENEFICIARY OR BENEFICIARIES INFORMATION

Complete this section if you want to designate a beneficiary or beneficiaries to receive any unpaid retired pay you are due at death.

If you do not complete this section OR check the block above, it will cause significant delay in disbursement of remaining pay upon your death.

a. NAME (Last, First, Middle Initial) |

b. SSN |

c. ADDRESS (Street, City, State, ZIP Code) |

d. RELATIONSHIP e. SHARE |

(1) |

|

|

% |

(2)

%

(3)

%

SECTION VI - FEDERAL INCOME TAX WITHHOLDING INFORMATION (Submit information in Items 17 – 21 in lieu of IRS Form

17. MARITAL STATUS (Check one)

SINGLE

SINGLE  MARRIED

MARRIED

MARRIED BUT WITHHOLD AT HIGHER SINGLE RATE

18.TOTAL NUMBER OF EXEMPTIONS CLAIMED

19.ADDITIONAL WITHHOLDING (Optional)

20.I CLAIM EXEMPTION FROM WITHHOLDING (Enter "EXEMPT")

21.ARE YOU A UNITED STATES CITIZEN?

Yes

Yes

No (See Instructions)

SECTION VII - VOLUNTARY STATE TAX WITHHOLDING INFORMATION (Complete only if monthly withholding is desired.)

22.STATE DESIGNATED TO RECEIVE TAX

23.MONTHLY AMOUNT

(Whole dollar amount not less than $10.00)

24.RESIDENCE ADDRESS (If different from address listed in Block 9)

a. STREET (Include apartment number) |

b. CITY |

c. STATE |

d. ZIP CODE |

|

|

|

|

DD FORM 2656, OCT 2018

PREVIOUS EDITION IS OBSOLETE. |

Page 2 of 5 |

AEM LiveCycle Designer |

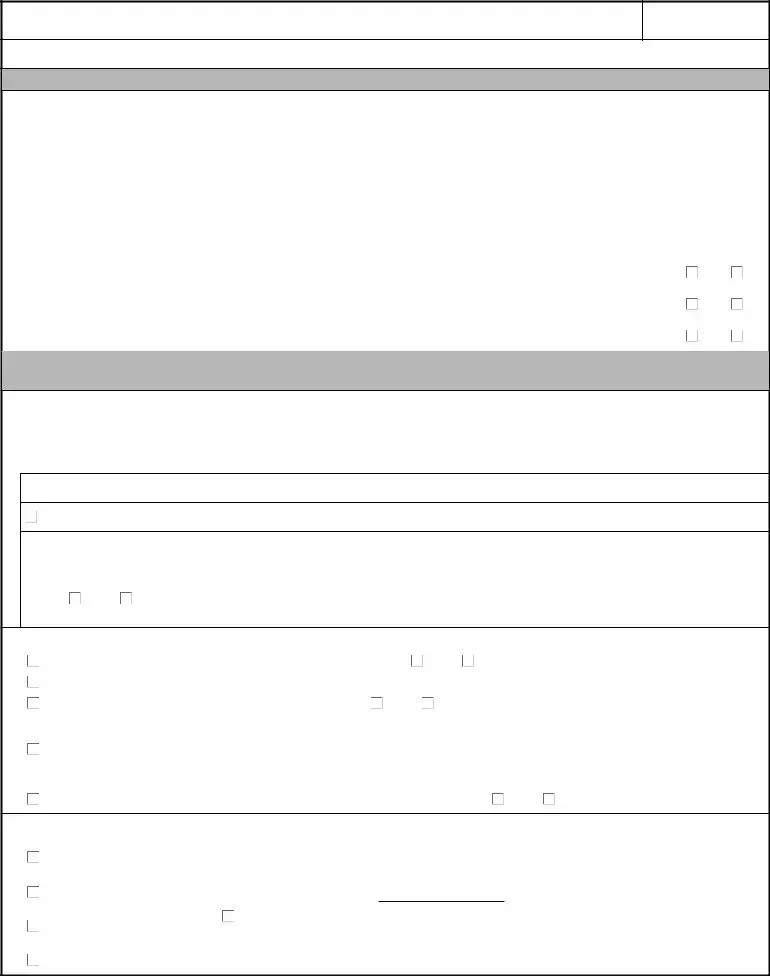

MEMBER NAME (Last, First, Middle Initial)

SSN

DO NOT COMPLETE PART II,

If you are not covered by the BLENDED RETIREMENT SYSTEM or do not want to elect a lump sum of retired pay

PART II - LUMP SUM ELECTION

This election must be made NO LATER THAN 90 days prior to the date in Part I, Section I, Item 4, in accordance with 10 U.S.C. §1415

For example, if the date in Block 4 is June 1, 2018, the date in Block 28b must be on or before March 3, 2018

SECTION VIII - BLENDED RETIREMENT SYSTEM LUMP SUM ELECTION

Members covered by the Blended Retirement System may, upon retirement (regular retirement), or upon reaching the age of eligibility to receive retired pay

25. LUMP SUM PERCENTAGE

(Check one only, if electing to receive a LUMP SUM; if no choice is indicated you will default to receiving your full retired pay on a monthly basis)

a. I elect to receive a 25 PERCENT lump sum that is a discounted

portion of my retired pay for the period from when I am eligible to begin receiving retired pay until I reach full social security retirement age.

b. I elect to receive a 50 PERCENT lump sum that is a discounted portion of my retired pay for the period from when I am eligible to begin receiving retired pay until I reach full social security retirement age.

26. LUMP SUM PAYMENTS

(Check one only. Complete Block 26 only, if electing a LUMP SUM in Block 25)

I ELECT TO RECEIVE THE LUMP SUM IN

a. ONE INSTALLMENT

a. ONE INSTALLMENT

b. TWO EQUAL ANNUAL INSTALLMENTS

b. TWO EQUAL ANNUAL INSTALLMENTS

c. THREE EQUAL ANNUAL INSTALLMENTS

c. THREE EQUAL ANNUAL INSTALLMENTS

d. FOUR EQUAL ANNUAL INSTALLMENTS

d. FOUR EQUAL ANNUAL INSTALLMENTS

27.LUMP SUM CONSIDERATIONS (Read the following carefully before signing in Block 28.)

•You are only eligible to elect a lump sum if you are qualified for a Regular or

•A lump sum election must be made NO LATER THAN 90 days prior to the date of your retirement (for Regular Retirement) or 90 days prior to the date you are eligible to begin receiving retired pay (for

•You may elect to receive either a 25 percent or 50 percent discounted portion of your future estimated retired pay as a discounted lump sum in exchange for reduced monthly retired pay until you reach your full Social Security Retirement Age.

•As a result of electing a lump sum, your monthly retired pay will be reduced to either 75 or 50 percent of its normal amount depending on whether you elect to receive 25 or 50 percent. At Full Social Security Retirement Age, your monthly retired pay will be restored to its full amount.

•The discount rate used to calculate your lump sum is the rate published by the Department of Defense in June of the year prior to the year of your retirement or year you first become eligible for retired pay, based on the date in Part I, Section I, Block 4.

•A lump sum payment is earned income for purposes of Federal Income Tax – receipt of it may have significant tax implications.

•The amount of the lump sum is based on your calculated military retired pay, the discount rate in effect for the year in which you retire or become eligible to begin receiving retired pay, and the remaining amount of time until you reach full Social Security Retirement Age. Once distributed, you do not have the ability to seek review of or challenge the amount of the lump sum with regard to any assumptions or factors used to compute the amount of the lump sum.

•Survivor Benefit Plan premiums (Part III) will still be deducted from your remaining monthly retired pay should you elect the lump sum. The premiums and your beneficiary’s coverage will be based on the unreduced amount of your monthly retired pay, as if you had not elected a lump sum, unless you indicate otherwise in Block 35 of Part III.

•If you expect to receive a disability rating from the Department of Veterans Affairs, dependent upon your rating, your ability to receive disability compensation could be affected by the lump sum.

•It is important to understand that a lifetime of full monthly payments will most likely be worth more than the lump sum with reduced monthly retired pay. It is highly recommended that you consult with a financial counselor before electing a lump sum of retired pay.

COMPARE YOUR ESTIMATED RETIREMENT BENEFITS WITH OR WITHOUT THE LUMP SUM:

http://militarypay.defense.gov/Calculators/

28. LUMP SUM ACKNOWLEDGEMENT

By signing below, I am indicating that I am aware that I am electing to receive a discounted portion of my retired pay as a lump sum, and that this lump sum will likely be less than I would have received if I had not elected to receive it. I am aware that there are resources available to assist me in making this decision, and that I have reviewed a comparison of my retirement benefits with and without a lump sum. I am also aware that once accepted, I may not seek review of, or otherwise challenge the amount of the lump sum, particularly in regard to deviations from future cost of living adjustments, actuarial assumptions, or other factors used in computing this amount.

a. MEMBER SIGNATURE (Sign only if electing a lump sum in Block 25)

b. DATE SIGNED (YYYYMMDD)

DD FORM 2656, OCT 2018

PREVIOUS EDITION IS OBSOLETE. |

Page 3 of 5 |

AEM LiveCycle Designer |

MEMBER NAME (Last, First, Middle Initial)

SSN

PART III - SURVIVOR BENEFIT PLAN

SECTION IX - DEPENDENCY INFORMATION (This section must be completed regardless of SBP Election.)

29. SPOUSE

a. NAME (Last, First, Middle Initial) |

|

|

|

|

b. SSN |

c. DATE OF BIRTH |

|

|

|

|

|

|

|

|

(YYYYMMDD) |

|

|

|

|

|

|

|

|

|

|

|

30. DATE OF MARRIAGE (YYYYMMDD) |

|

|

31. PLACE OF MARRIAGE (See Instructions) |

|

|

|

||

|

|

|

|

|

|

|

|

|

32. DEPENDENT CHILDREN |

|

|

|

|

|

|

|

|

Indicate which child or children resulted from marriage to a former spouse by entering (FS) after relationship in column d. |

|

|

|

|||||

|

|

|

||||||

Add rows or continue on separate paper if necessary. |

|

|

|

|

|

|

|

|

a. NAME (Last, First, Middle Initial) |

b. SSN |

c. DATE OF BIRTH |

d. RELATIONSHIP |

|

e. DISABLED? |

|||

|

(YYYYMMDD) |

(Son, daughter, stepson, etc.) |

|

|||||

|

|

|

|

|

|

|||

(1) |

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

SECTION X - SURVIVOR BENEFIT PLAN (SBP) ELECTION (You should consult a Survivor Benefit Plan counselor before making an election.)

If you make no election, maximum coverage will be established for your spouse and/or eligible dependent children

33.RESERVE COMPONENT ONLY (This section refers to the decision you previously made on the DD Form

Reserve/National Guard members who achieve 20 qualifying years of service make the election to participate in the Reserve Component (RC) SBP on DD Form

OPTION A - Previously declined to make an election until eligible to receive retired pay (Proceed to Block 34 to make election)

OPTION A - Previously declined to make an election until eligible to receive retired pay (Proceed to Block 34 to make election)

OPTION B - Previously elected coverage to begin at age 60 (Do not make an election in Block 34, you have already elected coverage.)

OPTION C - Previously elected or defaulted to immediate  NOTE: If you were married at the time you were notified of eligibility for

NOTE: If you were married at the time you were notified of eligibility for

you defaulted to full coverage under OPTION C – do not make an election in Block 34

Marital status has changed since your initial election to participate in

Yes |

No If Yes, Attach Page with Explanation |

34.SBP BENEFICIARY CATEGORIES (Check one only. See Instructions and Section X.)

a. I ELECT COVERAGE FOR SPOUSE ONLY I have Dependent Child(ren) |

Yes |

No |

|

b. I ELECT COVERAGE FOR SPOUSE AND CHILD(REN) |

|

|

|

c. I ELECT COVERAGE FOR CHILD(REN) ONLY I have a Spouse |

Yes |

No |

|

d. I ELECT COVERAGE FOR THE PERSON NAMED IN BLOCK 37 WHO HAS AN INSURABLE INTEREST IN ME (See Instructions)

d. I ELECT COVERAGE FOR THE PERSON NAMED IN BLOCK 37 WHO HAS AN INSURABLE INTEREST IN ME (See Instructions)

e.I ELECT COVERAGE FOR MY FORMER SPOUSE INDICATED IN BLOCK 38 (See Instructions) Complete DD

f. I ELECT COVERAGE FOR MY FORMER SPOUSE AND DEPENDENT CHILD(REN) OF THAT MARRIAGE

f. I ELECT COVERAGE FOR MY FORMER SPOUSE AND DEPENDENT CHILD(REN) OF THAT MARRIAGE

g. I ELECT NOT TO PARTICIPATE IN SBP |

I have eligible dependents under the plan. |

Yes |

No |

|

If ‘Yes’, spouse concurrence is required in Part V. |

|

|

35.SBP LEVEL OF COVERAGE (Check one only. Complete UNLESS Option B or Option C was selected in 33 OR Check Box 34 d or 34 g was selected. See Instructions.)

a. I ELECT COVERAGE BASED ON FULL GROSS PAY

(If I elected the Career Status Bonus under REDUX or a lump sum of retired pay under the Blended Retirement System (Part II), full gross pay is the amount of retired pay I would have received had I NOT elected the Career Status Bonus or Lump Sum.)

b. I ELECT COVERAGE WITH A REDUCED BASE AMOUNT OF $ (Spouse concurrence is required in Part V)

c. CSB /REDUX MEMBERS ONLY

I elect coverage based on my actual Reduced Retired Pay Under REDUX.

I understand that this represents a Reduced Base Amount and requires Spouse Concurrence. (See Instructions)

I understand that this represents a Reduced Base Amount and requires Spouse Concurrence. (See Instructions)

d. I ELECT COVERAGE BASED ON THE THRESHOLD AMOUNT IN EFFECT ON THE DATE OF RETIREMENT.

(Spouse concurrence is required in Part V)

DD FORM 2656, OCT 2018

PREVIOUS EDITION IS OBSOLETE. |

Page 4 of 5 |

AEM LiveCycle Designer |

MEMBER NAME (Last, First, Middle Initial)

SSN

36.SPECIAL NEEDS TRUST (Check only if you intend to designate a special needs trust (SNT) as beneficiary for a child/children designated in Item 32e. as disabled. You must elect either 34b., 34c., or 34f. to be eligible to designate an SNT. See DoDI 1332.42 for procedures for designating an SNT.)

I INTEND TO DESIGNATE AN SNT AS BENEFICIARY FOR THE CHILD OR CHILDREN DESIGNATED AS DISABLED IN BLOCK 32.

I INTEND TO DESIGNATE AN SNT AS BENEFICIARY FOR THE CHILD OR CHILDREN DESIGNATED AS DISABLED IN BLOCK 32.

(It is your responsibility to separately submit a written statement of the decision to have the annuity paid to the SNT, an attorney’s certification of that SNT, and the name and tax identification number for the SNT)

37.INSURABLE INTEREST BENEFICIARY (See instructions prior to completing this section - DO NOT complete if you have an ELIGIBLE SPOUSE or FORMER SPOUSE)

a. NAME (Last, First, Middle Initial)

b. SSN

c. DATE OF BIRTH |

d. RELATIONSHIP |

|

(YYYYMMDD) |

||

|

e. STREET (Include apartment number)

f. CITY

g. STATE h. ZIP CODE

i. TELEPHONE (Incl. area code)

j. EMAIL ADDRESS

38.FORMER SPOUSE INFORMATION (Complete only if you have a former spouse)

a. NAME (Last, First, Middle Initial) |

b. SSN |

c. DATE OF BIRTH |

d. DATE OF DIVORCE |

|

(YYYYMMDD) |

(YYYYMMDD) |

|||

|

|

|||

|

|

|

|

e. TELEPHONE (Incl. area code)

f. EMAIL ADDRESS

PART IV – CERTIFICATION

SECTION XI - CERTIFICATION

39. MEMBER

Under penalties of perjury, I certify that the number of withholding exemptions claimed does not exceed the number to which I am entitled, and that all statements on this form are made with full knowledge of the penalties for making false statements (18 U.S.C. §287 and §1001) provide for a penalty of not more than $10,000 fine, or 5 years in prison, or both). Also, I understand that if I elected less than full SBP coverage for my spouse, I will need my spouse’s notarized concurrence signed no earlier than the date of my signature and prior to the date of my retirement; otherwise, by law, I will automatically be covered at the maximum spouse coverage.

a. NAME (Last, First, Middle Initial)

b. SIGNATURE

c. DATE SIGNED(YYYYMMDD)

40. WITNESS

a. NAME (Last, First, Middle Initial) |

b. SIGNATURE |

c. DATE SIGNED(YYYYMMDD) |

d. UNIT OR ORGANIZATION ADDRESS (Include room number)

e. CITY/BASE OR POST

f. STATE g. ZIP CODE

PART V – SPOUSE SBP CONCURRENCE

Required ONLY when the member is married and elects either: (a) child only SBP coverage, (b) does not elect full spouse SBP coverage; or (c) declines SBP coverage. The date of the spouse's signature in Block 41c MUST NOT be before the date of the member's signature in Block 39c, or on or after the date of retirement listed in Part I, Section I, Block 4. The spouse's signature MUST be notarized.

SECTION XII - SBP SPOUSE CONCURRENCE

41. SPOUSE

I hereby concur with the Survivor Benefit Plan election made by my spouse. I have received information that explains the options available and the effects of those options. I know that retired pay stops on the day the retiree dies. I have signed this statement of my free will.

a. NAME (Last, First, Middle Initial) |

|

|

b. SIGNATURE |

c. DATE SIGNED(YYYYMMDD) |

|

|

|

|

|

|

|

42. NOTARY WITNESS |

|

|

|

|

|

|

|

|

|

|

|

On this |

day of |

, 20 |

, before me, the undersigned notary public, personally |

|

|

appeared (Name of Spouse in Block 41a.)

provided to me through satisfactory evidence of identification, which were |

, |

to be the person whose name is signed in block 41.a. of this document in my presence.

Signature of Notary |

|

My Commission Expires |

NOTARY SEAL |

DD FORM 2656, OCT 2018

PREVIOUS EDITION IS OBSOLETE. |

Page 5 of 5 |

AEM LiveCycle Designer |

INSTRUCTIONS

GENERAL

1.Read these instructions and Privacy Act Statement carefully before completing the data form.

2.The Defense Finance and Accounting Service

3.Ensure that you promptly advise

4.If completed electronically, this form automatically disables certain fields based on information you entered. If one of the items listed below does not appear on the form, it is due to information you previously entered that indicates this item is not applicable to you.

PART I - RETIRED PAY INFORMATION

SECTION I - PAY IDENTIFICATION.

ITEMS 1 through 3.

ITEM 4. If you are retiring from active duty, enter the date you will transfer to the Fleet Reserve or date of retirement. If you are a Reserve/National Guard member qualified to retire under 10 U.S. Code, Chapter 1223, enter either the date of your 60th birthday or, a later date on which you desire to begin receiving retired pay. If you are eligible for reduced age retirement earlier than your 60th birthday, you will need to enter that date.

ITEMS 5 and 6.

ITEM 7. Indicate whether you are (or were) a member of the Active Component (Regular Component) or a member of the Reserve Component. The Reserve Component includes all reserve and National Guard members, including

ITEM 8. Indicate which retirement plan covers you:

If your Date of Initial Entry into Military Service (DIEMS) is prior to September 8, 1980, you should enter “Final Pay” UNLESS you elected to opt into the Blended Retirement System.

If your DIEMS is on or after September 8, 1980, but before January 1, 2018, you should enter

If your DIEMS is on or after August 1, 1986, AND you elected to receive the Career Status Bonus (CSB) upon completion of 15 years of service, you should enter “CSB/REDUX.”

If you elected to opt into the Blended Retirement System, OR your DIEMS is on or after January 1, 2018, you should enter “Blended Retirement System.”

If you are retiring with a disability retirement, regardless of your DIEMS enter “Disability.”

ITEM 9.

SECTION II - DIRECT DEPOSIT/ELECTRONIC FUND TRANSFER INFORMATION.

ITEMS 10 through 13. Enter the routing and account information for your bank or financial institution. Indicate whether your account is (S) for Savings or

(C)for Checking account in Item 10. Also, provide the nine digit Routing Transit Number (RTN) of your financial institution in Item 11, your account number in Item 12, and your financial institution name and address in Item 13. This section must be completed. Your net retired/retainer pay must be sent to your financial institution by direct deposit/electronic fund transfer (DD/EFT).

ACTIVE COMPONENT RETIREES ONLY: If you are directing your retired pay to the same account number and financial institution to which you directed your active duty pay, check the box immediately below “Section II”. If you have a copy of the Direct Deposit Authorization form used to establish your DD/EFT for your active duty pay, attach a copy to this form.

SECTION III - SEPARATION PAYMENT INFORMATION.

ITEM 14. Indicate in 14.a if you previously received separation or severance pay. If you mark one of the boxes in 14.a, complete 14.b by entering the gross amount for Severance, Separation and Special Separation Bonus payments and the annual installment gross amount for Voluntary Separation Incentive payments. Attach a copy of the orders that authorized the payment and a copy of previous DD Form 214.

SECTION IV - VA DISABILITY COMPENSATION.

ITEM 15. All retirees must read and acknowledge Item 15.a. Note that if you later apply for and are awarded VA disability compensation, you must notify DFAS of the amount of the award. Indicate in Item 15.b if you are currently, or have previously, received VA disability compensation. If you mark YES in 15.b, complete 15.c, and 15.d.

SECTION V - DESIGNATION OF BENEFICIARIES FOR UNPAID RETIRED PAY.

ITEM 16. Upon your death, 10 U.S.C. §2771 provides that any pay due and unpaid will be paid to the surviving person highest on the following list: (1) beneficiary(ies) designated in writing; (2) your spouse; (3) your children and their descendants, by representation; (4) your parents in equal parts, or if either is dead, the survivor; (5) the legal representative of your estate, and (6) person(s) entitled under the law of your domicile. You may choose to designate your spouse as the primary beneficiary for 100% of your unpaid retired pay by checking the box directly below “Section V” and leaving blocks 16.a through 16.e blank. If you choose to designate a different beneficiary or beneficiaries, you must complete Items 16.a through 16.e. If you designate multiple beneficiaries, you can either provide a SHARE percentage to be paid to each person or leave the SHARE percentage blank. If you leave the SHARE percentage blank, any retired pay you are owed when you die will be divided equally among your designated beneficiaries. If you list more than one person with a 100% SHARE, the beneficiaries will be paid in the order as you list them on the form. If, for example, you designate two beneficiaries, then the SHARE percentage must either be 100% for each beneficiary, or the SHARE percentages when added together must equal 100%. If you designate more than one person, and the total percentage designated is greater than 100%, the person listed first is considered the primary beneficiary. If you check the box designating your spouse as 100% beneficiary, that election will take precedence over any designation made in Item 16a through 16e.

If you do not designate a beneficiary or beneficiaries in Item 16, or all designated beneficiaries have died before the date of your death, any unpaid retired pay will be paid to the living person or persons in the highest category of beneficiary listed above, as required by law.

SECTION VI - FEDERAL INCOME TAX WITHHOLDING INFORMATION. Complete this section after determining your allowed exemptions with the aid of your disbursing/finance office, or from the instructions available on IRS Form

ITEM 17. Mark the status you desire to claim.

DD FORM 2656 INSTRUCTIONS, OCT 2018 |

Page 1 of 3 |

PREVIOUS EDITION IS OBSOLETE. |

AEM LiveCycle Designer |

ITEM 18. Enter the number of exemptions claimed. |

|

PART III - SURVIVOR BENEFIT PLAN. |

|

||

ITEM 19. Enter the dollar amount of additional Federal income tax you desire |

It is very important that you are counseled and are fully aware of your options |

||||

under the Survivor Benefit Plan (SBP). SBP pays your eligible beneficiary or |

|||||

withheld from each month's pay. Leave blank if you do not desire additional |

beneficiaries an |

||||

withholding. |

|

|

|||

|

|

event of your death. The cost of SBP is subsidized by the government, but you |

|||

ITEM 20. Enter the word "EXEMPT" in this item only if you meet all the |

will be required to pay a portion of the cost of SBP through deductions from |

||||

your retired pay. All retiring active duty members and all members of the |

|||||

following criteria: (1) you had no Federal income tax liability in the prior year; |

Reserves / National Guard who complete 20 qualifying years of service are |

||||

(2) you anticipate no Federal income tax liability this year; and (3) you therefore |

|||||

automatically fully covered under the SBP or the Reserve Component SBP |

|||||

desire no Federal income tax to be withheld from your retired/retainer pay. |

|||||

NOTE: You must file a new exemption claim form with DFAS - Cleveland by |

|||||

special requirements for reducing or declining coverage that are covered in |

|||||

February 15th of each year for which you claim exemption from withholding. |

|||||

Part III. |

|

||||

|

|

|

|

||

ITEM 21. If you are not a U.S. citizen, provide, on an additional sheet, a list of |

SECTION IX - DEPENDENCY INFORMATION. |

|

|||

all periods of ACTIVE DUTY served in the continental U.S., Alaska, and |

|

||||

|

|

||||

Hawaii. Indicate periods of service by year and month only. List only service at |

ITEM 29. Provide your spouse's name, SSN, and date of birth. If no current |

||||

shore activities; do not report service aboard a ship. |

|

||||

|

spouse, enter "N/A" and proceed to Item 32. |

|

|||

|

|

|

|

||

For example: |

DUTY STATION |

TO (Year/Month) |

ITEMS 30 and 31. Enter the date and location of your marriage to your current |

||

FROM (Year/Month) |

spouse. In Item 30, if marriage occurred outside the United States, include city, |

||||

1994/02 |

NAVSTA, Norfolk, VA |

1995/01 |

|||

province, and name of country. |

|

||||

|

|

|

|

||

NOTE: This information may affect the portion of retired/retainer pay which is |

ITEM 32. If you do not have dependent children, enter "N/A" in this item. If you |

||||

taxable in accordance with the Internal Revenue Code if you maintain a |

|||||

do have dependent children, provide the requested information. Designate |

|||||

permanent residence outside the U.S., Alaska, or Hawaii. |

|

||||

|

which children resulted from marriage to a former spouse, if any, by indicating |

||||

SECTION VII - VOLUNTARY STATE TAX WITHHOLDING. |

|

(FS) after the relationship in Item 32.d. |

|

||

|

|

|

|||

Complete this section only if you want monthly state tax withholding. If you |

ITEM 32.e. Enter YES or NO as appropriate. A disabled child is an unmarried |

||||

choose not to have a monthly deduction, you remain liable for state taxes, if |

|||||

child who meets one of the following conditions: a child who has become |

|||||

applicable. |

|

|

|||

|

|

incapable of |

|||

ITEM 22. Enter the name of the state for which you desire state tax withheld. |

incapable of |

||||

student. If answering yes, attach documentation. |

|

||||

ITEM 23. Enter the dollar amount you want deducted from your monthly retired/ |

SECTION X - SURVIVOR BENEFIT PLAN (SBP) ELECTION. |

||||

retainer pay. This amount must not be less than $10.00 and in whole dollars |

In this section, you will be able to indicate your desired SBP election and |

||||

(Example: $50.00, not $50.25). |

|

||||

|

designate the beneficiary for SBP in the event of your death. If you make no |

||||

ITEM 24. Enter only if different from the address in Item 9. |

|

election, you will automatically receive maximum coverage for all eligible family |

|||

|

members (spouse and/or children). If you elect to reduce or decline your |

||||

PART II - LUMP SUM ELECTION. |

|

coverage, your spouse will have to concur with that decision. You may |

|||

|

discontinue your SBP participation within one year after the second |

||||

OPTIONAL. Only complete Part II if you are: |

|

anniversary of the commencement of retired/retainer pay. Termination of SBP |

|||

|

is effective the first of the month after |

||||

Covered under the Blended Retirement System; AND, |

|

disenrollment request. There will be no refund of SBP costs paid for the period |

|||

Want to elect a partial lump sum of retired pay |

|

||||

|

before the SBP disenrollment. You are advised to consult with a SBP |

||||

If you are not covered under the Blended Retirement System or do NOT want |

Counselor or Retirement Services Officer prior to completing this section. |

||||

|

|

||||

to elect a partial lump sum, proceed to PART III of the form. |

|

ITEM 33. RESERVE COMPONENT ONLY. Information to complete this |

|||

SECTION VIII - BLENDED RETIREMENT SYSTEM LUMP SUM ELECTION. |

section can be found on the DD Form |

||||

first notified that you had completed 20 years of creditable service, known as |

|||||

ITEM 25. Indicate in Item 25.a OR 25.b whether you intend to receive a 25 |

your “Notification of Eligibility.” Reserve or National Guard members who |

||||

previously completed 20 qualifying years of service are automatically covered |

|||||

percent or 50 percent lump sum of retired pay. |

|

under the |

|||

ITEM 26. If indicating in Item 25.a or 25.b that you desire to receive a lump |

of Eligibility, to decline this coverage. Indicate in Item 33.a., 33.b., or 33.c. your |

||||

previous election. If you elected immediate coverage (Item 33.c, or “Option |

|||||

sum of retired pay, indicate in 26.a through 26.d whether you would like that in |

C”), elected coverage to begin at age 60 (Item 33.b, or “Option B”) or made no |

||||

one payment or a series of equal, annual installments over 2, 3, or 4 years. |

election previously, this remains your coverage and cannot be changed. |

||||

ITEM 27. Before signing in Item 28, you must read the considerations listed in |

However, Reserve/National Guard members who declined to make an election |

||||

until reaching the age of eligibility to receive retired pay (Item 33.a, or “Option |

|||||

Item 27. You are highly encouraged to review your options with a financial |

A”), or who were unmarried and had no eligible children at initial |

||||

professional and compare your estimated retirement benefits with or without a |

|||||

election and made no subsequent |

|||||

lump sum using the online calculator located at |

|

and 35 (and Items 36 through 38 if applicable). If you elected either Immediate |

|||

http://militarypay.defense.gov/calculators/BRS. |

|

||||

|

(Option C) or Deferred (Option B) |

||||

ITEM 28. If you mark Items 25 and Items 26, you must sign in the block at |

beneficiary is no longer eligible, provide supporting documentation with this |

||||

form. |

|

||||

28.a, and indicate the date you are signing in 28.b. The date in 28.b must be |

|

|

|||

at least 90 days prior to the date of your retirement or the date you transfer to |

ITEM 34. Enter your desired coverage in Items 34.a through 34.g. You may |

||||

the Fleet Reserve (shown in Item 4, this is also the same date indicated on |

only select one item. If you elect 34.a, 34.c, or 34.g, you MUST also indicate |

||||

your DD 108 request for retirement). If you are a Reserve/National Guard |

|||||

whether you are declining coverage for other eligible dependents. |

|||||

member qualified to receive retired pay with a |

|||||

|

|

||||

in 28.b must be 90 days prior to the date upon which you will be eligible to |

|

|

|||

begin receiving retired pay (shown in Item 4, this is also the same date |

|

|

|||

indicated on your DD 108 request for retirement). |

|

|

|

||

If you are NOT electing a lump sum of retired pay, DO NOT SIGN Item 28. |

|

|

|||

|

|

|

|

||

DD FORM 2656 INSTRUCTIONS, OCT 2018 |

PREVIOUS EDITION IS OBSOLETE. |

Page 2 of 3 |

|||

|

|

AEM LiveCycle Designer |

|||

ITEM 34.d. Mark if you are not married and desire coverage for a person with an insurable interest in you, and provide the requested information about that person in Item 37. An election of this type must be based on your full gross retired/retainer pay. If the person is a

ITEMS 34.e and 34.f. Mark Item 34.e if you elect coverage for a former spouse. Mark Item 34.f if you desire coverage for a former spouse and dependent child(ren) of that marriage, and provide the requested information about these children in Item 32 as appropriate. Provide a certified photocopy of final decree that includes separation agreement or property settlement which discusses SBP for former spouse coverage. The DD Form

ITEM 34.g. Mark if you decline coverage under SBP. If married and declining coverage, Items 41 and 42 of Part V, Section XI MUST be completed.

ITEM 35. This item allows you to designate the amount of your retired pay that will be the “base amount” for determining your SBP premiums and the resulting SBP annuity. If you make no entry, you will default to the full base amount.

ITEM 35.a. Mark if you desire the coverage to be based on your full gross retired/retainer pay. For members who previously elected the Career Status Bonus (CSB) or members covered by the Blended Retirement System who elect a lump sum of retired pay, the full gross retired/retainer pay is what your retired pay would have been had you not elected (CSB) or the lump sum.

ITEM 35.b. Mark if you desire the coverage to be based on a reduced portion of your retired/retainer pay. This reduced amount may not be less than $300.00. If your gross retired/retainer pay is less than $300.00, the full gross pay is automatically used as the base amount. Enter the desired amount in the space provided to the right of this item.

ITEM 35.c. Used by a REDUX member who wants coverage based on actual retired pay received under REDUX. If this option is selected, proceed to Section XII, if married.

ITEM 35.d. Mark if you desire the higher threshold amount in effect on the date of your retirement to be used as your base amount.

ITEM 36. You may elect payment of the SBP benefit, for beneficiary categories designated in Items 34.b, 34.c, or 34.f, to a special needs trust (SNT) who meets the criteria of a disabled child for SBP, and is indicated as such in Item 32.e of these instructions. You must provide to

ITEM 37. Enter the information for insurable interest beneficiary. See instruction for Item 34.e

ITEM 38. Enter the information for your former spouse, if applicable.

PART IV - CERTIFICATION.

SECTION XI - CERTIFICATION

ITEM 39. Read the statement carefully, then sign your name and indicate the date of signature. For your SBP election to be valid, you must sign and date the form prior to the effective date of your retirement/transfer, or the date you are eligible to begin receiving retired pay. (Note: if you elected a lump sum of retired pay in Part II, this form must be signed and dated no later than 90 days prior to your retirement/transfer date, or the date you are eligible to begin receiving retired pay).

ITEM 40. A witness to your signature must also sign and provide their information in Items 40.a through 40.g. A witness cannot be named as beneficiary in Sections V, IX or X.

PART V - SPOUSE SBP CONCURRENCE

SECTION XII - SBP SPOUSE CONCURRENCE.

Completion of this section is required only in certain circumstances if you declined to elect SBP coverage, elected less than the maximum coverage, or elected

ITEM 41. 10 U.S.C. §1448 requires that an otherwise eligible spouse concur if the member declines to elect SBP coverage, elects less than maximum coverage, or elects

ITEM 42. A Notary Public must witness the signature of the spouse in Item 41. This witness cannot be a named beneficiary in Section V, IX, or X. The spouse's concurrence must be obtained and dated on or after the date of the member's election, but before the retirement / transfer date. If concurrence is not obtained when required, maximum coverage will be established for your spouse and child(ren) if appropriate.

DD FORM 2656 INSTRUCTIONS, OCT 2018 |

Page 3 of 3 |

PREVIOUS EDITION IS OBSOLETE. |

AEM LiveCycle Designer |

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The DD 2656 form is used to designate beneficiaries for retirement benefits and to provide information for the payment of those benefits. |

| Eligibility | Active duty and retired members of the Armed Forces can use the DD 2656 form to designate beneficiaries. |

| Submission Process | The completed DD 2656 form must be submitted to the appropriate military finance office. |

| Updates | Beneficiaries can be updated at any time by submitting a new DD 2656 form. |

| Governing Law | The form is governed by the Department of Defense regulations and policies regarding military benefits. |

| State-Specific Forms | Some states may have additional requirements for beneficiary designations, which can vary based on local laws. |

| Required Information | Members must provide personal information, including social security numbers, to complete the form. |

| Impact on Benefits | The designated beneficiaries will receive benefits upon the member's death, as specified in the form. |

| Importance of Accuracy | Accurate completion of the form is crucial to ensure that benefits are distributed according to the member's wishes. |

| Additional Resources | Members can access guidance and resources through their military branch's official website or finance office. |

DD 2656 - Usage Guidelines

Filling out the DD 2656 form is an important step in managing your benefits. Once you have completed the form, it will need to be submitted to the appropriate office for processing. Make sure to double-check your information for accuracy before sending it off.

- Begin by downloading the DD 2656 form from the official military website or obtaining a hard copy from your local military office.

- Read through the instructions carefully to understand what information is required.

- Fill out your personal information in Section I, including your name, Social Security number, and contact details.

- In Section II, indicate your marital status and provide details about your spouse, if applicable.

- Complete Section III by providing information about your dependents, including their names, birth dates, and relationship to you.

- Section IV requires you to provide your service information, such as your branch of service and dates of active duty.

- In Section V, you will need to select your desired payment options and any additional benefits you wish to enroll in.

- Review all the information you have entered to ensure it is accurate and complete.

- Sign and date the form at the designated areas.

- Submit the completed form according to the instructions provided, either by mail or electronically, as specified.

Common PDF Forms

What Is a Nda Used for - The Non-Circumvention clause prohibits bypassing the introducing party to secure a deal directly with their contacts.

To establish a clear framework for your LLC, understanding the importance of an effective document is crucial. For guidance, explore our resource on the vital components of an Operating Agreement template and guidelines that can help streamline your company’s operations.

Hazmat Bol Requirements - Lists consequences for inaccurate information provided by shippers.

Hvac Job Application - List manufacturers of HVAC equipment you have worked with during your career.

Dos and Don'ts

When filling out the DD 2656 form, it's essential to approach the task with care to ensure accuracy and compliance. Here’s a helpful list of things you should and shouldn't do:

- Do read the instructions carefully before starting the form.

- Do provide accurate and up-to-date information.

- Do double-check all entries for any typographical errors.

- Do ensure that all required signatures are included.

- Don't leave any mandatory fields blank.

- Don't use correction fluid or tape on the form.

- Don't submit the form without making a copy for your records.

Following these guidelines can help streamline the process and prevent potential delays in processing your form.

Common mistakes

-

Inaccurate Personal Information: Many individuals fail to provide accurate personal details, such as their full name, Social Security number, or date of birth. This can lead to significant delays in processing.

-

Incomplete Sections: Some people overlook sections of the form, leaving them blank. Each section is important, and missing information can result in the rejection of the application.

-

Incorrect Signature: It’s crucial to ensure that the form is signed correctly. A signature that does not match the name on the form can raise red flags and cause complications.

-

Failure to Review Before Submission: Rushing through the form can lead to mistakes. Taking the time to review all entries before submission can help catch errors that might otherwise go unnoticed.

-

Not Keeping a Copy: After submitting the form, some individuals forget to keep a copy for their records. This can be problematic if there are questions or issues that arise later.