Fill in a Valid Citibank Direct Deposit Form

Document Sample

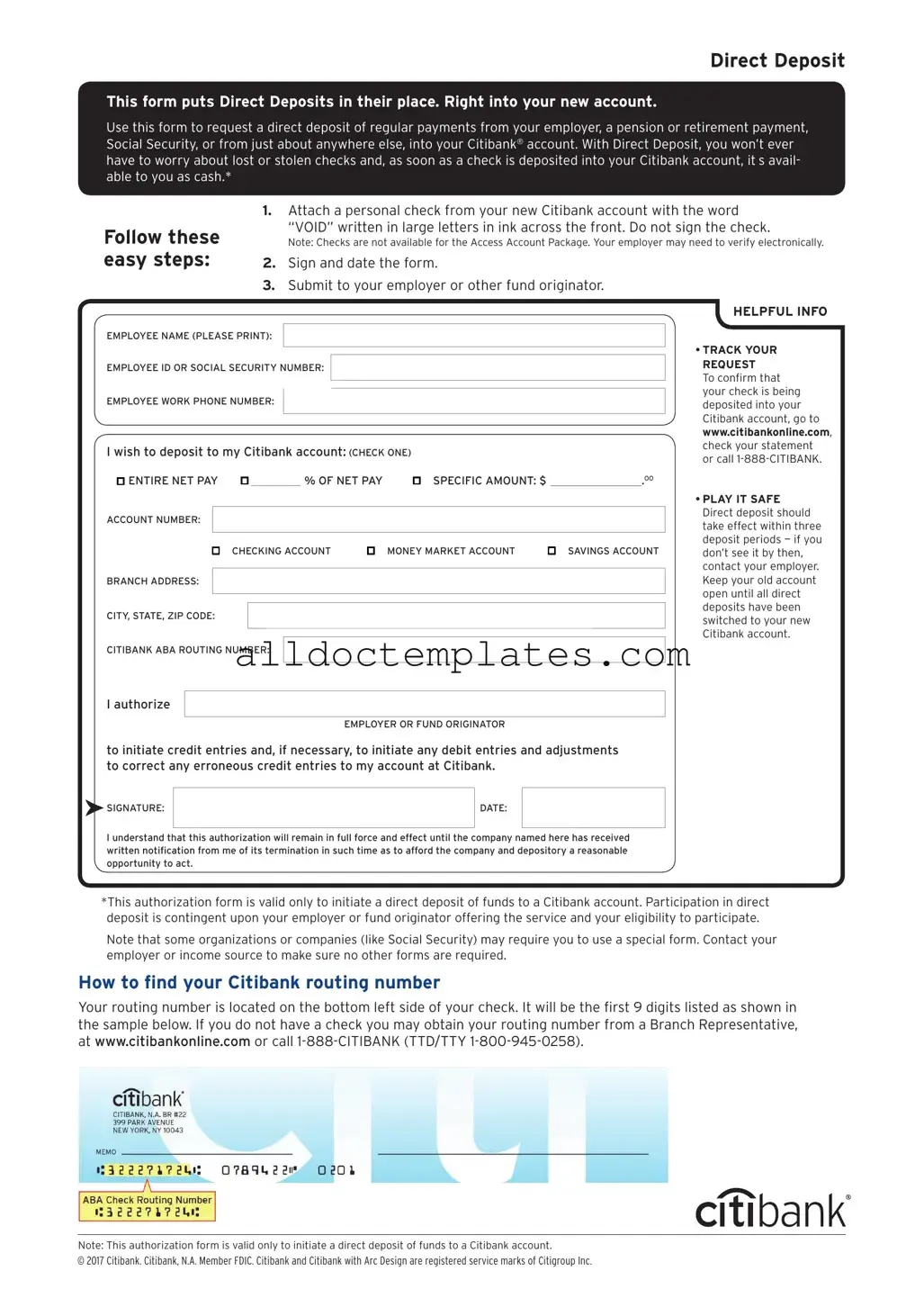

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

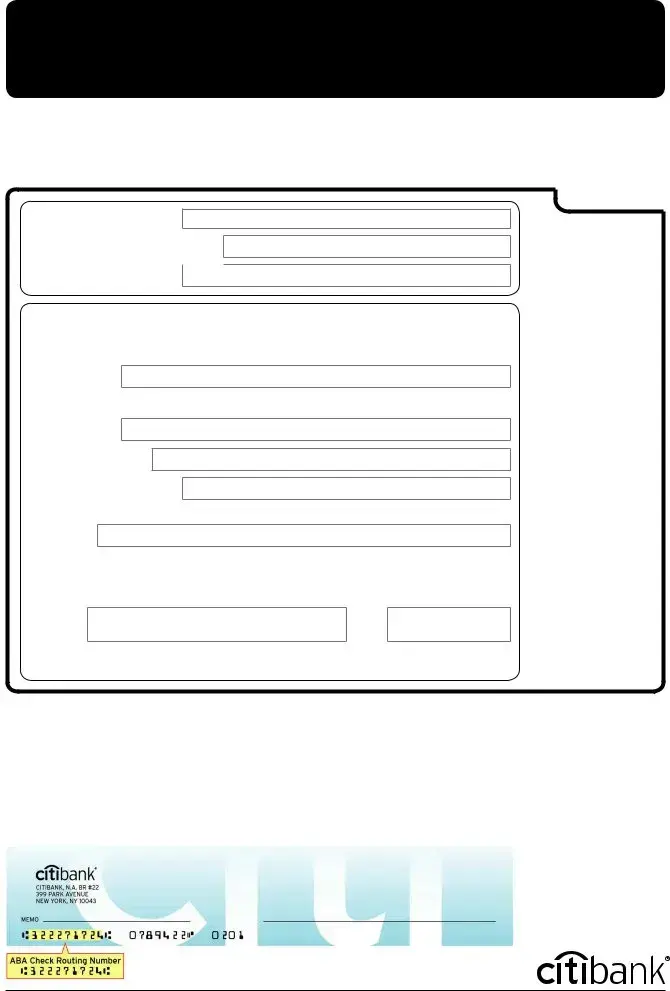

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form is used to authorize direct deposit of funds into a Citibank account. |

| Eligibility | Individuals and businesses can use the form to set up direct deposits for payroll, government benefits, or other payments. |

| Governing Law | The form is subject to federal regulations, particularly the Electronic Funds Transfer Act (EFTA), and may also be governed by state-specific laws. |

| Submission Process | Completed forms must be submitted to the payer (e.g., employer or government agency) to initiate the direct deposit process. |

Citibank Direct Deposit - Usage Guidelines

After obtaining the Citibank Direct Deposit form, you will need to provide specific information to set up your direct deposit. This process typically involves filling out your personal details and banking information accurately to ensure a smooth transaction.

- Begin by entering your name in the designated field. Make sure to use your full legal name.

- Next, provide your address. Include your street address, city, state, and ZIP code.

- In the following section, input your Social Security Number (SSN) or Tax Identification Number (TIN).

- Indicate your email address and phone number for contact purposes.

- Locate the section for bank information. Enter the name of your bank, which is Citibank.

- Fill in your bank account number. Double-check this number for accuracy.

- Specify the type of account you are using: checking or savings.

- Provide the routing number for your Citibank account. This number is essential for processing the deposit.

- Review all the information you have entered to ensure it is correct.

- Sign and date the form at the bottom to confirm that the information is accurate and that you authorize the direct deposit.

Once you have completed the form, submit it to your employer or the relevant department that handles payroll. They will process your request and set up your direct deposit accordingly.

Common PDF Forms

California Corrective Deed - The affidavit is typically relatively straightforward in its content.

When engaging in the sale of a mobile home, it is important to utilize the appropriate documentation to protect both the buyer and seller; for instance, the Colorado Mobile Home Bill of Sale serves this purpose effectively. For those looking to obtain this essential form, resources such as Colorado PDF Templates can be invaluable in providing properly formatted templates that ensure clarity and legality in the transaction.

Horse Training Agreement Template - Trainer maintains full control over training methods with an emphasis on safety and effectiveness.

Health Insurance Marketplace Statement - Maintaining accurate records and documentation can simplify the tax filing process significantly.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it’s important to ensure accuracy and completeness. Here are some helpful tips on what to do and what to avoid:

- Do double-check your account number. A small mistake can lead to delays or misdirected funds.

- Do provide your employer's information accurately. This helps in processing your direct deposit smoothly.

- Do sign and date the form. An unsigned form may be rejected, causing delays in your payments.

- Do keep a copy of the completed form. This serves as a reference in case any issues arise.

- Don't leave any required fields blank. Incomplete forms can lead to processing errors.

- Don't use a temporary account number. Always use your permanent account details to avoid complications.

- Don't forget to update your information if you change banks. Keeping your details current ensures your deposits are directed correctly.

- Don't submit the form without reviewing it first. Take a moment to check for any errors or omissions.

Common mistakes

-

Not double-checking the account number: A common mistake is entering the wrong account number. This can lead to funds being deposited into the wrong account, causing delays and confusion.

-

Forgetting to include the routing number: The routing number is essential for directing the funds to the correct bank. Omitting it can result in failed deposits.

-

Using an incorrect account type: It’s important to specify whether the account is a checking or savings account. Choosing the wrong type can prevent the deposit from going through.

-

Neglecting to sign the form: Some people overlook the requirement to sign the direct deposit form. Without a signature, the form may be considered invalid.

-

Not providing updated information: If you change banks or accounts, it’s crucial to update your direct deposit information promptly. Failing to do so can lead to missed payments.

-

Leaving fields blank: Each section of the form must be filled out completely. Blank fields can cause processing delays or rejection of the form.

-

Using illegible handwriting: If the form is not clear and easy to read, it may be misinterpreted by the bank. Always print neatly or consider typing the information.

-

Not keeping a copy: It’s wise to retain a copy of the completed form for your records. This can be helpful if any issues arise later.

-

Failing to confirm the deposit: After submitting the form, it’s important to check your account to ensure that the direct deposit has started as expected. Delays can happen, and following up can provide peace of mind.