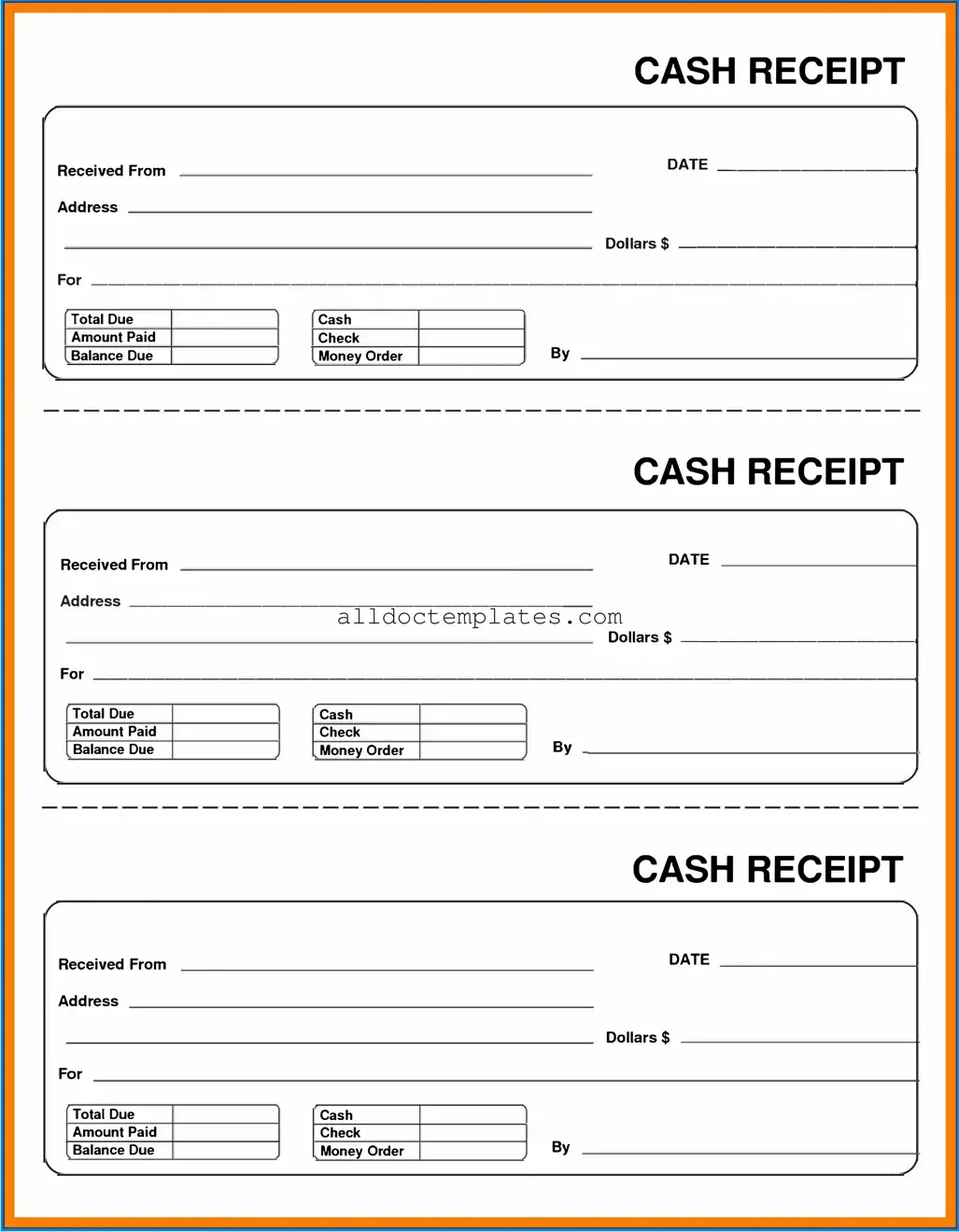

Fill in a Valid Cash Receipt Form

Document Sample

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments in various transactions. |

| Record Keeping | This form serves as an official record for both the payer and the payee, ensuring transparency in financial dealings. |

| Details Required | Typically, it includes the date of the transaction, amount received, payer's name, and purpose of payment. |

| State Variations | Some states may have specific requirements for Cash Receipt forms, governed by state laws regarding financial transactions. |

| Legal Compliance | Using this form helps organizations comply with legal and tax obligations by providing a clear record of income. |

| Audit Trail | The form contributes to an audit trail, which is essential for financial audits and reviews. |

| Storage Requirements | Organizations should securely store Cash Receipt forms for a specified period, often dictated by state or federal laws. |

| Electronic Versions | Many organizations now use electronic versions of the Cash Receipt form, which can streamline record-keeping processes. |

| Signature Requirement | Some forms may require signatures from both the payer and the receiver to validate the transaction. |

Cash Receipt - Usage Guidelines

After gathering the necessary information, you are ready to complete the Cash Receipt form. This form is essential for documenting cash transactions accurately. Follow the steps below to ensure that you fill it out correctly.

- Begin by entering the date of the transaction in the designated field.

- Next, input the name of the payer or the individual making the payment.

- In the amount received section, write the total cash amount that has been received.

- Specify the payment method used (e.g., cash, check, credit card) in the appropriate area.

- Provide a brief description of the purpose of the payment.

- Sign the form in the signature field to validate the transaction.

- Finally, keep a copy of the completed form for your records.

Common PDF Forms

Dd Form 2870 - Completing the DD 2870 ensures that health records are up to date.

A Colorado Medical Power of Attorney form is a legal document that allows an individual to designate someone else to make medical decisions on their behalf if they become unable to do so. This important tool ensures that a person's healthcare preferences are honored, even when they cannot communicate them. To assist in this process, you can find a comprehensive Medical Power of Attorney form at Colorado PDF Templates, making it easier for individuals to safeguard their medical choices.

Dos 1246 - Applicants must ensure all sections of the form are completed for a successful renewal.

Bdsm Limits Checklist - A way to celebrate what you love in BDSM.

Dos and Don'ts

When filling out a Cash Receipt form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below are ten things you should and shouldn't do:

- Do double-check all entries for accuracy.

- Do use clear and legible handwriting or type the information.

- Do include the date of the transaction.

- Do specify the amount received in both numbers and words.

- Do sign the form to validate the receipt.

- Don't leave any required fields blank.

- Don't use correction fluid or tape on the form.

- Don't provide vague descriptions of the payment.

- Don't forget to keep a copy for your records.

- Don't submit the form without a supervisor's review if required.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Leaving out essential details like the date, amount, or payer's information can lead to confusion and delays in processing.

-

Incorrect Amounts: Double-checking the amounts entered is crucial. Errors in the total can result in financial discrepancies, which may require additional time and effort to resolve.

-

Improper Documentation: Supporting documentation should always accompany the Cash Receipt form. Not attaching receipts or invoices can create problems during audits or reconciliations.

-

Neglecting Signatures: Signatures are often required to validate the transaction. Failing to obtain the necessary approvals can render the receipt invalid and complicate record-keeping.

-

Using Outdated Forms: Ensure that the most current version of the Cash Receipt form is used. Using an outdated form can lead to compliance issues and errors in processing.