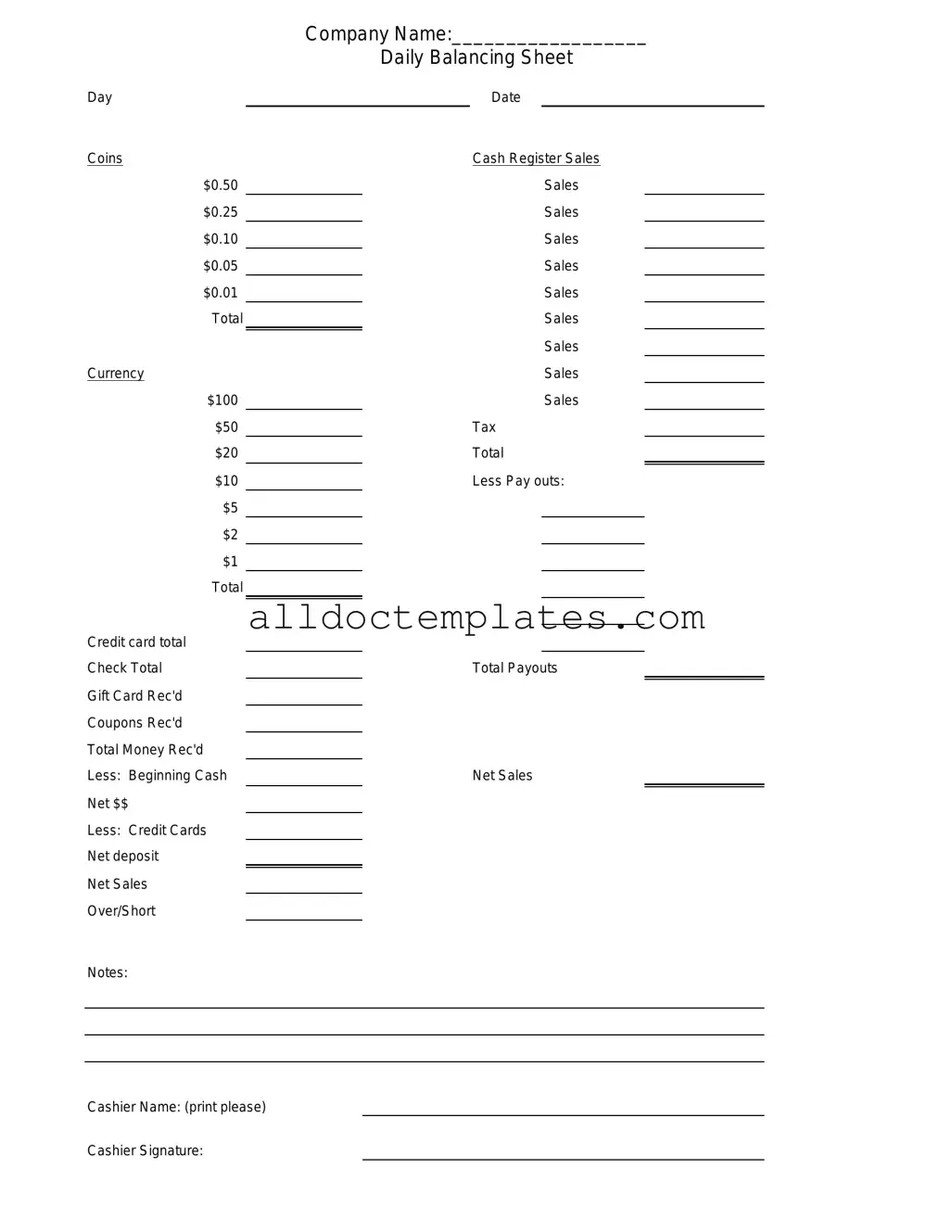

Fill in a Valid Cash Drawer Count Sheet Form

Document Sample

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to track the cash in a register at the end of a shift or business day. |

| Importance | It helps ensure that the amount of cash in the drawer matches the sales recorded, aiding in loss prevention. |

| Frequency of Use | This form is typically used daily or at the end of each cash handling period. |

| Governing Law | While there is no specific federal law governing cash drawer count sheets, businesses must comply with general accounting and tax regulations. |

Cash Drawer Count Sheet - Usage Guidelines

After gathering the necessary information, you will be ready to complete the Cash Drawer Count Sheet form. This document will help you accurately record the cash in your drawer, ensuring that all amounts are accounted for. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form.

- In the designated section, write down your name or the name of the person responsible for the cash drawer.

- List the starting cash amount in the appropriate box. This is the amount you expect to have at the beginning of your shift.

- Count the cash in the drawer. Separate bills and coins for clarity.

- Record the total amount of cash counted in the designated area. Make sure to double-check your math.

- If applicable, note any discrepancies between the expected starting amount and the counted amount.

- Sign and date the form at the bottom to verify that the information is accurate.

Once you have completed the Cash Drawer Count Sheet form, it should be submitted to the appropriate supervisor or manager for review. This will ensure proper record-keeping and accountability for cash handling.

Common PDF Forms

Netspend Withdrawal Limit - Monitoring your accounts can help prevent future disputes from arising.

The use of a Colorado Horse Bill of Sale form is crucial for ensuring a clear and legally binding transfer of ownership. This document not only articulates the terms of the sale but also protects the interests of both parties involved. For those looking to facilitate this process smoothly, resources such as Colorado PDF Templates provide valuable templates that can simplify the documentation needed for this important transaction.

1099 Nec Fillable Form - If the total for sales of consumer products exceeds $5,000, check Box 2.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, attention to detail is crucial. Here are some guidelines to follow to ensure accuracy and compliance.

- Do double-check the cash amount before recording it on the form.

- Do use a pen with black or blue ink to fill out the form for clarity.

- Do ensure that all sections of the form are completed before submission.

- Do keep the form in a secure location until it is submitted to prevent tampering.

- Do record any discrepancies immediately and report them to a supervisor.

- Don't use pencil or any erasable ink when filling out the form.

- Don't leave any sections blank; this can lead to confusion and errors.

- Don't ignore the importance of legibility; your handwriting should be clear.

- Don't forget to date and sign the form after completing it.

- Don't submit the form without reviewing it for accuracy first.

By adhering to these dos and don’ts, you can contribute to a more efficient cash management process.

Common mistakes

Filling out the Cash Drawer Count Sheet form can be straightforward, but mistakes can happen. Here are eight common errors to watch out for:

-

Missing Signatures:

Not signing the form can lead to confusion about who completed the count.

-

Incorrect Dates:

Writing the wrong date can cause discrepancies in records and audits.

-

Inaccurate Cash Amounts:

Double-check the cash totals. Simple math errors can lead to significant issues.

-

Omitting Denomination Breakdown:

Failing to list the breakdown of bills and coins can make it difficult to verify totals.

-

Not Using the Correct Form:

Ensure you have the latest version of the Cash Drawer Count Sheet. Using an outdated form can lead to errors.

-

Overlooking Change Fund Amount:

Always include the change fund amount in your total. Forgetting this can skew the final count.

-

Rushing the Process:

Taking your time is crucial. Rushing can lead to careless mistakes.

-

Not Keeping a Copy:

Failing to keep a copy of the completed form can cause issues if questions arise later.

By being mindful of these common mistakes, you can ensure that the Cash Drawer Count Sheet is filled out accurately and effectively. Attention to detail is key!