Free Transfer-on-Death Deed Document for California State

Document Sample

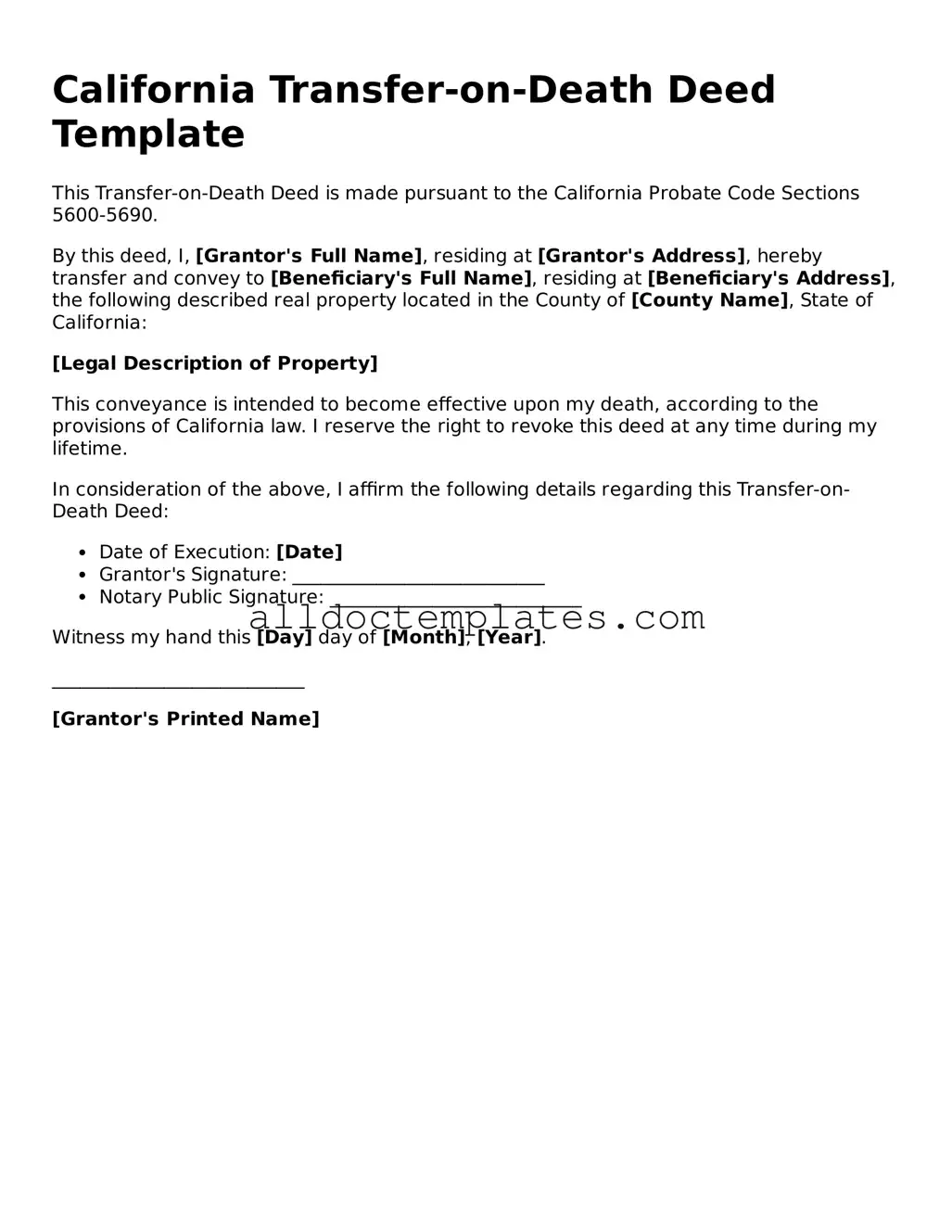

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the California Probate Code Sections 5600-5690.

By this deed, I, [Grantor's Full Name], residing at [Grantor's Address], hereby transfer and convey to [Beneficiary's Full Name], residing at [Beneficiary's Address], the following described real property located in the County of [County Name], State of California:

[Legal Description of Property]

This conveyance is intended to become effective upon my death, according to the provisions of California law. I reserve the right to revoke this deed at any time during my lifetime.

In consideration of the above, I affirm the following details regarding this Transfer-on-Death Deed:

- Date of Execution: [Date]

- Grantor's Signature: ___________________________

- Notary Public Signature: ___________________________

Witness my hand this [Day] day of [Month], [Year].

___________________________

[Grantor's Printed Name]

Form Data

| Fact Name | Description |

|---|---|

| What is a TOD Deed? | A Transfer-on-Death (TOD) deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD deed is governed by California Probate Code Section 5600-5694. |

| Eligibility | Any individual who owns real property in California can create a TOD deed. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the TOD deed. |

| No Immediate Transfer | The transfer of property does not occur until the owner passes away. |

| Revocation | A TOD deed can be revoked or changed at any time before the owner’s death. |

| Recording Requirement | The TOD deed must be recorded with the county recorder's office where the property is located. |

| Impact on Taxes | The property remains part of the owner’s estate for tax purposes until death. |

| Legal Assistance | While not required, consulting a legal professional can help ensure the TOD deed is properly executed. |

California Transfer-on-Death Deed - Usage Guidelines

After gathering the necessary information, you are ready to fill out the California Transfer-on-Death Deed form. This form allows property owners to designate a beneficiary who will receive the property upon their passing. Completing the form accurately is essential for ensuring that your wishes are honored.

- Obtain the Form: Download the California Transfer-on-Death Deed form from the official state website or acquire a physical copy from a legal stationery store.

- Fill in Your Information: Start by entering your name as the current owner of the property. Include your address and any other identifying details required.

- Describe the Property: Provide a detailed description of the property you wish to transfer. This includes the address, parcel number, and any other relevant identifiers.

- Designate a Beneficiary: Clearly state the name of the person or entity you wish to inherit the property. Make sure to include their address to avoid any confusion.

- Include Alternate Beneficiaries: If desired, you can name alternate beneficiaries. This ensures that if your primary choice cannot inherit, another will be designated.

- Sign the Form: As the property owner, sign the form in the designated area. Your signature must be notarized to validate the document.

- File the Form: Submit the completed and notarized form to the county recorder’s office where the property is located. Ensure you keep a copy for your records.

Once the form is filed, it becomes part of the public record. This step is crucial as it officially establishes your wishes regarding the transfer of the property upon your death. Be sure to inform your beneficiary about the deed and its implications to avoid any misunderstandings in the future.

Some Other Transfer-on-Death Deed State Templates

Transfer Upon Death Deed Texas - Property transferred in this way does not count as part of your estate for probate purposes.

Transfer on Death Deed Florida Form - Some may choose this deed to provide specific instructions for their property distribution.

By utilizing a Colorado Hold Harmless Agreement, individuals can safeguard themselves from potential liabilities, fostering a more secure environment for activities. For those seeking a reliable template to draft such an agreement, Colorado PDF Templates offers valuable resources to assist in the process, ensuring all parties are informed and protected.

Transfer on Death Deed Form Pennsylvania - The process of creating a Transfer-on-Death Deed is relatively simple.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, there are important steps to follow to ensure everything is done correctly. Here’s a straightforward list of dos and don’ts to guide you through the process.

- Do provide accurate information about the property, including its legal description.

- Do clearly identify the beneficiaries who will receive the property upon your passing.

- Do sign the deed in front of a notary public to ensure it is legally valid.

- Do record the deed with the county recorder’s office to make it effective.

- Don't leave out any required information, as this could invalidate the deed.

- Don't forget to check local laws or seek legal advice if you're unsure about any part of the process.

Common mistakes

-

Failing to include all required information. The form must have the names of both the transferor and the beneficiary clearly stated.

-

Not properly identifying the property. It is essential to provide a complete legal description of the property being transferred, rather than just the address.

-

Using incorrect names or spellings. Any discrepancies in names can lead to complications during the transfer process.

-

Neglecting to sign the form. The transferor must sign the deed for it to be valid; an unsigned deed is not legally effective.

-

Overlooking the requirement for notarization. The deed must be notarized to be legally binding, which is often forgotten.

-

Failing to record the deed. After completing the form, it is crucial to file it with the appropriate county office to ensure the transfer is recognized.

-

Not informing beneficiaries. It is advisable to communicate with the beneficiaries about the deed to avoid confusion later.

-

Ignoring state-specific regulations. Each state may have unique requirements regarding Transfer-on-Death Deeds, and California is no exception.

-

Assuming the deed is revocable without formal action. While a Transfer-on-Death Deed can be revoked, it must be done according to the law to avoid issues.