Free Tractor Bill of Sale Document for California State

Document Sample

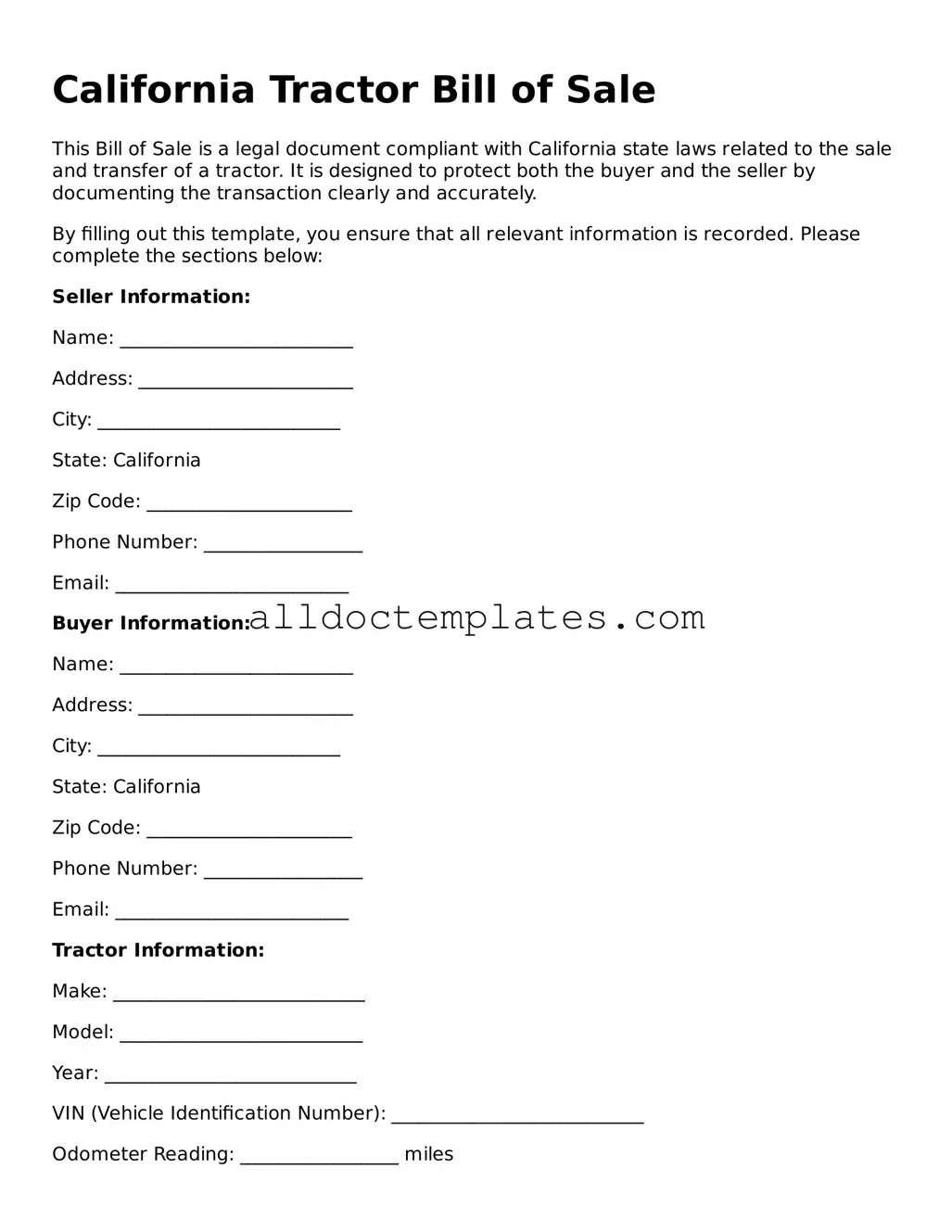

California Tractor Bill of Sale

This Bill of Sale is a legal document compliant with California state laws related to the sale and transfer of a tractor. It is designed to protect both the buyer and the seller by documenting the transaction clearly and accurately.

By filling out this template, you ensure that all relevant information is recorded. Please complete the sections below:

Seller Information:

Name: _________________________

Address: _______________________

City: __________________________

State: California

Zip Code: ______________________

Phone Number: _________________

Email: _________________________

Buyer Information:

Name: _________________________

Address: _______________________

City: __________________________

State: California

Zip Code: ______________________

Phone Number: _________________

Email: _________________________

Tractor Information:

Make: ___________________________

Model: __________________________

Year: ___________________________

VIN (Vehicle Identification Number): ___________________________

Odometer Reading: _________________ miles

Transaction Details:

Sale Price: $_____________________

Date of Sale: ______________________

Both the buyer and seller acknowledge that:

- The tractor is sold "as is", without warranties against defects.

- All information provided is accurate to the best of their knowledge.

- All applicable laws regarding the sale and transfer of the tractor will be followed.

Signatures:

Seller's Signature: ______________________ Date: ________________

Buyer's Signature: ______________________ Date: ________________

This document serves as a record of the transaction between the parties involved and may be used for registration or proof of ownership as needed.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The California Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in California. |

| Governing Law | This form is governed by California Vehicle Code Section 5901, which outlines the requirements for vehicle sales and transfers. |

| Parties Involved | The form must be filled out by both the seller and the buyer, ensuring that both parties agree to the terms of the sale. |

| Required Information | Essential details include the tractor's make, model, year, Vehicle Identification Number (VIN), and the sale price. |

| Notarization | While notarization is not required for the bill of sale, it can provide additional legal protection for both parties. |

| Record Keeping | Both the buyer and seller should keep a copy of the completed bill of sale for their records, as it serves as proof of the transaction. |

California Tractor Bill of Sale - Usage Guidelines

After gathering all necessary information, you’re ready to fill out the California Tractor Bill of Sale form. Completing this form is a straightforward process that requires specific details about the tractor and the parties involved in the sale. Follow these steps to ensure you fill it out correctly.

- Obtain the Form: Download the California Tractor Bill of Sale form from a reliable source or visit your local DMV office to get a physical copy.

- Seller Information: Fill in the seller's name, address, and contact information at the top of the form.

- Buyer Information: Enter the buyer's name, address, and contact details just below the seller's information.

- Tractor Details: Provide the tractor's make, model, year, and Vehicle Identification Number (VIN). This information is crucial for identification.

- Sale Price: Clearly state the sale price of the tractor. This should be the amount agreed upon by both parties.

- Date of Sale: Write the date when the sale is taking place. This helps establish the timeline of the transaction.

- Signatures: Both the seller and the buyer must sign the form. This indicates that both parties agree to the terms of the sale.

- Notarization (if required): Depending on your situation, you may need to have the form notarized. Check local requirements.

Once the form is completed, make sure both parties keep a copy for their records. This document serves as proof of the transaction and can be important for future reference.

Some Other Tractor Bill of Sale State Templates

Do You Need a Bill of Sale to Register a Car in Florida - Having a Bill of Sale minimizes the risk of misunderstandings between the involved parties.

In the context of mobile home transactions, it is vital to utilize the appropriate documentation to ensure clarity and legality; the https://mobilehomebillofsale.com/blank-virginia-mobile-home-bill-of-sale serves as an essential resource, providing a comprehensive template for the Virginia Mobile Home Bill of Sale form, which can significantly streamline the process of transferring ownership while protecting both parties' interests.

Bill of Sale for Farm Equipment - A straightforward form that simplifies the selling process.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it’s important to follow certain guidelines to ensure everything is completed correctly. Here’s a list of dos and don’ts to keep in mind:

- Do provide accurate information about the tractor, including make, model, year, and VIN.

- Do include the sale price clearly to avoid any misunderstandings.

- Do have both the buyer and seller sign the form to validate the transaction.

- Do keep a copy of the completed bill of sale for your records.

- Don't leave any fields blank; fill in all required information.

- Don't use white-out or any correction fluid on the form; instead, cross out mistakes and initial them.

By following these simple guidelines, you can ensure that your Tractor Bill of Sale is completed correctly and serves its purpose effectively.

Common mistakes

-

Failing to include the date of sale. This is crucial for establishing the timeline of the transaction.

-

Not providing accurate buyer and seller information. Names, addresses, and contact details must be correct to avoid future disputes.

-

Omitting the vehicle identification number (VIN). This number uniquely identifies the tractor and is essential for registration purposes.

-

Leaving out the purchase price. Clearly stating the amount helps clarify the terms of the sale.

-

Not signing the form. Both parties must sign to validate the transaction.

-

Using incorrect tractor description. The make, model, and year should be accurately listed to avoid confusion.

-

Failing to check for liens or encumbrances on the tractor. Buyers should ensure the tractor is free of any legal claims.

-

Not including odometer readings if applicable. This information can be important for future resale.

-

Neglecting to keep a copy of the completed form. Both parties should retain a copy for their records.

-

Overlooking the need for witness signatures if required. Some transactions may necessitate additional verification.