Free Promissory Note Document for California State

Document Sample

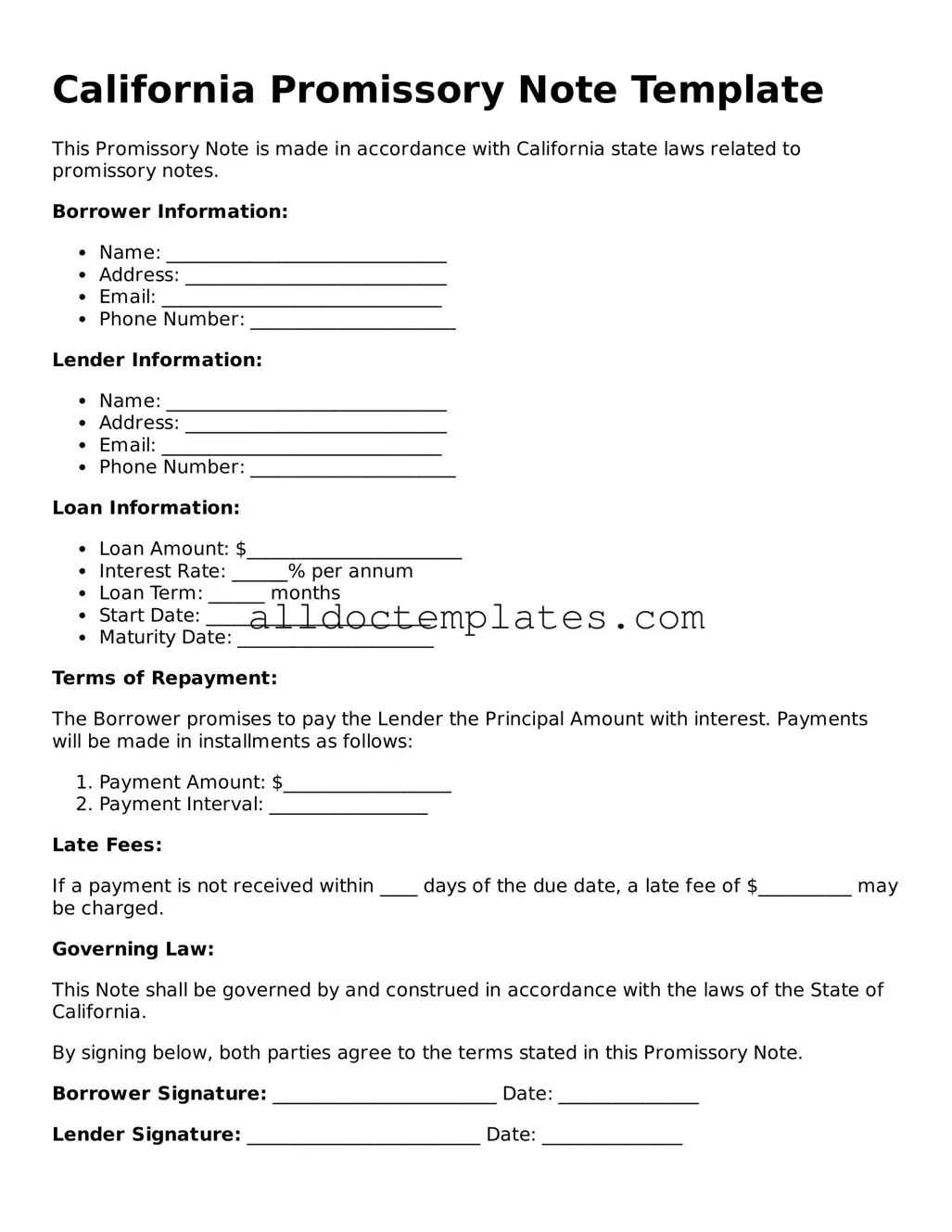

California Promissory Note Template

This Promissory Note is made in accordance with California state laws related to promissory notes.

Borrower Information:

- Name: ______________________________

- Address: ____________________________

- Email: ______________________________

- Phone Number: ______________________

Lender Information:

- Name: ______________________________

- Address: ____________________________

- Email: ______________________________

- Phone Number: ______________________

Loan Information:

- Loan Amount: $_______________________

- Interest Rate: ______% per annum

- Loan Term: ______ months

- Start Date: ________________________

- Maturity Date: _____________________

Terms of Repayment:

The Borrower promises to pay the Lender the Principal Amount with interest. Payments will be made in installments as follows:

- Payment Amount: $__________________

- Payment Interval: _________________

Late Fees:

If a payment is not received within ____ days of the due date, a late fee of $__________ may be charged.

Governing Law:

This Note shall be governed by and construed in accordance with the laws of the State of California.

By signing below, both parties agree to the terms stated in this Promissory Note.

Borrower Signature: ________________________ Date: _______________

Lender Signature: _________________________ Date: _______________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | The California Uniform Commercial Code (UCC) governs promissory notes in California. |

| Parties Involved | The note involves two parties: the borrower (maker) and the lender (payee). |

| Payment Terms | It outlines the payment amount, due date, and any interest rates applicable. |

| Signatures Required | The borrower must sign the note for it to be legally binding. |

| Interest Rates | California allows for both fixed and variable interest rates in promissory notes. |

| Default Clauses | Many notes include clauses that specify actions in the event of default. |

| Transferability | A promissory note can be transferred or sold to another party unless stated otherwise. |

| Notarization | While notarization is not mandatory, it can enhance the enforceability of the note. |

| State-Specific Requirements | California law requires specific language and disclosures for certain types of loans. |

California Promissory Note - Usage Guidelines

Completing the California Promissory Note form requires careful attention to detail. After filling out the form, the parties involved will have a clear understanding of the terms of the loan, which can help prevent misunderstandings in the future. Below are the steps to accurately fill out the form.

- Begin by entering the date at the top of the form. This date marks when the agreement takes effect.

- Identify the borrower. Write the full legal name and address of the individual or entity receiving the loan.

- Next, identify the lender. Provide the full legal name and address of the individual or entity providing the loan.

- State the principal amount of the loan in both numeric and written form. This is the total amount that the borrower agrees to repay.

- Specify the interest rate. Indicate whether the interest is fixed or variable, and include the percentage rate.

- Outline the repayment schedule. Indicate how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments. Clearly state the conditions under which these fees will apply.

- Provide any additional terms or conditions that both parties have agreed upon. This could include prepayment options or collateral details.

- Sign and date the form. Both the borrower and lender must sign the document to make it legally binding.

Some Other Promissory Note State Templates

Promissory Note for Loan - Failure to repay as promised can affect the borrower's credit rating significantly.

Free Promissory Note Template Florida - Keeping a copy of the signed note aids both parties for record-keeping purposes.

Understanding the significance of a General Power of Attorney is crucial for effective financial management. This document not only empowers your agent to act on your behalf but also ensures that your financial decisions are executed in alignment with your wishes. For further details, consider reviewing our resource on the importance of the General Power of Attorney document.

Promissory Note Template Texas - Interest rates specified in promissory notes may be fixed or variable.

How to Write a Promissory Note Example - A valid promissory note requires the date of issuance to establish the timeline for repayment.

Dos and Don'ts

When filling out the California Promissory Note form, it is essential to follow certain guidelines to ensure clarity and legality. Below are some important do's and don'ts to consider.

- Do read the entire form carefully before filling it out.

- Do provide accurate information, including names, addresses, and loan amounts.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use unclear or ambiguous language when describing the terms of the loan.

- Don't forget to have the form notarized if required.

- Don't rush through the process; take your time to ensure accuracy.

Common mistakes

-

Incorrect Borrower or Lender Information: Failing to provide accurate names and addresses can lead to confusion and potential legal issues.

-

Missing Date: Not including the date of the agreement can create ambiguity about when the terms take effect.

-

Improper Loan Amount: Listing an incorrect loan amount may cause disputes later on regarding repayment expectations.

-

Unclear Interest Rate: Not specifying whether the interest rate is fixed or variable can lead to misunderstandings about payment obligations.

-

Omitting Payment Schedule: Failing to outline the payment frequency and due dates can result in missed payments and penalties.

-

Neglecting Prepayment Terms: Not including terms for early repayment can limit options for the borrower and create frustration.

-

Not Including Default Terms: Omitting consequences for missed payments can leave both parties uncertain about their rights and responsibilities.

-

Signature Issues: Not having both parties sign the document can render the note unenforceable.

-

Failure to Keep Copies: Not retaining copies of the signed note can lead to difficulties in proving the agreement in the future.