Free Loan Agreement Document for California State

Document Sample

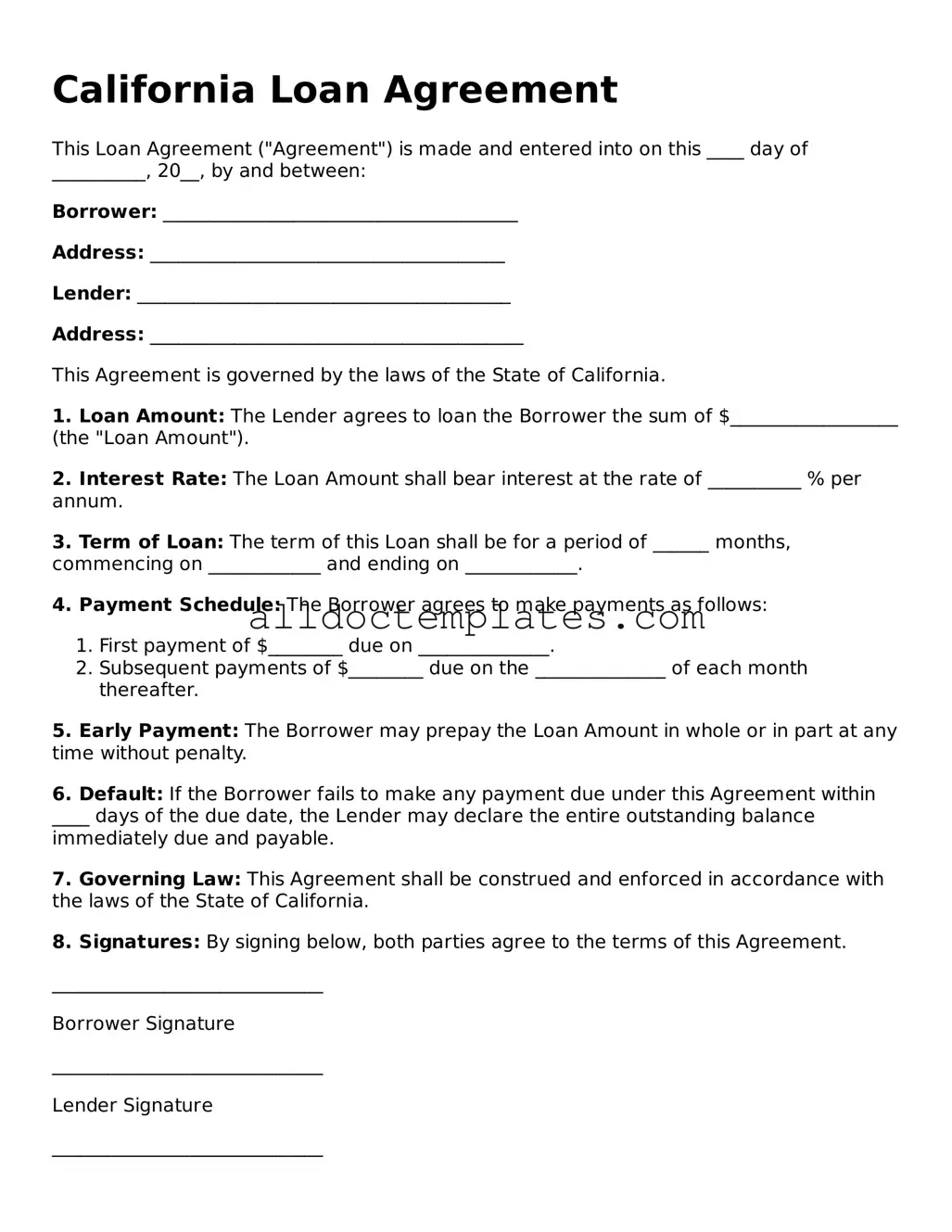

California Loan Agreement

This Loan Agreement ("Agreement") is made and entered into on this ____ day of __________, 20__, by and between:

Borrower: ______________________________________

Address: ______________________________________

Lender: ________________________________________

Address: ________________________________________

This Agreement is governed by the laws of the State of California.

1. Loan Amount: The Lender agrees to loan the Borrower the sum of $__________________ (the "Loan Amount").

2. Interest Rate: The Loan Amount shall bear interest at the rate of __________ % per annum.

3. Term of Loan: The term of this Loan shall be for a period of ______ months, commencing on ____________ and ending on ____________.

4. Payment Schedule: The Borrower agrees to make payments as follows:

- First payment of $________ due on ______________.

- Subsequent payments of $________ due on the ______________ of each month thereafter.

5. Early Payment: The Borrower may prepay the Loan Amount in whole or in part at any time without penalty.

6. Default: If the Borrower fails to make any payment due under this Agreement within ____ days of the due date, the Lender may declare the entire outstanding balance immediately due and payable.

7. Governing Law: This Agreement shall be construed and enforced in accordance with the laws of the State of California.

8. Signatures: By signing below, both parties agree to the terms of this Agreement.

_____________________________

Borrower Signature

_____________________________

Lender Signature

_____________________________

Date

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form outlines the terms and conditions under which a loan is made between a lender and a borrower. |

| Governing Law | The agreement is governed by California state laws, particularly the California Civil Code. |

| Parties Involved | The form must clearly identify the lender and the borrower, including their legal names and contact information. |

| Loan Amount | The document specifies the exact amount of money being loaned, ensuring clarity for both parties. |

| Repayment Terms | It outlines the repayment schedule, including interest rates, due dates, and any penalties for late payments. |

California Loan Agreement - Usage Guidelines

Completing the California Loan Agreement form is an important step in formalizing a loan between parties. The following steps will guide you through the process of filling out the form accurately, ensuring that all necessary information is included.

- Begin by entering the date at the top of the form. This should be the date on which the agreement is being signed.

- Identify the lender. Fill in the lender's full name, address, and contact information in the designated sections.

- Next, provide the borrower's information. Include the borrower's full name, address, and contact details.

- Specify the loan amount. Clearly state the total amount being loaned in the appropriate section.

- Indicate the interest rate. Write down the agreed-upon interest rate for the loan, ensuring it is clearly defined.

- Outline the repayment terms. Detail how and when the borrower will repay the loan, including the payment schedule and due dates.

- Include any additional terms. If there are specific conditions or agreements related to the loan, make sure to document them in this section.

- Both parties must sign the agreement. Ensure that the lender and borrower sign and date the form in the designated areas.

- Make copies of the completed agreement. Distribute copies to both the lender and borrower for their records.

Some Other Loan Agreement State Templates

Promissory Note Florida - A crucial document for maintaining financial integrity between parties.

If you're looking to understand the nuances of property transfers, our guide on how to effectively use a Quitclaim Deed can be invaluable. To learn more about this process, visit the detailed resource on our site: exploring the Quitclaim Deed options.

Promissory Note Template New York - The agreement may state that the loan is unsecured or secured by assets.

Dos and Don'ts

When filling out the California Loan Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do during this process.

- Do read the entire agreement carefully before filling it out. Understanding the terms is crucial.

- Do provide accurate and complete information. Inaccuracies can lead to complications later.

- Do sign and date the form where indicated. An unsigned agreement may not be enforceable.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Do ask questions if you are unsure about any part of the form. Clarification can prevent mistakes.

- Don't rush through the form. Taking your time helps to avoid errors.

- Don't leave any required fields blank. Missing information can delay the process.

- Don't use white-out or make alterations to the form. This can invalidate the agreement.

- Don't ignore deadlines. Submit the form on time to ensure the loan process proceeds smoothly.

- Don't assume that verbal agreements are sufficient. Everything should be documented in writing.

Common mistakes

-

Incorrect Borrower Information: Borrowers often provide inaccurate names or contact details. Double-checking this information is essential to avoid future issues.

-

Missing Loan Amount: Some individuals forget to specify the exact loan amount. This omission can lead to confusion and disputes later on.

-

Failure to Specify Interest Rate: Not including the interest rate or using an incorrect figure can result in misunderstandings about repayment terms.

-

Omitting Repayment Schedule: A clear repayment schedule is crucial. Without it, borrowers may not understand when payments are due.

-

Neglecting Signatures: Both parties must sign the agreement. Missing signatures can render the document unenforceable.

-

Ignoring State-Specific Requirements: California has specific laws regarding loan agreements. Failing to comply with these can lead to legal complications.

-

Not Including Default Terms: It is important to outline what happens in case of default. This information protects both parties and clarifies consequences.

-

Overlooking Additional Fees: Any fees associated with the loan should be clearly listed. Hidden fees can lead to disputes and dissatisfaction.