Free Gift Deed Document for California State

Document Sample

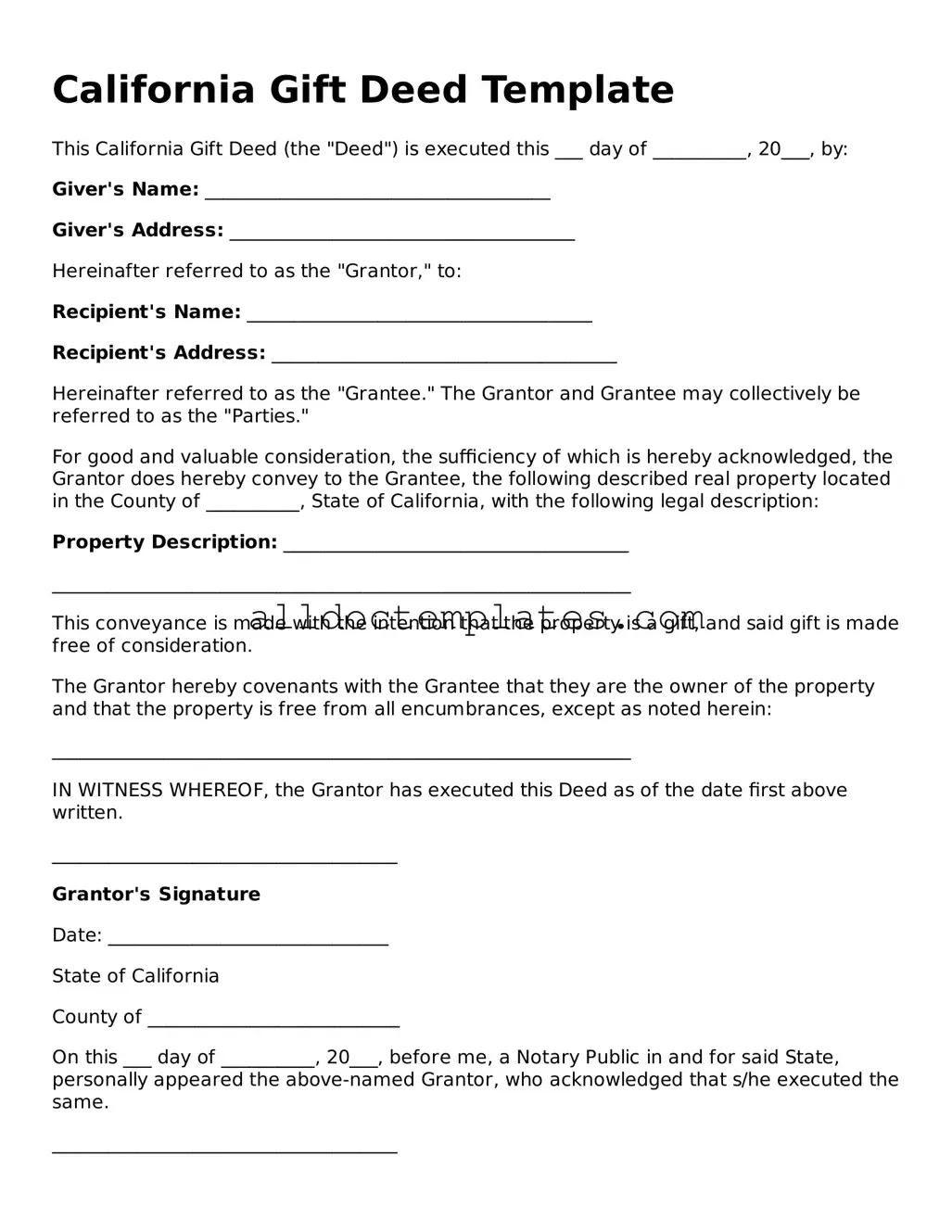

California Gift Deed Template

This California Gift Deed (the "Deed") is executed this ___ day of __________, 20___, by:

Giver's Name: _____________________________________

Giver's Address: _____________________________________

Hereinafter referred to as the "Grantor," to:

Recipient's Name: _____________________________________

Recipient's Address: _____________________________________

Hereinafter referred to as the "Grantee." The Grantor and Grantee may collectively be referred to as the "Parties."

For good and valuable consideration, the sufficiency of which is hereby acknowledged, the Grantor does hereby convey to the Grantee, the following described real property located in the County of __________, State of California, with the following legal description:

Property Description: _____________________________________

______________________________________________________________

This conveyance is made with the intention that the property is a gift, and said gift is made free of consideration.

The Grantor hereby covenants with the Grantee that they are the owner of the property and that the property is free from all encumbrances, except as noted herein:

______________________________________________________________

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the date first above written.

_____________________________________

Grantor's Signature

Date: ______________________________

State of California

County of ___________________________

On this ___ day of __________, 20___, before me, a Notary Public in and for said State, personally appeared the above-named Grantor, who acknowledged that s/he executed the same.

_____________________________________

Notary Public Signature

My commission expires: ___________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer ownership of real property as a gift without any exchange of money. |

| Governing Law | The Gift Deed is governed by California Civil Code Section 11911, which outlines the requirements for valid property transfers. |

| No Consideration Required | Unlike a traditional sale, no monetary consideration is required for a Gift Deed. The property is given freely. |

| Tax Implications | Gift tax may apply depending on the value of the property and the relationship between the giver and the receiver. |

| Recording | To ensure the transfer is legally recognized, the Gift Deed should be recorded with the county recorder's office where the property is located. |

| Revocation | Once executed and delivered, a Gift Deed generally cannot be revoked unless specific conditions are met, such as mutual agreement or a court order. |

California Gift Deed - Usage Guidelines

Once you have gathered the necessary information and documents, you can begin filling out the California Gift Deed form. This form allows you to transfer property ownership without financial exchange, typically as a gift. Properly completing this form is essential for ensuring the transfer is legally recognized.

- Obtain the California Gift Deed form. You can find it online or at your local county recorder's office.

- Fill in the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift). Ensure that the names match the legal identification documents.

- Provide the address of the property being gifted. This should include the full street address, city, and zip code.

- Describe the property in detail. Include the legal description, which can typically be found on the property’s title or deed.

- State the consideration. Since this is a gift deed, you can indicate “love and affection” or simply put “gift” in this section.

- Include the date of the transfer. This is the date when the gift is officially made.

- Sign the form. The grantor must sign the document in the presence of a notary public.

- Have the form notarized. A notary will verify the identities of the signers and witness the signing.

- Make copies of the completed and notarized form for your records.

- File the original form with the county recorder’s office where the property is located. There may be a filing fee, so check with the office beforehand.

Some Other Gift Deed State Templates

Gift Deed Texas - Consistency in the Gift Deed's wording can prevent future confusion.

When preparing for end-of-life care, it's crucial to understand the implications of a Colorado Do Not Resuscitate (DNR) Order form, which allows individuals to refuse resuscitation efforts during a medical emergency. This legal document serves to ensure that healthcare providers honor a person's wishes regarding life-sustaining treatment. For those interested in acquiring this form, resources such as Colorado PDF Templates can be invaluable in navigating the process and ensuring that the form is completed correctly.

Dos and Don'ts

When filling out the California Gift Deed form, it is essential to approach the process with care. Here are five important dos and don'ts to consider:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Do use clear and legible handwriting or type the information to avoid any misinterpretation.

- Do sign the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Don't leave any sections blank. If a section does not apply, indicate that it is not applicable.

- Don't forget to include a legal description of the property. This description is necessary for the deed to be effective.

By following these guidelines, you can help ensure that your Gift Deed is properly executed and legally binding.

Common mistakes

-

Incorrect Property Description: Many individuals fail to provide a clear and accurate description of the property being gifted. This can lead to confusion or disputes in the future. Ensure that the legal description is precise, including the parcel number and address.

-

Missing Signatures: A common mistake is neglecting to obtain all necessary signatures. Both the donor (the person giving the gift) and the recipient (the person receiving the gift) must sign the deed. Without these signatures, the deed may be considered invalid.

-

Improper Notarization: Failing to have the document properly notarized is another frequent error. The Gift Deed must be notarized to be legally binding. Make sure to visit a notary public who can verify the identities of the signers.

-

Ignoring Tax Implications: Some people overlook the potential tax consequences of gifting property. It’s important to consult with a tax professional to understand any gift tax liabilities that may arise from the transaction.

-

Omitting the Date: Forgetting to include the date on the Gift Deed can create complications. A date is essential for establishing when the transfer of ownership takes place, which can affect tax and legal matters.

-

Not Recording the Deed: After completing the Gift Deed, some individuals fail to record it with the county recorder’s office. Recording the deed is crucial to ensure that the gift is recognized legally and to protect the recipient’s ownership rights.