Free Dirt Bike Bill of Sale Document for California State

Document Sample

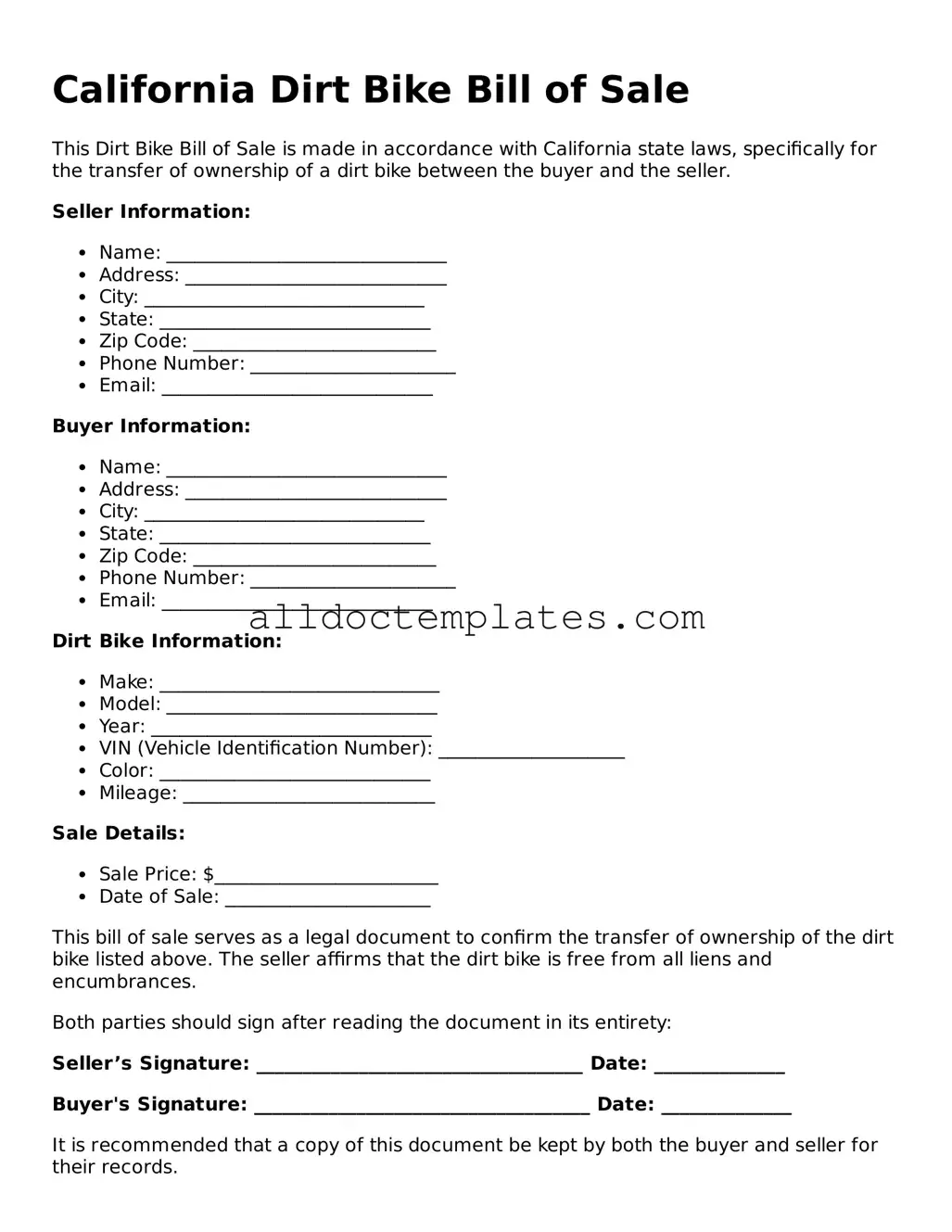

California Dirt Bike Bill of Sale

This Dirt Bike Bill of Sale is made in accordance with California state laws, specifically for the transfer of ownership of a dirt bike between the buyer and the seller.

Seller Information:

- Name: ______________________________

- Address: ____________________________

- City: ______________________________

- State: _____________________________

- Zip Code: __________________________

- Phone Number: ______________________

- Email: _____________________________

Buyer Information:

- Name: ______________________________

- Address: ____________________________

- City: ______________________________

- State: _____________________________

- Zip Code: __________________________

- Phone Number: ______________________

- Email: _____________________________

Dirt Bike Information:

- Make: ______________________________

- Model: _____________________________

- Year: ______________________________

- VIN (Vehicle Identification Number): ____________________

- Color: _____________________________

- Mileage: ___________________________

Sale Details:

- Sale Price: $________________________

- Date of Sale: ______________________

This bill of sale serves as a legal document to confirm the transfer of ownership of the dirt bike listed above. The seller affirms that the dirt bike is free from all liens and encumbrances.

Both parties should sign after reading the document in its entirety:

Seller’s Signature: ___________________________________ Date: ______________

Buyer's Signature: ____________________________________ Date: ______________

It is recommended that a copy of this document be kept by both the buyer and seller for their records.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The California Dirt Bike Bill of Sale form serves as a legal document for transferring ownership of a dirt bike. |

| Governing Law | The form is governed by California Vehicle Code Section 5901. |

| Required Information | The form requires details such as the buyer's and seller's names, addresses, and signatures. |

| Vehicle Information | It must include specific information about the dirt bike, including make, model, year, and VIN. |

| As-Is Clause | The form typically includes an "as-is" clause, indicating the buyer accepts the bike in its current condition. |

| Notarization | Notarization is not required for the bill of sale in California but can be beneficial for added security. |

| Tax Implications | Sales tax may apply based on the sale price of the dirt bike, and both parties should be aware of this. |

| Record Keeping | Both the buyer and seller should keep a copy of the signed bill of sale for their records. |

| Registration Requirement | The buyer must register the dirt bike with the California DMV within 10 days of purchase. |

| Legal Protection | The bill of sale provides legal protection for both parties in case of disputes regarding ownership. |

California Dirt Bike Bill of Sale - Usage Guidelines

Filling out the California Dirt Bike Bill of Sale form is an essential step when buying or selling a dirt bike. This document ensures that both parties have a clear record of the transaction, which can be useful for registration and ownership purposes. Once completed, the form should be kept in a safe place, as it may be needed for future reference or legal matters.

- Begin by downloading the California Dirt Bike Bill of Sale form from a reliable source.

- At the top of the form, enter the date of the sale.

- Provide the seller's full name and address in the designated fields.

- Next, fill in the buyer's full name and address.

- In the section for the dirt bike details, write the make, model, year, and Vehicle Identification Number (VIN) of the bike.

- Indicate the sale price of the dirt bike in the appropriate space.

- Both the seller and buyer should sign and date the form at the bottom.

- Make copies of the completed form for both the seller and buyer for their records.

Some Other Dirt Bike Bill of Sale State Templates

Do You Need a Bill of Sale in Florida - Can be used for resale or as proof of ownership later on.

Dirtbike Bill of Sale - Promotes transparency in the sale transaction.

Before entering into a working relationship, it is crucial to understand the significance of an Independent Contractor Agreement, which serves as a foundational document in defining roles and expectations. To explore more about these agreements and their importance, consider visiting the useful guide on Independent Contractor Agreement forms.

How to Write a Bill of Sale for a Dirt Bike - Contains warranty information if applicable to the sale.

Motorcycle Bill of Sale Form - A signed Bill of Sale can help establish legal possession of the dirt bike.

Dos and Don'ts

When filling out the California Dirt Bike Bill of Sale form, it is essential to follow certain guidelines to ensure the document is valid and serves its intended purpose. Below are some dos and don’ts to keep in mind.

- Do provide accurate information about the dirt bike, including the make, model, year, and Vehicle Identification Number (VIN).

- Do include the names and addresses of both the buyer and the seller to establish clear ownership transfer.

- Do specify the sale price to document the transaction value for both parties.

- Do sign and date the form to validate the agreement and ensure both parties acknowledge the sale.

- Don't leave any fields blank; incomplete forms can lead to confusion or disputes later on.

- Don't use outdated or incorrect information, as this could cause legal issues or complications with registration.

By adhering to these guidelines, individuals can create a clear and effective Bill of Sale that protects both the buyer and seller in the transaction of a dirt bike in California.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the buyer's and seller's names, addresses, and contact information, can lead to issues later on.

-

Incorrect Vehicle Identification Number (VIN): Entering an incorrect VIN can cause confusion and may invalidate the sale.

-

Missing Signatures: Not having both the buyer's and seller's signatures can make the document unenforceable.

-

Neglecting to Date the Document: Omitting the date of the sale can create problems regarding the timeline of ownership transfer.

-

Failing to Include Payment Details: Not specifying the sale price or payment method can lead to disputes over the transaction.

-

Not Providing a Bill of Sale Copy: Forgetting to give a copy to the buyer can result in the buyer not having proof of ownership.

-

Ignoring Local Laws: Overlooking specific local regulations related to dirt bike sales can lead to legal complications.

-

Using Incorrect Form Version: Utilizing an outdated version of the Bill of Sale form may not comply with current regulations.

-

Not Keeping Records: Failing to maintain a copy of the completed form for personal records can be problematic in the future.