Fill in a Valid California Affidavit of Death of a Trustee Form

Document Sample

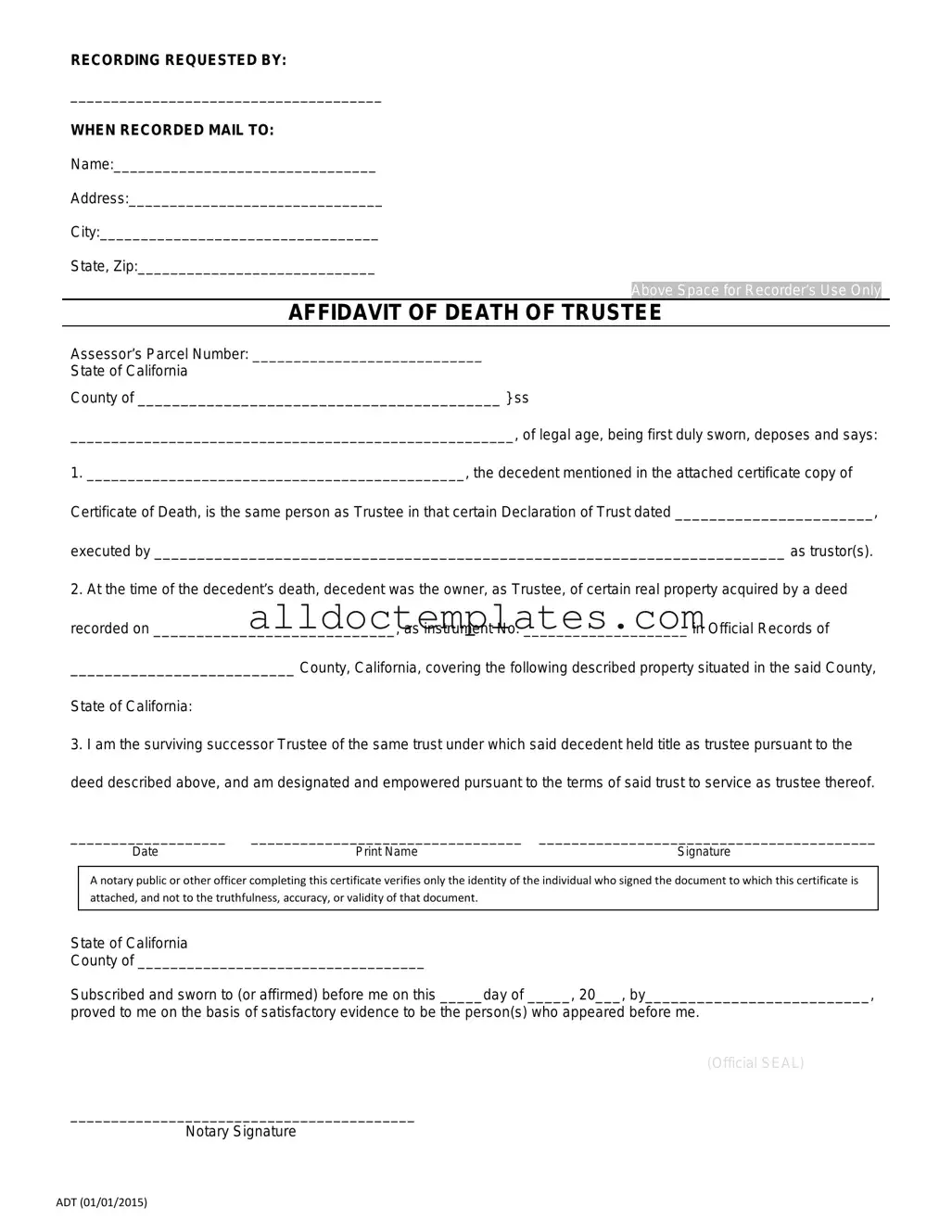

RECORDING REQUESTED BY:

______________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:_______________________________

City:__________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF TRUSTEE

Assessor’s Parcel Number: ____________________________

State of California

County of __________________________________________ } ss

______________________________________________________, of legal age, being first duly sworn, deposes and says:

1.______________________________________________, the decedent mentioned in the attached certificate copy of Certificate of Death, is the same person as Trustee in that certain Declaration of Trust dated _______________________, executed by _________________________________________________________________________ as trustor(s).

2.At the time of the decedent’s death, decedent was the owner, as Trustee, of certain real property acquired by a deed recorded on ____________________________, as instrument No. ____________________ in Official Records of

__________________________ County, California, covering the following described property situated in the said County,

State of California:

3.I am the surviving successor Trustee of the same trust under which said decedent held title as trustee pursuant to the deed described above, and am designated and empowered pursuant to the terms of said trust to service as trustee thereof.

___________________ |

_________________________________ |

_________________________________________ |

Date |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

__________________________________________

Notary Signature

ADT (01/01/2015)

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee form is used to formally notify interested parties of a trustee's death and to facilitate the transfer of trust property. |

| Governing Law | This form is governed by the California Probate Code, specifically sections 15660 and 15661. |

| Who Can Use It | Any successor trustee or an interested party can file the affidavit after the death of the original trustee. |

| Required Information | The affidavit must include the deceased trustee's name, date of death, and details about the trust. |

| Filing Process | The completed affidavit should be filed with the county recorder's office where the trust property is located. |

| Effect on Trust | Filing the affidavit helps confirm the authority of the successor trustee to manage the trust and its assets. |

| Legal Standing | Once filed, the affidavit serves as legal proof of the trustee's death and the succession of authority, impacting all trust-related transactions. |

California Affidavit of Death of a Trustee - Usage Guidelines

Once you have gathered all necessary information, you can proceed to fill out the California Affidavit of Death of a Trustee form. This document is essential for updating the records regarding the trust and its management following the trustee's passing. Ensure that you have the required details at hand to complete the form accurately.

- Obtain the California Affidavit of Death of a Trustee form from a reliable source, such as the California state website or a legal stationery store.

- Begin by entering the name of the deceased trustee in the designated field.

- Provide the date of death for the trustee. This information is crucial for the validity of the affidavit.

- Fill in the name of the trust that the deceased trustee managed.

- Include the date the trust was created. This helps establish the timeline of the trust's management.

- Identify the successor trustee, if applicable. This person will take over the responsibilities of the trust.

- Sign the affidavit in the designated signature area. Ensure that your signature matches the name provided in the form.

- Have the affidavit notarized. A notary public must witness your signature to validate the document.

- Make copies of the completed and notarized affidavit for your records and for any relevant parties involved with the trust.

Common PDF Forms

Generic Invoice Form - Customizable template for professional-looking invoices.

How to Get Check Stubs - Helps verify bonuses and incentive payment details.

For those navigating the complexities of mobile home transactions, understanding the significance of a well-prepared document is paramount. Take steps to protect your investment by utilizing a reliable full mobile home bill of sale form that ensures all necessary details are accurately captured and recorded.

Abn Form Pdf - This notice can help beneficiaries make confident choices about their health services.

Dos and Don'ts

When filling out the California Affidavit of Death of a Trustee form, it is essential to approach the process with care. Below are some important dos and don'ts to keep in mind:

- Do ensure that you have the correct form. Verify that you are using the most current version of the California Affidavit of Death of a Trustee.

- Do provide accurate information. Double-check all details regarding the deceased trustee, including their full name, date of death, and any relevant trust information.

- Do sign the affidavit in front of a notary. This step is crucial for the affidavit to be considered valid and legally binding.

- Do keep copies of the completed form. Having a record of what you submitted can be helpful for future reference.

- Don't leave any sections blank. Incomplete forms may lead to delays or rejection by the court.

- Don't use outdated information. Make sure that all details reflect the most current status of the trust and the trustee.

- Don't rush the process. Take your time to review each section carefully before submitting the form.

- Don't overlook the filing requirements. Be aware of where and how to submit the affidavit to ensure it is processed correctly.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays. Ensure that the name of the deceased trustee, the date of death, and the trust name are filled out completely.

-

Incorrect Signatures: The form must be signed by the surviving trustee or a successor trustee. A signature from someone who is not authorized can invalidate the affidavit.

-

Missing Notarization: The affidavit requires notarization. Omitting this step can result in the document being rejected by institutions that need it.

-

Failure to Attach Supporting Documents: Often, additional documentation is needed, such as a death certificate. Not including these can hinder the processing of the affidavit.

-

Incorrect Filing Location: Submitting the affidavit to the wrong office can cause complications. It’s important to file with the appropriate county clerk or recorder’s office.