Valid Business Purchase and Sale Agreement Template

Document Sample

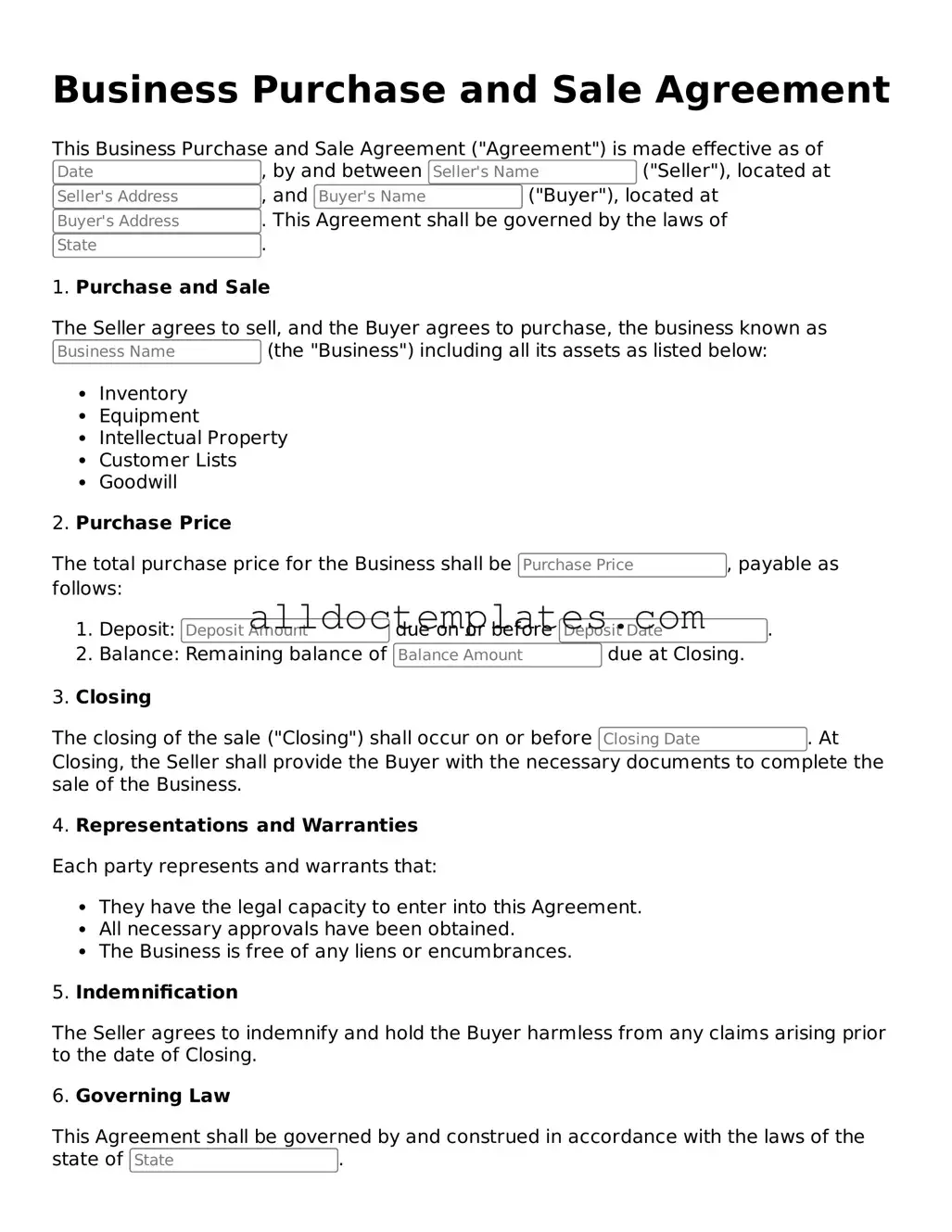

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made effective as of , by and between ("Seller"), located at , and ("Buyer"), located at . This Agreement shall be governed by the laws of .

1. Purchase and Sale

The Seller agrees to sell, and the Buyer agrees to purchase, the business known as (the "Business") including all its assets as listed below:

- Inventory

- Equipment

- Intellectual Property

- Customer Lists

- Goodwill

2. Purchase Price

The total purchase price for the Business shall be , payable as follows:

- Deposit: due on or before .

- Balance: Remaining balance of due at Closing.

3. Closing

The closing of the sale ("Closing") shall occur on or before . At Closing, the Seller shall provide the Buyer with the necessary documents to complete the sale of the Business.

4. Representations and Warranties

Each party represents and warrants that:

- They have the legal capacity to enter into this Agreement.

- All necessary approvals have been obtained.

- The Business is free of any liens or encumbrances.

5. Indemnification

The Seller agrees to indemnify and hold the Buyer harmless from any claims arising prior to the date of Closing.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of .

7. Entire Agreement

This Agreement constitutes the entire understanding between the parties and supersedes any prior agreements or understandings, whether written or oral.

IN WITNESS WHEREOF, the parties have executed this Business Purchase and Sale Agreement as of the date first above written.

___________________________

___________________________

Date: ________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document outlining the terms for buying or selling a business. |

| Parties Involved | The agreement typically involves the seller, the buyer, and may also include brokers or agents. |

| Governing Law | The agreement is governed by state law, which varies depending on the state where the business operates. |

| Key Components | Essential elements include purchase price, payment terms, and representations and warranties. |

| Due Diligence | Buyers often conduct due diligence to verify the business's financial health and legal standing. |

| Confidentiality | Many agreements include confidentiality clauses to protect sensitive information during negotiations. |

| Contingencies | Contingencies may be included, allowing the buyer to withdraw if certain conditions are not met. |

| Closing Process | The closing process is the final step where ownership is transferred, and funds are exchanged. |

| State-Specific Forms | Some states have specific forms or requirements that must be followed in the agreement. |

Business Purchase and Sale Agreement - Usage Guidelines

Completing the Business Purchase and Sale Agreement form is a critical step in the process of buying or selling a business. This document outlines the terms and conditions of the sale, ensuring that both parties are on the same page. Follow these steps carefully to ensure accuracy and clarity.

- Identify the Parties: Begin by entering the full legal names and addresses of both the buyer and the seller at the top of the form.

- Describe the Business: Provide a detailed description of the business being sold, including its name, location, and any relevant business identification numbers.

- Specify the Purchase Price: Clearly state the total purchase price for the business. Include any terms regarding deposits or payment schedules.

- Outline the Assets Included: List all assets that are part of the sale, such as equipment, inventory, intellectual property, and customer lists.

- Detail Liabilities: Specify any liabilities that the buyer will assume as part of the transaction, including debts and obligations.

- Set Closing Date: Indicate the expected closing date for the transaction. This is when the transfer of ownership will officially take place.

- Include Contingencies: If applicable, outline any contingencies that must be met before the sale can be finalized, such as financing or inspections.

- Signatures: Ensure that both parties sign and date the agreement. Include spaces for witnesses or notary if required by state law.

After completing the form, both parties should review it carefully to ensure all details are accurate and agreed upon. Proper execution of this agreement is essential for a smooth transaction.

Browse Popular Documents

What Information Must Be Listed on a Job Application? - Be prepared to discuss the details of your work history in further interviews.

Land Purchase Agreement Form - Parties may include specific timelines for inspections and due diligence in the agreement.

A Colorado Medical Power of Attorney form is a legal document that allows an individual to designate someone else to make medical decisions on their behalf if they become unable to do so. This important tool ensures that a person's healthcare preferences are honored, even when they cannot communicate them. Understanding how to properly complete and utilize this form is essential for anyone looking to safeguard their medical choices, which can be facilitated by resources like Colorado PDF Templates.

Terminate Real Estate Agent Contract Letter - Utilizing this form may help to preserve a positive relationship between parties.

Dos and Don'ts

When filling out a Business Purchase and Sale Agreement form, it’s crucial to approach the task with care. Here’s a guide to help ensure that you cover all your bases effectively.

- Do: Read the entire agreement thoroughly before starting to fill it out.

- Do: Clearly identify all parties involved, including their legal names and addresses.

- Do: Specify the terms of the sale, including price and payment structure.

- Do: Include any contingencies that might affect the sale.

- Do: Ensure that all necessary attachments and exhibits are included with the agreement.

- Do: Have all parties sign the document in the presence of a witness or notary, if required.

- Do: Keep a copy of the signed agreement for your records.

- Don't: Rush through the form; mistakes can lead to legal complications.

- Don't: Leave any sections blank; this can create ambiguity.

- Don't: Use vague language; clarity is key to avoid misunderstandings.

- Don't: Ignore state-specific regulations that may apply to your agreement.

- Don't: Forget to consult with a legal professional if you have questions.

- Don't: Assume that verbal agreements are sufficient; everything should be documented.

- Don't: Neglect to follow up on any conditions or obligations after the agreement is signed.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. Missing information can lead to misunderstandings and potential legal issues down the line.

-

Incorrect Valuation: Some buyers and sellers miscalculate the value of the business. This mistake can result in financial loss or disputes over the sale price.

-

Neglecting Due Diligence: Skipping thorough research about the business can lead to unpleasant surprises. Buyers should verify financial statements, liabilities, and other critical factors before finalizing the agreement.

-

Ignoring Contingencies: Failing to include necessary contingencies can create problems later. Contingencies protect both parties by allowing for specific conditions to be met before the sale is finalized.

-

Overlooking Legal Compliance: Some individuals do not ensure that the agreement complies with local, state, and federal laws. This oversight can result in legal complications and delays in the transaction.

-

Not Seeking Professional Help: Many people attempt to fill out the form without consulting legal or financial professionals. Expert guidance can provide valuable insights and help avoid costly mistakes.