Fill in a Valid Business Credit Application Form

Document Sample

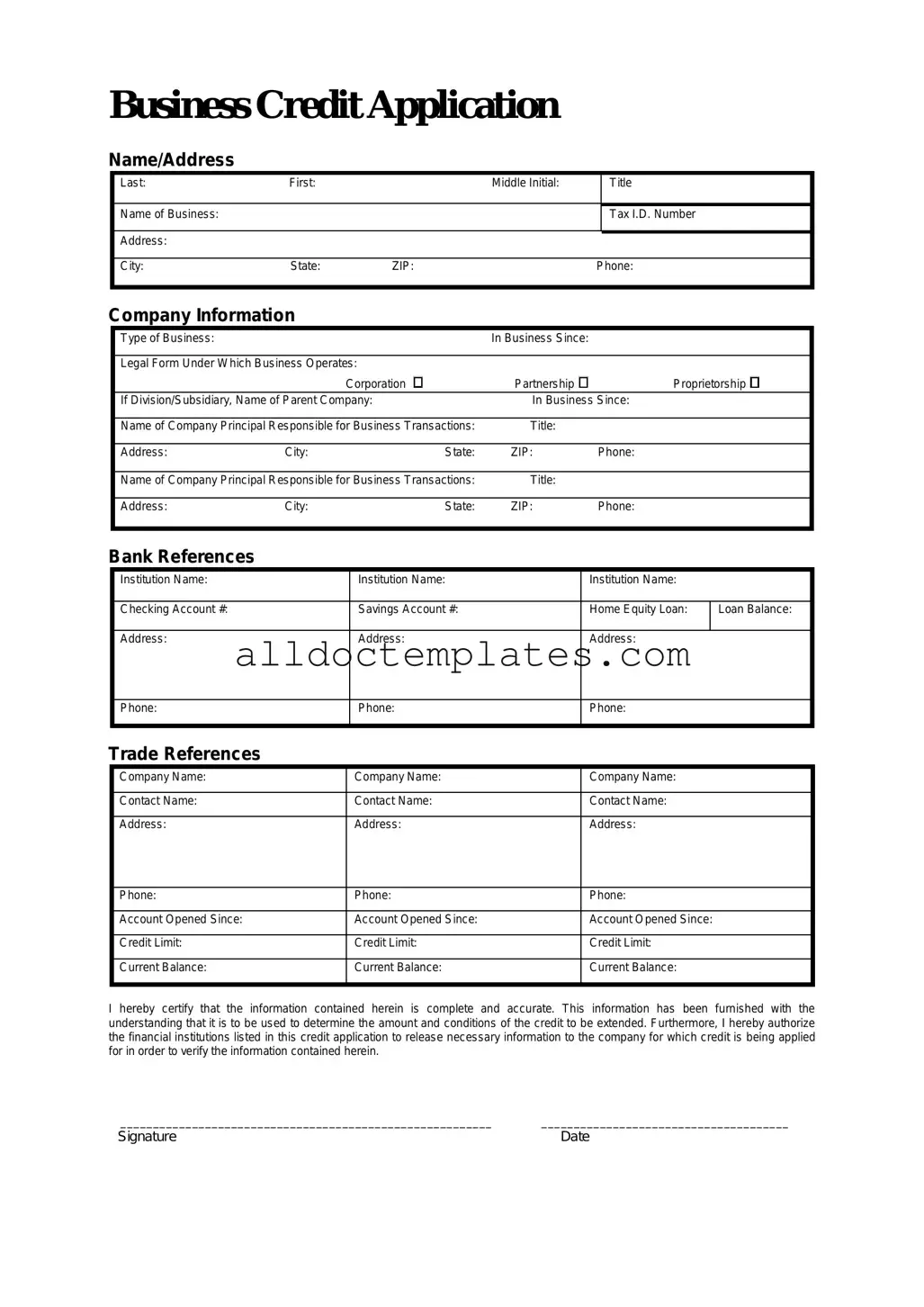

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Document Information

| Fact Name | Details |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or lenders. |

| Information Required | This form typically requires details such as business name, address, tax identification number, and financial information. |

| State-Specific Forms | Some states may have specific requirements or forms, governed by local commercial laws. |

| Governing Laws | For example, in California, the form must comply with the California Commercial Code. |

| Importance of Accuracy | Providing accurate information is crucial, as it affects credit decisions and potential financing opportunities. |

Business Credit Application - Usage Guidelines

Filling out the Business Credit Application form is an important step for obtaining credit for your business. Make sure to provide accurate information to avoid delays in processing. Follow these steps to complete the form correctly.

- Start with your business information: Enter the legal name of your business, the business address, and the type of business structure (e.g., corporation, LLC, sole proprietorship).

- Provide contact details: Fill in the primary contact person's name, phone number, and email address. This person will be the main point of contact for any follow-up.

- List your business's tax identification number: Include your Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

- Detail your business operations: Describe the nature of your business, including what products or services you offer and your years in operation.

- Financial information: Provide your business's annual revenue, estimated monthly credit needs, and any existing debts or obligations.

- Trade references: List at least three trade references, including their names, addresses, and contact information. These should be businesses you have credit with.

- Sign and date the application: Make sure to sign and date the application to certify that all information is accurate and complete.

After completing the form, review it carefully for any errors. Submit the application as instructed, and be prepared to provide any additional information if requested.

Common PDF Forms

Citizens Roof Certification Form - Check for peeling paint as a potential indicator of moisture presence around walls.

In Colorado, utilizing the Motor Vehicle Bill of Sale form is crucial for documenting the transfer of vehicle ownership, and accessing resources like Colorado PDF Templates can help facilitate this process, ensuring that both buyers and sellers meet all necessary legal requirements.

How to Make a Doctor Excuse for Work - Facilitates authorized health-related absences for students or employees.

Dos and Don'ts

When filling out a Business Credit Application form, it’s important to be thorough and accurate. Here’s a list of things to do and things to avoid.

- Do read the entire application before starting.

- Do provide accurate and up-to-date information.

- Do include all required documents.

- Do double-check your numbers and calculations.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations that may confuse the reader.

- Don't rush through the application; take your time.

Following these tips can help ensure your application is processed smoothly. Good luck!

Common mistakes

-

Incomplete Information: Many applicants forget to fill out all required fields. Missing details can delay the approval process. Always double-check your application for completeness.

-

Inaccurate Financial Data: Providing incorrect financial figures can lead to misunderstandings. Ensure that all numbers are accurate and reflect your current financial situation.

-

Neglecting to Include Supporting Documents: Some applicants fail to attach necessary documents, such as tax returns or bank statements. These documents help verify the information provided. Make sure to include everything required.

-

Not Reviewing the Terms: It’s crucial to read the terms and conditions carefully. Some applicants skip this step and miss important details about interest rates or fees. Take the time to understand what you are agreeing to.