Valid Business Bill of Sale Template

Document Sample

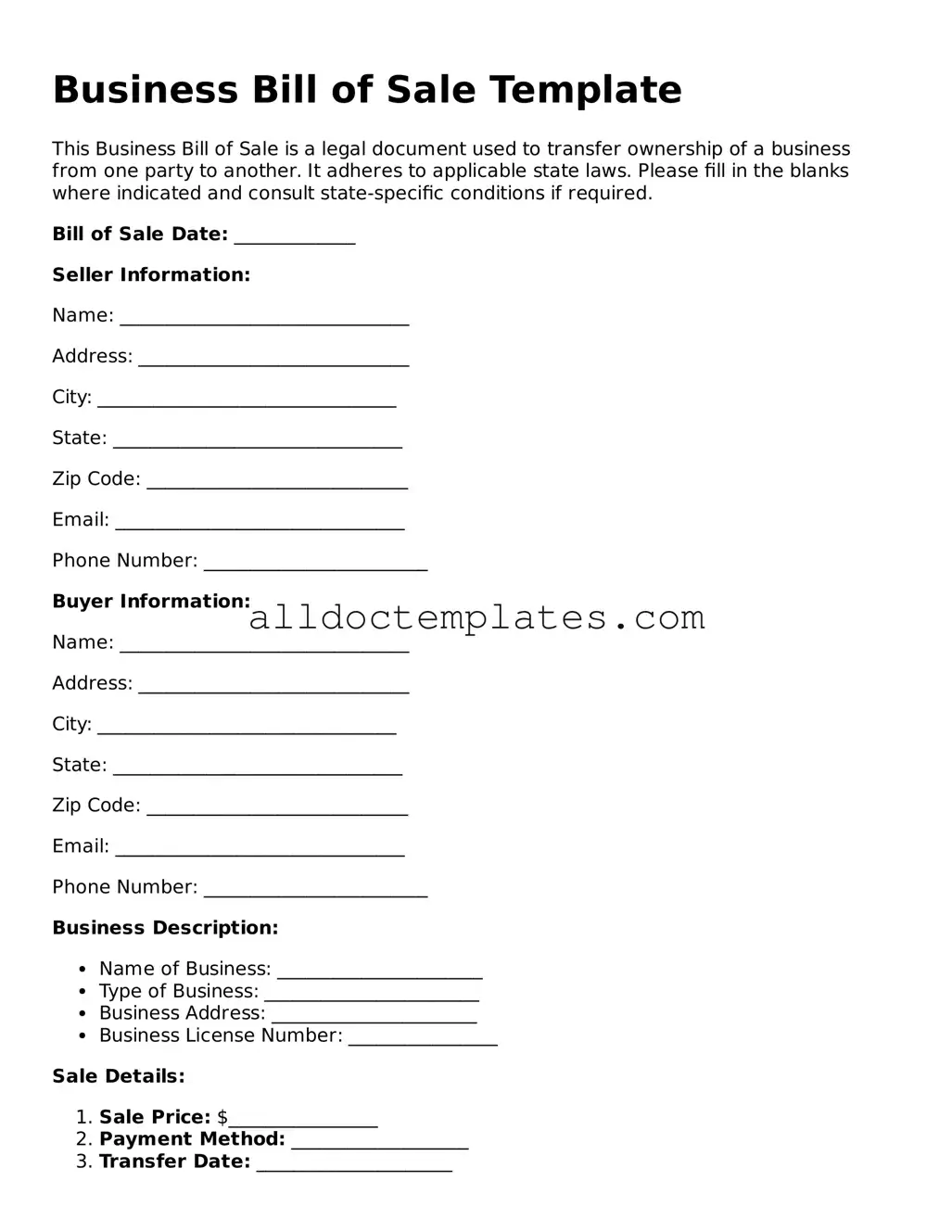

Business Bill of Sale Template

This Business Bill of Sale is a legal document used to transfer ownership of a business from one party to another. It adheres to applicable state laws. Please fill in the blanks where indicated and consult state-specific conditions if required.

Bill of Sale Date: _____________

Seller Information:

Name: _______________________________

Address: _____________________________

City: ________________________________

State: _______________________________

Zip Code: ____________________________

Email: _______________________________

Phone Number: ________________________

Buyer Information:

Name: _______________________________

Address: _____________________________

City: ________________________________

State: _______________________________

Zip Code: ____________________________

Email: _______________________________

Phone Number: ________________________

Business Description:

- Name of Business: ______________________

- Type of Business: _______________________

- Business Address: ______________________

- Business License Number: ________________

Sale Details:

- Sale Price: $________________

- Payment Method: ___________________

- Transfer Date: _____________________

Both parties acknowledge that the terms of this sale have been mutually agreed upon. Seller affirms they have the right to sell this business and that it is free of liens or encumbrances.

Seller Signature: __________________________ Date: _______________

Buyer Signature: __________________________ Date: _______________

This document serves as proof of ownership transfer and may be used for record-keeping purposes. It is advisable to keep a copy for your records.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Business Bill of Sale form is used to document the transfer of ownership of a business or its assets from one party to another. |

| Parties Involved | The form typically includes the seller (current owner) and the buyer (new owner), detailing their names and contact information. |

| Governing Law | Each state has its own laws governing business transactions. For example, in California, the Uniform Commercial Code (UCC) applies. |

| Asset Description | It is important to provide a detailed description of the business assets being sold, including equipment, inventory, and goodwill. |

| Signatures | The form must be signed by both parties to be legally binding. Witnesses or notarization may be required in some states. |

Business Bill of Sale - Usage Guidelines

Completing the Business Bill of Sale form is straightforward. By following these steps, you can ensure that all necessary information is accurately recorded. This will help facilitate a smooth transaction between the buyer and seller.

- Obtain the Form: Get a copy of the Business Bill of Sale form. This can usually be found online or at your local business office.

- Enter Seller Information: Fill in the seller's name, address, and contact information in the designated fields.

- Enter Buyer Information: Provide the buyer's name, address, and contact details just as you did for the seller.

- Describe the Business: Clearly outline the business being sold. Include its name, address, and any relevant identification numbers.

- Specify the Sale Price: Write down the agreed-upon sale price for the business. Be clear and precise.

- Include Terms of Sale: If there are specific terms or conditions related to the sale, make sure to include them in this section.

- Sign the Form: Both the seller and buyer must sign the form. Ensure that the signatures are dated.

- Keep Copies: Make copies of the completed form for both parties' records.

After filling out the form, ensure that both parties have a signed copy. This will serve as proof of the transaction and protect the interests of both the buyer and the seller.

More Types of Business Bill of Sale Templates:

Simple Bill of Sale for Car - Record essential details of the vehicle sale with this straightforward Bill of Sale.

For those looking to formalize the transfer of ownership, the Illinois Bill of Sale form is a vital legal document. It is designed to facilitate the sale of various personal items, including vehicles and furniture. When preparing this document, it is important to understand its components and requirements, which can greatly assist in achieving a successful transaction. For a comprehensive resource, you can refer to Illinois Templates PDF.

Dos and Don'ts

When filling out a Business Bill of Sale form, it is important to follow certain guidelines to ensure the document is accurate and legally binding. Here are some do's and don'ts to keep in mind:

- Do provide accurate information about the business being sold, including its name and address.

- Do include the sale price and payment terms clearly to avoid misunderstandings.

- Do have both the buyer and seller sign the document to confirm the transaction.

- Do keep a copy of the signed Bill of Sale for your records.

- Don't leave any fields blank; this can lead to confusion later on.

- Don't use vague language; be specific about what is included in the sale.

Common mistakes

-

Not including the date of the transaction. This is crucial for legal purposes and record-keeping.

-

Failing to provide accurate business details. This includes the legal name of the business and its address. Incorrect information can lead to disputes.

-

Omitting the purchase price. Clearly stating the amount helps avoid confusion later on.

-

Not listing the assets being sold. Be specific about what is included in the sale to prevent misunderstandings.

-

Forgetting to include signatures from both the buyer and seller. Without signatures, the document may not be legally binding.

-

Leaving out contact information for both parties. This is important for any future communication regarding the sale.

-

Not specifying any conditions of the sale. If there are warranties or guarantees, they should be clearly stated.

-

Neglecting to check for errors after filling out the form. Typos or incorrect information can lead to complications.

-

Using outdated or incorrect form versions. Always ensure you have the most current version of the Business Bill of Sale.

-

Not keeping a copy of the completed form for personal records. This is essential for future reference and accountability.