Fill in a Valid Auto Insurance Card Form

Document Sample

|

|

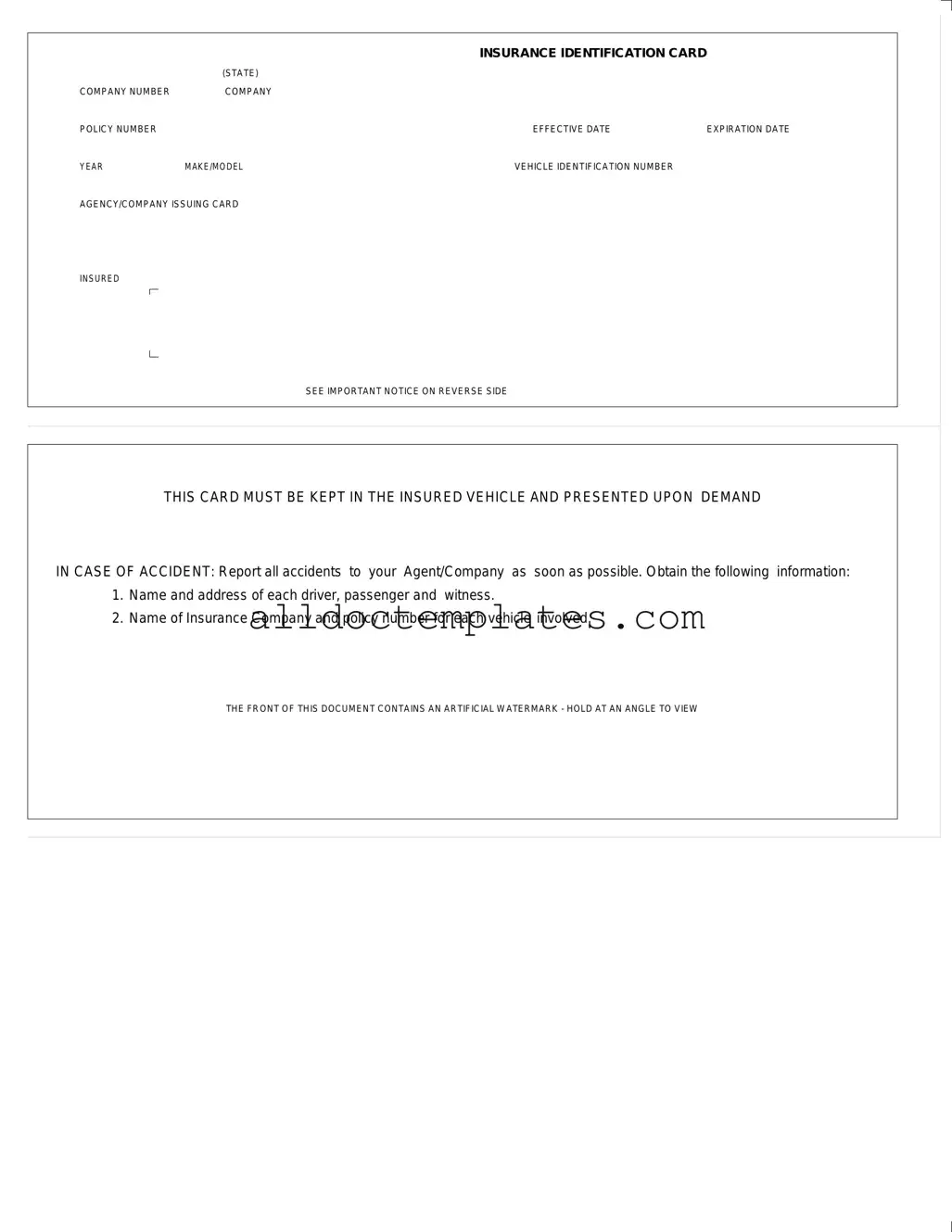

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Document Information

| Fact Name | Description |

|---|---|

| Document Purpose | This card serves as proof of auto insurance coverage for the insured vehicle. |

| Legal Requirement | Most states require drivers to carry this card in their vehicle at all times. |

| Information Included | The card includes essential details such as the insurance company name, policy number, and vehicle identification number (VIN). |

| Accident Protocol | In the event of an accident, the insured must present this card and report the incident to their insurance agent promptly. |

| Watermark Feature | The front of the card features an artificial watermark, which can be viewed by holding it at an angle. |

Auto Insurance Card - Usage Guidelines

Filling out your Auto Insurance Card form is a straightforward process that ensures you have the necessary information readily available in your vehicle. This card is essential for providing proof of insurance when needed. Follow these steps carefully to complete the form accurately.

- Locate the form and ensure you have a pen or pencil ready for filling it out.

- Fill in the "Company Number" section with the number provided by your insurance company.

- Enter your "Company Policy Number" in the designated field. This number is unique to your insurance policy.

- Write the "Effective Date" of your policy. This is usually found on your insurance documents.

- Fill in the "Expiration Date" of your policy. Make sure this date is accurate to avoid any issues.

- Provide the "Year, Make/Model" of your vehicle. This identifies the car you are insuring.

- Input the "Vehicle Identification Number" (VIN). This unique number can typically be found on your vehicle registration or on the dashboard.

- Indicate the "Agency/Company Issuing Card" to specify which agency provided your insurance.

- Review all entries to ensure accuracy. Double-check for any typos or missing information.

- Keep the card in your vehicle as required. This ensures you can present it if needed.

Once you’ve filled out the form, keep it in a safe place within your vehicle. This will allow you to easily access it when required, especially in case of an accident. Remember to report any accidents to your insurance agent as soon as possible, and gather all relevant information from those involved.

Common PDF Forms

10-2850c - The VA 10-2850a is used by the VA to assess the ongoing competency of providers.

The proper completion of a Colorado Mobile Home Bill of Sale is vital for those looking to buy or sell a mobile home, and for comprehensive guidance, you can refer to Colorado PDF Templates, which provides templates and instructions to help ensure that all necessary information is accurately captured and that the transaction proceeds without complications.

Driver License Online - All personal information provided is securely stored by DMV for licensing purposes.

Dos and Don'ts

When filling out your Auto Insurance Card form, it’s crucial to ensure accuracy and completeness. Here are some important dos and don’ts to keep in mind:

- Do provide accurate personal information, including your name and address.

- Do double-check the policy number and company number for accuracy.

- Do include the effective and expiration dates of your insurance policy.

- Do ensure the vehicle identification number (VIN) is correct.

- Don't leave any fields blank; fill out every section of the form.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't forget to keep the card in your vehicle at all times.

Completing this form accurately is essential for your protection and compliance with the law. Review your information carefully before submitting it.

Common mistakes

-

Failing to include the company number. This number is essential for identifying your insurance provider.

-

Omitting the policy number. Without this, your insurance coverage cannot be verified.

-

Not updating the effective and expiration dates. Ensure these dates are current to avoid any coverage gaps.

-

Incorrectly entering the vehicle identification number (VIN). A wrong VIN can lead to complications in claims processing.

-

Neglecting to provide the make and model of the vehicle. This information is crucial for proper identification of the insured vehicle.

-

Forgetting to list the agency or company issuing the card. This detail helps in contacting the right provider if needed.

-

Ignoring the instructions on the reverse side of the card. Important notices can contain vital information regarding accidents and reporting procedures.