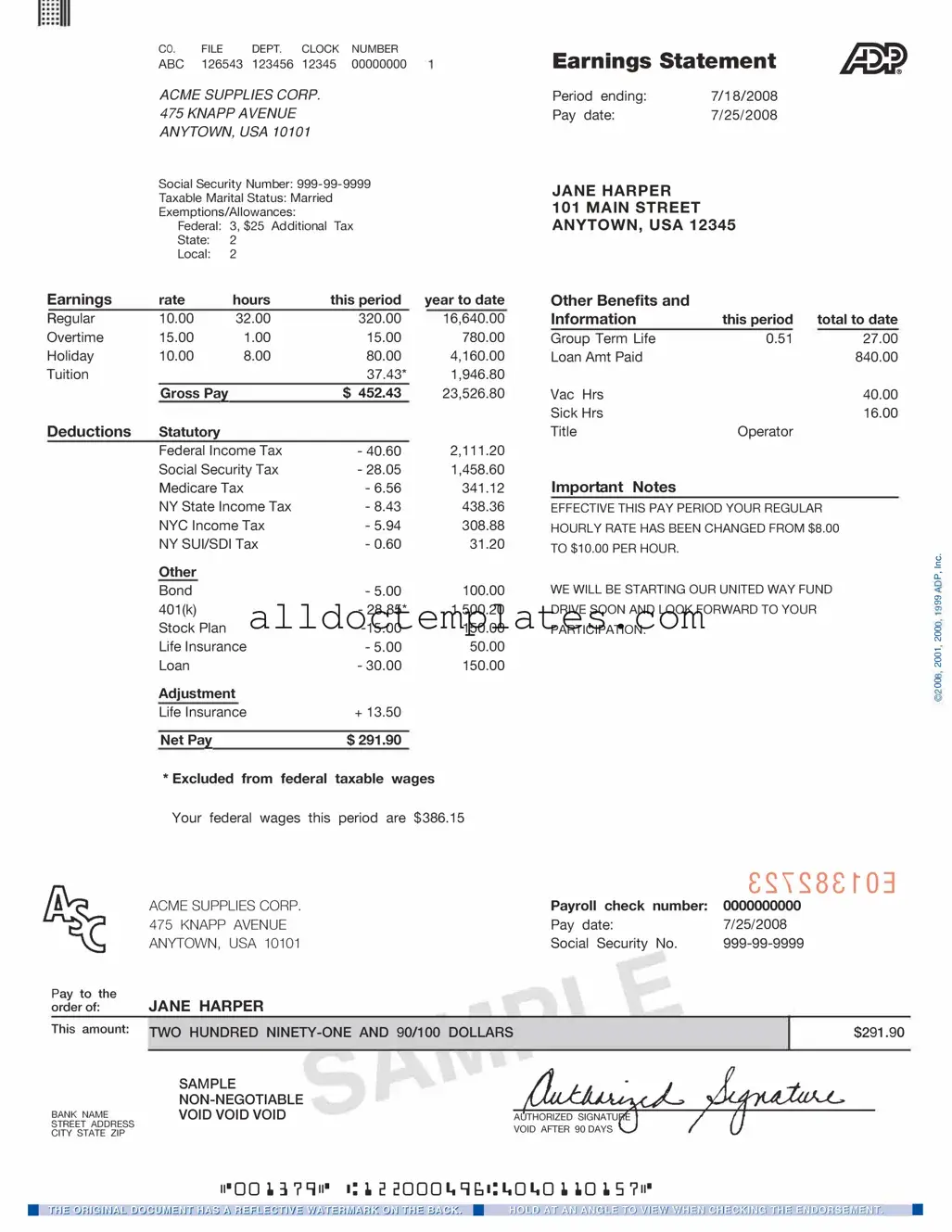

Fill in a Valid Adp Pay Stub Form

Document Sample

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Document Information

| Fact Name | Details |

|---|---|

| Purpose | The ADP Pay Stub form provides a detailed breakdown of an employee's earnings and deductions for a specific pay period. |

| Components | The form typically includes information such as gross pay, net pay, taxes withheld, and other deductions. |

| State-Specific Requirements | Some states require additional information on pay stubs, such as the employee's rate of pay and hours worked. |

| Governing Laws | In California, for example, Labor Code Section 226 mandates specific details to be included in pay stubs. |

| Accessibility | Employees can often access their pay stubs online through the ADP portal or receive them via email or physical mail. |

Adp Pay Stub - Usage Guidelines

Completing the ADP Pay Stub form involves several straightforward steps. This process ensures that all necessary information is accurately recorded for payroll purposes. Follow these steps carefully to fill out the form correctly.

- Gather your personal information, including your name, address, and employee ID.

- Locate the pay period dates, which are usually provided by your employer.

- Fill in the date of the paycheck on the form.

- Enter your gross pay, which is the total amount earned before deductions.

- Document any deductions, such as taxes, health insurance, and retirement contributions.

- Calculate your net pay by subtracting total deductions from your gross pay.

- Review all entries for accuracy and completeness.

- Sign and date the form if required.

Once the form is filled out, it should be submitted to the appropriate department for processing. Ensure that you keep a copy for your records.

Common PDF Forms

Changing Your Address - This form is a crucial part of postal service communication.

To facilitate the transfer process, it is advisable to utilize resources that provide templates and guidance; for instance, you can find the necessary documentation at All Templates PDF, which simplifies the preparation of the California Motor Vehicle Bill of Sale form and helps ensure all required details are accurately captured.

Can I Print My Own Ds-11 Form? - The application must be submitted in person; mail-in applications do not apply.

Dos and Don'ts

When filling out the ADP Pay Stub form, it’s essential to be accurate and thorough. Here’s a helpful list of things to do and avoid to ensure your form is completed correctly.

- Do double-check your personal information for accuracy, including your name, address, and Social Security number.

- Do verify your pay period dates to ensure they align with your work schedule.

- Do review your deductions carefully to confirm they are correct and reflect your benefits.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; incomplete forms can lead to processing delays.

- Don't use incorrect or outdated information, as this can cause issues with your payroll.

- Don't forget to sign and date the form; an unsigned form may not be accepted.

- Don't rush through the process; take your time to ensure everything is filled out correctly.

Taking these steps seriously can help prevent potential payroll issues and ensure you receive the correct compensation in a timely manner. Stay informed and proactive to protect your financial interests!

Common mistakes

-

Incorrect Personal Information: Many people forget to double-check their name, address, and Social Security number. Any errors here can lead to significant issues down the line.

-

Wrong Pay Period Dates: It's easy to mix up the start and end dates of the pay period. This mistake can affect how much you believe you earned.

-

Neglecting to Update Tax Information: Failing to update your W-4 form when your tax situation changes can lead to incorrect withholding amounts. This oversight might result in owing money at tax time.

-

Not Reviewing Deductions: People often overlook the deductions listed on their pay stub. It's crucial to ensure that all deductions are accurate and reflect your current benefits.