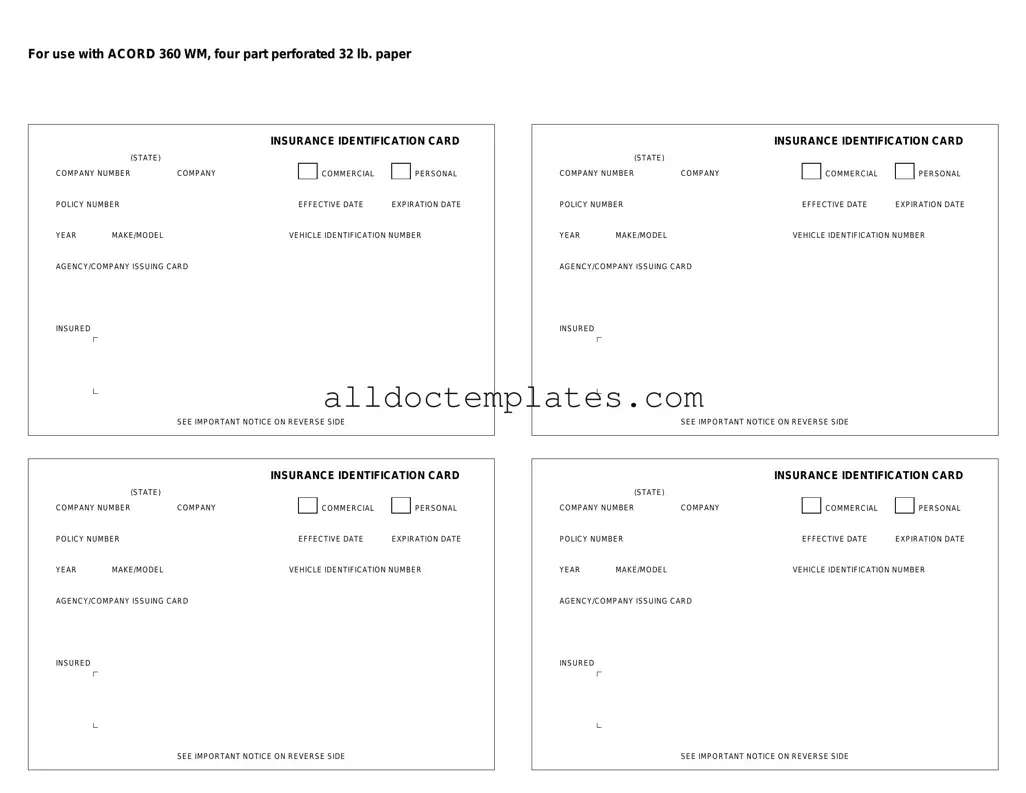

Fill in a Valid Acord 50 WM Form

Document Sample

For use with ACORD 360 WM, four part perforated 32 lb. paper

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Acord 50 WM form is used primarily for workers' compensation insurance applications. |

| Standardization | This form is part of the Acord family of forms, which standardizes information for insurance companies. |

| State-Specific Regulations | The form must comply with the workers' compensation laws of the state where the business operates. |

| Submission Process | After completion, the form is typically submitted to the insurance provider for processing. |

| Information Required | The form collects essential details such as the business name, address, and type of work performed. |

Acord 50 WM - Usage Guidelines

Completing the Acord 50 WM form is an important step in your process. Follow these clear steps to ensure that all necessary information is accurately provided. Attention to detail is crucial, so take your time as you fill out each section.

- Begin with the top section of the form. Enter your name, address, and contact information in the designated fields.

- Next, provide the policy number and effective date of your insurance policy.

- In the section for coverage details, specify the types of coverage you are requesting.

- Fill in the limits of liability as required for each type of coverage.

- Complete the deductibles section by indicating the amounts you are willing to pay out of pocket.

- If applicable, provide information about any additional insureds or endorsements.

- Review the signature section. Ensure that the form is signed and dated by the appropriate individual.

- Finally, double-check all entries for accuracy before submitting the form.

Common PDF Forms

What Is a 940 - This form can be filed electronically or via paper submission to the IRS, depending on the employer's preference.

If you're looking to make informed decisions regarding your financial affairs, a powerful document like the General Power of Attorney can be invaluable. It grants authority to an agent, enabling them to manage transactions and decisions effectively. Discover how this essential tool can assist you by visiting this page on General Power of Attorney forms in Arizona.

Free Bid Template - A pivotal part of the construction business, simplifying project documentation.

Signs of a Miscarriage Coming - There is an option to note the specifics of the week of gestation during the miscarriage.

Dos and Don'ts

When filling out the Acord 50 WM form, attention to detail is crucial. Here are seven things to do and avoid:

- Do: Read the instructions carefully before starting.

- Do: Provide accurate and complete information.

- Do: Use clear and legible handwriting or type your responses.

- Do: Double-check all entries for errors.

- Do: Sign and date the form where required.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations that may confuse the reader.

Following these guidelines will help ensure your form is processed smoothly.

Common mistakes

-

Incorrect Policy Number: One common mistake is entering the wrong policy number. This can lead to confusion and delays in processing the application.

-

Missing Contact Information: Failing to provide complete contact details, such as phone numbers or email addresses, can hinder communication.

-

Inaccurate Business Description: A vague or incorrect description of the business can result in misunderstandings regarding coverage needs.

-

Omitting Relevant Coverage Information: Some individuals forget to include specific coverage types they are seeking, which can lead to inadequate protection.

-

Neglecting Signature Requirements: Not signing the form or having an authorized person sign can render the application invalid.

-

Failing to Review for Accuracy: Skimming through the form without checking for typos or errors can result in significant issues later on.

-

Using Outdated Information: Providing outdated or incorrect information about the business can affect the assessment of risks and premiums.

-

Ignoring Instructions: Not following the specific instructions provided for completing the form can lead to incomplete submissions.

-

Not Keeping a Copy: Failing to keep a copy of the completed form for personal records can make it difficult to track submissions and communications.