Fill in a Valid 14653 Form

Document Sample

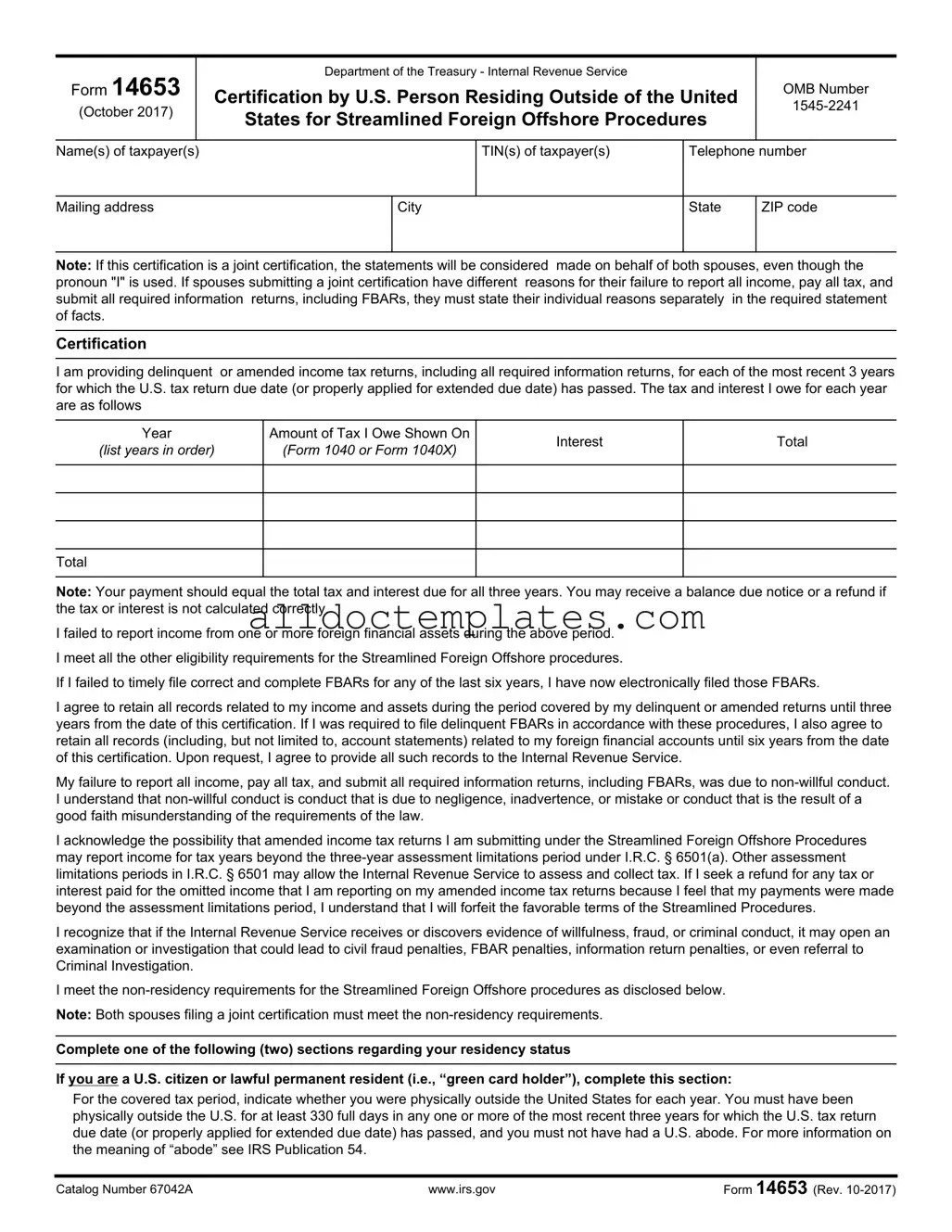

Form 14653

(October 2017)

Department of the Treasury - Internal Revenue Service

Certification by U.S. Person Residing Outside of the United

States for Streamlined Foreign Offshore Procedures

OMB Number

Name(s) of taxpayer(s)

TIN(s) of taxpayer(s)

Telephone number

Mailing address

City

State

ZIP code

Note: If this certification is a joint certification, the statements will be considered made on behalf of both spouses, even though the pronoun "I" is used. If spouses submitting a joint certification have different reasons for their failure to report all income, pay all tax, and submit all required information returns, including FBARs, they must state their individual reasons separately in the required statement of facts.

Certification

I am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for which the U.S. tax return due date (or properly applied for extended due date) has passed. The tax and interest I owe for each year are as follows

Year

(list years in order)

Amount of Tax I Owe Shown On

(Form 1040 or Form 1040X)

Interest

Total

Total

Note: Your payment should equal the total tax and interest due for all three years. You may receive a balance due notice or a refund if the tax or interest is not calculated correctly.

I failed to report income from one or more foreign financial assets during the above period.

I meet all the other eligibility requirements for the Streamlined Foreign Offshore procedures.

If I failed to timely file correct and complete FBARs for any of the last six years, I have now electronically filed those FBARs.

I agree to retain all records related to my income and assets during the period covered by my delinquent or amended returns until three years from the date of this certification. If I was required to file delinquent FBARs in accordance with these procedures, I also agree to retain all records (including, but not limited to, account statements) related to my foreign financial accounts until six years from the date of this certification. Upon request, I agree to provide all such records to the Internal Revenue Service.

My failure to report all income, pay all tax, and submit all required information returns, including FBARs, was due to

I acknowledge the possibility that amended income tax returns I am submitting under the Streamlined Foreign Offshore Procedures may report income for tax years beyond the

I recognize that if the Internal Revenue Service receives or discovers evidence of willfulness, fraud, or criminal conduct, it may open an examination or investigation that could lead to civil fraud penalties, FBAR penalties, information return penalties, or even referral to Criminal Investigation.

I meet the

Note: Both spouses filing a joint certification must meet the

Complete one of the following (two) sections regarding your residency status

If you are a U.S. citizen or lawful permanent resident (i.e., “green card holder”), complete this section:

For the covered tax period, indicate whether you were physically outside the United States for each year. You must have been physically outside the U.S. for at least 330 full days in any one or more of the most recent three years for which the U.S. tax return due date (or properly applied for extended due date) has passed, and you must not have had a U.S. abode. For more information on the meaning of “abode” see IRS Publication 54.

Catalog Number 67042A |

www.irs.gov |

Form 14653 (Rev. |

Page of

I was physically outside the United States for at least 330 full days (answer Yes or No for each year)

Year

Yes

No

Both spouses filing a joint certification must meet the

If you are not a U.S. citizen or lawful permanent resident, complete this section:

If you are not a U.S. citizen or a lawful permanent resident, please attach to this certification your computation showing that you did not meet the substantial presence test under I.R.C. sec. 7701(b)(3). Your computation must disclose the number of days you were present in the U.S. for the three years included in your Streamlined Foreign Offshore Procedures submission and the previous two years. If you do not attach a complete computation showing that you did not meet the substantial presence test, your submission will be considered incomplete and your submission will not qualify for the Streamlined Foreign Offshore Procedures.

Both spouses filing a joint certification must meet the

Note: You must provide specific facts on this form or on a signed attachment explaining your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Any submission that does not contain a narrative statement of facts will be considered incomplete and will not qualify for the streamlined penalty relief.

Provide specific reasons for your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Include the whole story including favorable and unfavorable facts. Specific reasons, whether favorable or unfavorable to you, should include your personal background, financial background, and anything else you believe is relevant to your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Additionally, explain the source of funds in all of your foreign financial accounts/assets. For example, explain whether you inherited the account/asset, whether you opened it while residing in a foreign country, or whether you had a business reason to open or use it. And explain your contacts with the account/asset including withdrawals, deposits, and investment/ management decisions. Provide a complete story about your foreign financial account/asset. If you relied on a professional advisor, provide the name, address, and telephone number of the advisor and a summary of the advice. If married taxpayers submitting a joint certification have different reasons, provide the individual reasons for each spouse separately in the statement of facts. The field below will automatically expand to accommodate your statement of facts.

Catalog Number 67042A |

www.irs.gov |

Form 14653 (Rev. |

Page of

Under penalties of perjury, I declare that I have examined this certification and all accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.

Signature of Taxpayer |

Name of Taxpayer |

Date |

|

|

|

Signature of Taxpayer (if joint certification) |

Name of Taxpayer (if joint certification) |

Date |

|

|

|

For Estates Only

Signature of Fiduciary |

Date |

|

|

Title of Fiduciary (e.g., executor or administrator)

Name of Fiduciary

For Paid Preparer Use Only (the signature of taxpayer(s) or fiduciary is required even if this form is signed by a paid preparer)

Signature of Preparer |

Name of Preparer |

|

|

Date |

|

|

|

|

|

Firm’s name |

|

|

|

Firm’s EIN |

|

|

|

|

|

Firm’s address |

City |

|

State |

ZIP code |

|

|

|

|

|

Telephone number |

PTIN |

|

|

Check if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this form with the IRS |

Yes (complete information below) |

No |

||

|

|

|

|

|

Designee’s name |

|

|

Telephone number |

|

|

|

|

|

|

Privacy Act and Paperwork Reduction Notice

We ask for the information on this certification by U.S. person residing in the United States for streamlined domestic offshore procedures to carry out the Internal Revenue laws of the United States. Our authority to ask for information is sections 6001, 6109, 7801, 7803 and the regulations thereunder. This information will be used to determine and collect the correct amount of tax under the terms of the streamlined filing compliance program. You are not required to apply for participation in the streamlined filing compliance program. If you choose to apply, however, you are required to provide all the information requested on the streamlined certification. You are not required to provide the information requested on a document that is subject to the Paperwork Reduction Act unless the document displays a valid OMB control number. Books or records relating to a document or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. Section 6103, however, allows or requires the Internal Revenue Service to disclose or give this information to others as described in the Internal Revenue Code. For example, we may disclose this information to the Department of Justice to enforce the tax laws, both civil and criminal, and to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. Failure to provide this information may delay or prevent processing your application. Providing false information may subject you to penalties. The time needed to complete and submit the streamlined certification will vary depending on individual circumstances. The estimated average time is: 8 hours

Catalog Number 67042A |

www.irs.gov |

Form 14653 (Rev. |

Document Information

| Fact Name | Details |

|---|---|

| Purpose | Form 14653 is used for certifying U.S. persons residing outside the U.S. who wish to participate in the Streamlined Foreign Offshore Procedures. |

| Eligibility | To qualify, individuals must meet specific residency requirements and demonstrate non-willful conduct regarding their tax obligations. |

| Filing Requirement | Taxpayers must provide delinquent or amended returns for the last three years for which the tax return due date has passed. |

| FBAR Compliance | If applicable, individuals must electronically file any delinquent FBARs for the past six years. |

| Record Retention | Taxpayers must retain records related to their income and assets for three years, and FBAR records for six years from the date of certification. |

| Joint Certification | Spouses can file jointly, but both must meet the non-residency requirements and provide separate reasons for any discrepancies in income reporting. |

| Governing Law | This form is governed by the Internal Revenue Code, particularly sections related to tax compliance and penalties. |

14653 - Usage Guidelines

Completing Form 14653 is an important step for individuals seeking to correct past tax filings. After submitting the form, the Internal Revenue Service (IRS) will review your information to determine your eligibility for the Streamlined Foreign Offshore Procedures. This process aims to help you resolve any issues related to unreported income and tax obligations.

- Gather Required Information: Collect your taxpayer identification number (TIN), mailing address, and contact information. If applicable, gather information for your spouse if filing jointly.

- Complete Taxpayer Information: Fill in your name(s), TIN(s), telephone number, mailing address, city, state, and ZIP code at the top of the form.

- Indicate Tax Years: List the years for which you are submitting delinquent or amended income tax returns. Include the amount of tax owed and interest for each year.

- Confirm Eligibility: Check the box to confirm that you meet the eligibility requirements for the Streamlined Foreign Offshore Procedures.

- Residency Status: Complete the section regarding your residency status, indicating if you were physically outside the U.S. for at least 330 full days for each applicable year.

- Provide Reasons for Non-Compliance: Write a detailed statement explaining your reasons for failing to report income, pay taxes, and submit required information returns, including FBARs. Include any relevant personal and financial background.

- Sign and Date the Form: Sign and date the form at the bottom. If filing jointly, ensure both spouses sign and date the form.

- Submit the Form: Send the completed form to the appropriate IRS address specified in the instructions. Ensure you keep a copy for your records.

Common PDF Forms

Vs4 Form - Compliance with state regulations is mandatory for acceptance.

Army Packing List Form - This packing list helps ensure that operations remain uninterrupted.

When considering essential documents for financial management, understanding the implications of a General Power of Attorney is crucial. This form provides a pathway for individuals to delegate financial decision-making to a trusted person, ensuring that their interests are safeguarded. For further insights, explore our guide on how to utilize a General Power of Attorney effectively at effective General Power of Attorney management strategies.

Concert Band Seating Arrangement - Utilize clear labels when indicating instrument types in seating rows.

Dos and Don'ts

When filling out Form 14653, keep these tips in mind:

- Ensure all information is accurate and complete. Double-check your taxpayer identification number and contact details.

- Clearly explain your reasons for failing to report income or file returns. Provide a full narrative that includes both positive and negative factors.

- Attach any required documentation, especially if you are not a U.S. citizen or lawful permanent resident. Include your substantial presence test calculation.

- Sign and date the form. If filing jointly, both spouses must sign.

Avoid these common mistakes:

- Do not leave any sections blank. Incomplete forms will be rejected.

- Avoid vague explanations. Specific details about your financial situation are crucial.

- Do not forget to retain records related to your income and assets for the required time periods.

- Refrain from submitting the form without reviewing it thoroughly. Errors can lead to delays or penalties.

Common mistakes

-

Omitting Required Information: Many individuals fail to include all necessary details, such as their Tax Identification Number (TIN) or mailing address. This can lead to delays or rejections of the form.

-

Incorrectly Calculating Tax and Interest: It's crucial to accurately calculate the total tax and interest owed for each year. Errors in these calculations can result in a balance due notice or even a refund if the IRS finds discrepancies.

-

Not Providing a Complete Statement of Facts: A common mistake is failing to include a detailed narrative explaining the reasons for not reporting all income. This narrative is essential for the IRS to understand the taxpayer's situation.

-

Ignoring Joint Certification Requirements: When submitting a joint certification, both spouses must meet the non-residency requirements. Failing to disclose differing residency statuses can complicate the submission.

-

Neglecting to Attach Supporting Documentation: Individuals often forget to attach necessary computations or documents that demonstrate they did not meet the substantial presence test. Without this, the submission may be considered incomplete.

-

Not Retaining Required Records: Taxpayers must agree to keep all records related to their income and assets for the required periods. Not adhering to this requirement can lead to complications if the IRS requests documentation.

-

Misunderstanding Non-Willful Conduct: Some individuals may incorrectly assert that their failure to report was non-willful without understanding the IRS's definition. This could jeopardize their eligibility for the Streamlined Foreign Offshore Procedures.